FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

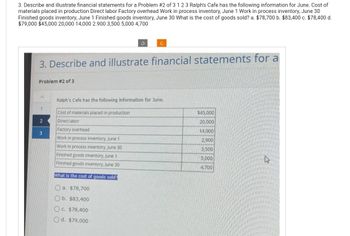

Transcribed Image Text:3. Describe and illustrate financial statements for a Problem #2 of 3 1 2 3 Ralph's Cafe has the following information for June. Cost of

materials placed in production Direct labor Factory overhead Work in process inventory, June 1 Work in process inventory, June 30

Finished goods inventory, June 1 Finished goods inventory, June 30 What is the cost of goods sold? a. $78,700 b. $83,400 c. $78,400 d.

$79,000 $45,000 20,000 14,000 2.900 3,500 5,000 4,700

Problem #2 of 3

3. Describe and illustrate financial statements for a

2

S

3

C

Ralph's Cafe has the following information for June.

Cost of materials placed in production

Direct labor

Factory overhead

Work in process inventory, June 1

Work in process inventory, June 30

Finished goods inventory, June 1

Finished goods inventory, June 30

What is the cost of goods sold?

a. $78,700

b. $83,400

c. $78,400

d. $79,000

$45,000

20,000

14,000

2,900

3,500

5,000

4.700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, June 1 Work in process inventory, June 30 Finished goods inventory, June 1 Finished goods inventory, June 30 a. For June, determine the cost of goods manufactured. Using the data given, prepare a statement of Cost of Goods Manufactured. Woodfall Company Statement of Cost of Goods Manufactured Costs Type Work in process inventory, June 1 Cost of direct materials used in production Direct labor Factory overhead Total manufacturing costs incurred in June Total manufacturing costs Work in process inventory, June 30 Cost of goods manufactured ✓ $260,000 340,000 182,300 70,200 74,000 33,300 44,100 ✓ Amount $ Amount 260,000 Xarrow_forwardJob cost sheets show the following information: Job January February March Completed Sold AA2 $2,600 $1,400 February Not sold AA4 4,840 January February AA5 3,230 February March ААЗ 3,408 $2,321 April Not sold Total $7,440 $8,038 $2,321 What are the balances in the work in process inventory, finished goods inventory, and cost of goods sold for January, February, and March? Work in Finished Process Goods COGS January $ February $ Marcharrow_forward5arrow_forward

- Pls asaparrow_forwardThe following T-accounts represent September activity for Kelly Tools: Work-in-Process Inventory Materials Inventory Debit Credit Debit Credit Beginning Ending Balance 24,900 Balance 42,400 (9/1) (9/30) Direct 120,800 Labor Cost of Goods Sold Debit Credit Manufacturing Overhead Applied Credit Debit Finished Goods Inventory Debit Credit Ending Balance 70,500 (9/30) Manufacturing Overhead Control Credit Debit 132,510 Wages Payable Sales Revenue Debit Credit Debit Credit 528,500 . Additional Data •Sales are billed at 175 percent of Cost of Goods Sold before the over- or underapplied overhead is prorated. Materials of $82,100 were purchased during the month, and the balance in the Materials Inventory account increased by $8,500 • Overhead is applied at the rate of 210 percent of direct materials cost. The balance in the Finished Goods Inventory account decreased by $23,900 during the month before any proration of under- or overapplied overhead. • Total credits to the Wages Payable account…arrow_forwardSelected accounts with a credit amount omitted are as follows Work in Process Apr. 1 Balance 6,600 Apr. 30 Goods finished X 30 Direct materials 69,800 30 Direct labor 193,900 30 Factory overhead 58,170 Finished Goods Apr. 1 Balance 15,600 30 Goods finished 307,900 What was the balance of Work in Process as of April 30? a.$58,170 b.$15,600 c.$20,570 d.$307,900arrow_forward

- Dont uplode imagesarrow_forwardSV f: Job 222 started on June 1 and finished on July 15. Total cost on July 1 was $12,400, and the costs added in July were $188,500. The entry for the sale at a price of $310,000 would be: O A. Finished goods inv. OB. Sales Revenue C. Work in process inventory OD. Accounts receivable C C ar sti Ccour Cost of goods sold Accounts receivable Cost of goods sold Sales Revenue 200,900 310,000 200,900 310,000 200,900 310,000 200,900 310,000 asedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education