ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

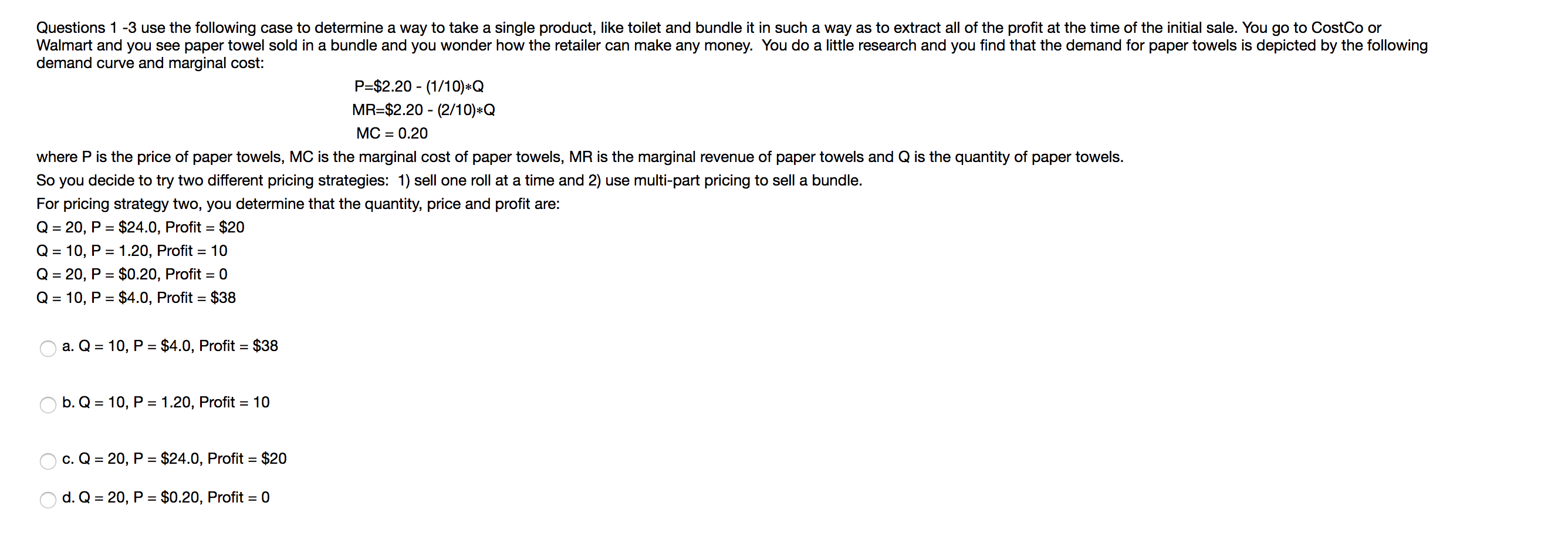

Transcribed Image Text:Questions 1-3 use the following case to determine a way to take a single product, like toilet and bundle it in such a way as to extract all of the profit at the time of the initial sale. You go to CostCo or

Walmart and you see paper towel sold in a bundle and you wonder how the retailer can make any money. You do a little research and you find that the demand for paper towels is depicted by the following

demand curve and marginal cost:

P-$2.20 (1/10)*Q

MR-$2.20 (2/10) Q

МС

0.20

where P is the price of paper towels, MC is the marginal cost of paper towels, MR is the marginal revenue of paper towels and Q is the quantity of paper towels.

So you decide to try two different pricing strategies: 1) sell one roll at a time and 2) use multi-part pricing to sell a bundle.

For pricing strategy two, you determine that the quantity, price and profit are:

Q 20, P $24.0, Profit

$20

Q 10, P 1.20, Profit 10

Q 20, P $0.20, Profit 0

=

Q 10, P $4.0, Profit $38

a. Q 10, P $4.0, Profit = $38

b. Q 10, P

1.20, Profit = 10

$24.0, Profit = $20

c. Q

20, P

$0.20, Profit = 0

d. Q

20, P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Suppose Felix runs a small business that manufactures frying pans. Assume that the market for frying pans is a competitive market, and the market price is $20 per frying pan. The following graph shows Felix's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for frying pans quantities zero through seven (inclusive) that Felix produces. TOTAL COST AND REVENUE (Dollars) 200 175 150 125 100 75 50 25 0 -25 0 1 ● ^ 2 O ☐ A ☐ A 3 4 5 QUANTITY (Frying pans) O ☐ 6 Total Cost ☐ 7 8 o Total Revenue Profit ? image 1 Calculate Felix's marginal revenue and marginal cost for the first seven frying pans he produces, and plot them on the following graph. Use the blue points (circle symbol) to plot marginal revenue and the orange points (square symbol) to plot marginal cost at each quantity.arrow_forwardQuestion 18 Alex Potter owns the only well in a town that produces clean drinking water. He faces the following demand P=200-2Q, and marginal cost MC=50+2Q, marginal revenue MR= 200-4Q curves. In order to maximize profits, Alex should charge a price of $150 at the profit maximizing quantity with a marginal revenue equal to $150. $100 at the profit maximizing quantity with a marginal revenue equal to $150. $100 at the profit maximizing quantity with a marginal revenue equal to $100. $150 at the profit maximizing quantity with a marginal revenue equal to $100. O Oarrow_forwardThe following graph shows Crest's demand curve, marginal-revenue (MR) curve, average-total-cost (ATC) curve, and marginal-cost (MC) curve. Use the black point (plus symbol) to indicate Crest's profit-maximizing output and price. (?) Price, Cost, Revenue Demand ATC O True MR Quantity of Crest Toothpaste True or False: Crest's profit is positive. + Profit Maxarrow_forward

- Please show working and calculations.arrow_forwardUse the following information to answer the next six questions. The accompanying graph depicts the demand (D) curve for general admission concert tickets to see ECON-Jammin', the world's first economics rock band, which is scheduled to visit your city next month. The concert venue can accommodate 100 fans with a marginal cost (MC) of $10 per person. Price T $50 $40 $30 $20 $10 0 10 20 MR D MC 30 40 50 60 Quantity If ECON-Jammin' charges a single price for its concert tickets and follows the profit-maximizing rule for a monopoly, what will be the ticket price? O a. $45 O b. $30 O c. $35 O d. $40 O e. $50arrow_forwardOne of the observations that has been made about the pricing of products produced in an industry where production is highly concentrated is that the costs of production can change up or down and yet prices do not change much. The Sweezy model was developed to explain this observation. Present a Sweezy model, show a cost change, and show that the optimal choice for the firm is to leave the product price unchanged. Provide words to explain the basic reason why the price does not move up or down as costs change.arrow_forward

- 3. Profit maximization using total cost and total revenue curves Suppose Jayden operates a handicraft pop-up retail shop that sells rompers. Assume a perfectly competitive market structure for rompers with a market price equal to $25 per romper. The following graph shows Jayden's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for rompers for quantities zero through seven (including zero and seven) that Jayden produces. TOTAL COST AND REVENUE (Dollars) 200 175 150 125 100 75 50 94 0 2 D QUANTITY (Rompers) 6 Total Cost 7 8 O- Total Revenue A Profit ?arrow_forwardDel's and Rodney's are two plumbing services in a gentrifying area of South East London. Within the area they service, the two firms operate as a duopoly and together serve one hundred percent of the available local market. One of their key lines of business is visiting customer's homes to install a new shower rail. A student project has been investigating the local plumbing business and has estimated the following information for Del's and Rodney's: Total demand for new shower rails per week is given by P = 200 - 4Q Where Q is total market demand and can be divided between Del's (qd) and Rodney's (qr) such that Q = qd + qr Assuming that the marginal cost of serving an extra customer is £40 for each, and that marginal revenue for Del is given by MRd 2008qd - 4qr And marginal revenue for Rodney is given by MRr Then 2008qr - 4qd 8 CONTINUEDarrow_forwardRefer to the accompanying figure to answer the following questions 1) the profit maximizing price and quantity are _______, respectively. 2) the total revenue when the firm is profit maximizing is_____. 3)the total cost when the firm is profit maximizing is _____. 4)the profit when the firm is profit maximizing is_____. (Please solve all of the subparts 1 to 4. I am willing to give it a thumbs up Thanks)arrow_forward

- G, 12 Economicsarrow_forwardUSE THE GRAPH TO ANSWER THE FOLLOWING QUESTIONS: (IF REQUIRED, USE THE DISCREET NUMBER OF BARRELS). ANSWERS IN WHOLE NUMBER a. How many barrels of natural-organic oil reflect the lowest minimum average variable cost?b. How much is the price of the natural-organic oil per barrel?c. How much is the fixed cost to produce the natural-organic oil?d. How many barrels of natural-organic oil should the firm produce to maximize its profit?e. At what production level would the marginal cost exceed the average cost?arrow_forwardAb 40 Economicsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education