FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

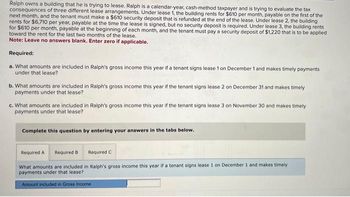

Transcribed Image Text:Ralph owns a building that he is trying to lease. Ralph is a calendar-year, cash-method taxpayer and is trying to evaluate the tax

consequences of three different lease arrangements. Under lease 1, the building rents for $610 per month, payable on the first of the

next month, and the tenant must make a $610 security deposit that is refunded at the end of the lease. Under lease 2, the building

rents for $6,710 per year, payable at the time the lease is signed, but no security deposit is required. Under lease 3, the building rents

for $610 per month, payable at the beginning of each month, and the tenant must pay a security deposit of $1,220 that is to be applied

toward the rent for the last two months of the lease.

Note: Leave no answers blank. Enter zero if applicable.

Required:

a. What amounts are included in Ralph's gross income this year if a tenant signs lease 1 on December 1 and makes timely payments

under that lease?

b. What amounts are included in Ralph's gross income this year if the tenant signs lease 2 on December 31 and makes timely

payments under that lease?

c. What amounts are included in Ralph's gross income this year if the tenant signs lease 3 on November 30 and makes timely

payments under that lease?

Complete this question by entering your answers in the tabs below.

Required C

What amounts are included in Ralph's gross income this year if a tenant signs lease 1 on December 1 and makes timely

payments under that lease?

Amount included in Gross Income.

Required A Required B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Mortgage interest Depreciation Repairs and maintenance Required: What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Rental income Real estate taxes Utilities Mortgage interest Repairs and maintenance Depreciation Net rental income 15,900 2,700 2,475 4,700 7,600 1,260 Schedule E Schedule Aarrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Mortgage interest Depreciation Repairs and maintenance Rental income Real estate taxes Required: What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Utilities Mortgage interest Repairs and maintenance $ 15,000 2,000 1,500 3,800 Depreciation Net rental income, 7,200 1,300 Schedule E Schedule Aarrow_forwardStephen purchased a rental property on 03 August 2020 and has rented the property from this date.He incurred the following expenses when purchasing the property –> $6,320 Lender’s Mortgage Insurance> $15,987 Stamp duty on transfer of the property> $1,500 Mortgage broker’s fee> $750 Conveyancing fees> $600 Bank loan establishment fee> $700 Stamp duty on the mortgageCalculate how much Stephen can claim in borrowing costs for the 2021 year and select the correct answer below. $1,766 $1,658 $1,311 $1,442 $1,879arrow_forward

- aRhonda owns an office building that has an adjusted basis of $45,000. The building is subject to a mortgage of $20,000. She transfers the building to Miguel in exchange for $15,000 cash and a warehouse with an FMV of $50,000. Miguel assumes the mortgage on the building. Required: What are LaRhonda’s realized and recognized gain or loss? What is her basis in the newly acquired warehouse?arrow_forwardMiller owns a personal residence with a fair market value of $317,450 and an outstanding first mortgage of $253,960, which was used entirely to acquire the residence. This year, Miller gets a home equity loan of $15,873 to purchase new jet skis. How much of this mortgage debt is treated as qualified residence indebtedness?arrow_forwardOn July 1 of year 1, Elaine purchased a new home for $430,000. At the time of the purchase, it was estimated that the property tax bill on the home for the year would be $8,600 ($430,000 * 2%). On the settlement statement, Elaine was charged $4,300 for the year in property taxes and the seller was charged $4,300. On December 31, year 1 Elaine discovered that the real property taxes on the home for the year were actually $9,600. Elaine wrote a $9,600 check to the local government to pay the taxes for that calendar year (Elaine was liable for the taxes because she owned the property when they became due). what amount of real property taxes is Elaine allowed to deduct for year 1? (Assume not married filing separately.) Multiple Choice ___ $0 ___ $4,300. ___ $4,800. ___ $5.300.arrow_forward

- Jasmine Dayne (29) is filing as a single taxpayer. In 2020, she received income from the following sources: $39,000 in wages. Alimony payments totaling $14,328. Her divorce was finalized in October 2019. Unemployment compensation of $6,200. Jasmine also made a timely $2,000 contribution to a traditional IRA for 2020.She had no other income or adjustments, and she will claim the standard deduction.To assist you in answering questions about Jasmine’s tax return, you may refer to Part I of Schedule 1, Additional Income and Adjustments to Income, which is shown below.Part I Additional Income1 Taxable refunds, credits, or offsets of state and local income taxes. ________2a Alimony received. _________2b Date of original divorce or separation agreement (see instructions). _________3 Business income or (loss). Attach Schedule C. _________4 Other gains or (losses). Attach Form 4797. ________5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E.…arrow_forwardQuin owns a house in Connecticut and an apartment in New Orleans. Quin spends most of her time in Connecticut, so she sometimes rents out the apartment in New Orleans when she is not there. This year, Quin rented out the apartment for thirty days and personally used the apartment for forty days. How will Quin’s rental activity be classified for tax purposes and why? A.Nontaxable activity because Quin used the apartment personally more than she rented it out. B.Mixed-use activity because Quin both rented out the apartment and used it personally. C.Mixed-use activity because Quin rented out the apartment for more than 14 days and personally used the apartment for the greater of 14 days or 10% of the rental days. D.Rental activity because Quin rented out the apartment for more than 14 days.arrow_forwardWhich of the following taxpayers may report the sale of their property as an installment sale? (a) Franklin. He sold a tractor to Roberto for $9,000. Roberto made two payments, one payment of $3,500 on May 15 and one payment of $5,500 on September 15 of the tax year. Franklin paid $7,000 for the tractor when it was new; it had fully depreciated before he sold it. (b) Janet. She sold her entire inventory, valued at $8,000, to Marvin for $12,000. Marvin intends to pay Janet $4,000 per year, plus interest, for the next three years. (c) Juan. He sold a plot of land for $50,000. He purchased the land for $45,000 and paid $10,000 to improve it. His buyer intends to pay for the land over five years. (d) Sara. She sold a rental condominium for $125,000. She purchased it for $90,000 and had claimed $20,000 in depreciation. Her buyer intends to pay her $20,000 per year plus 6% interest for five years.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education