Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

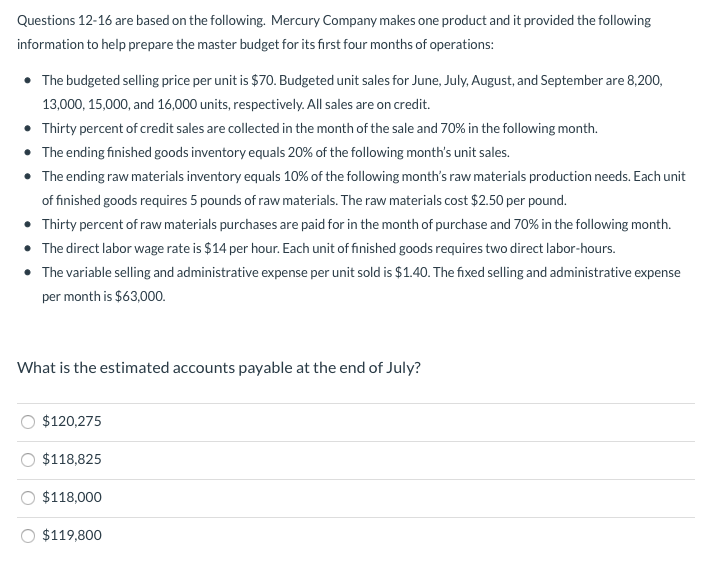

Transcribed Image Text:Questions 12-16 are based on the following. Mercury Company makes one product and it provided the following

information to help prepare the master budget for its first four months of operations:

• The budgeted selling price per unit is $70. Budgeted unit sales for June, July, August, and September are 8,200,

13,000, 15,000, and 16,000 units, respectively. All sales are on credit.

• Thirty percent of credit sales are collected in the month of the sale and 70% in the following month.

• The ending finished goods inventory equals 20% of the following month's unit sales.

• The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit

of finished goods requires 5 pounds of raw materials. The raw materials cost $2.50 per pound.

• Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month.

• The direct labor wage rate is $14 per hour. Each unit of finished goods requires two direct labor-hours.

• The variable selling and administrative expense per unit sold is $1.40. The fixed selling and administrative expense

per month is $63,000.

What is the estimated accounts payable at the end of July?

$120,275

$118,825

$118,000

$119,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: In Shalimars experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are 4,900,000 and for the fourth quarter of the current year are 6,850,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. 3. What if the recession led Shalimars top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption.arrow_forwardThe sales department of Macro Manufacturing Co. has forecast sales for its single product to be 20,000 units for June, with three-quarters of the sales expected in the East region and one-fourth in the West region. The budgeted selling price is 25 per unit. The desired ending inventory on June 30 is 2,000 units, and the expected beginning inventory on June 1 is 3,000 units. Prepare the following: a. A sales budget for June. b. A production budget for June.arrow_forwardPalmgren Company produces consumer products. The sales budget for four months of the year is presented below. Company policy requires that ending inventories for each month be 25 percent of next months sales. At the beginning of July, the beginning inventory of consumer products met that policy. Required: Prepare a production budget for the third quarter of the year. Show the number of units that should be produced each month as well as for the quarter in total.arrow_forward

- Eastman, Inc., manufactures and sells three products: R, S, and T. In January, Eastman, Inc., budgeted sales of the following. At the end of the year, actual sales revenue for Product R and Product S was 3,075,000 and 3,254,000, respectively. The actual price charged for Product R was 25 and for Product S was 20. Only 10 was charged for Product T to encourage more consumers to buy it, and actual sales revenue equaled 540,000 for this product. Required: 1. Calculate the sales price and sales volume variances for each of the three products based on the original budget. 2. Suppose that Product T is a new product just introduced during the year. What pricing strategy is Eastman, Inc., following for this product?arrow_forwardA companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forward

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardBudgeted income statement and supporting budgets for three months Bellaire Inc. gathered the following data for use in developing the budgets for the first quarter (January, February, March) of its fiscal year: Estimated sales at 125 per unit: Estimated finished goods inventories: Work in process inventories are estimated to be insignificant (zero). Estimated direct materials inventories: Manufacturing costs: Selling expenses: Instructions Prepare the following budgets using one column for each month and a total column for the first quarter, as shown for the sales budget: Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement with budgeted operating income for March.arrow_forwardMesa Aquatics, Inc. estimated direct labor hours as 1,900 in quarter 1, 2,000 in quarter 2.2,200 in quarter 3, and 1,800 in quarter 4. a sales and administration budget using the information provided.arrow_forward

- The following data were obtained from the financial records of Sonicbrush, Inc., for March: Sales are expected to increase each month by 15%. Prepare a budgeted income statement.arrow_forwardThe sales department of F. Pollard Manufacturing Co. has forecast sales in March to be 20,000 units. Additional information follows: Materials used in production: Prepare the following: a. A production budget for March (in units). b. A direct materials budget for the month (in units and dollars).arrow_forwardBefore the year began, the following static budget was developed for the estimated sales of 50,000. Sales are higher than expected and management needs to revise its budget. Prepare a flexible budget for 100,000 and 110,000 units of sales.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College