Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Ans

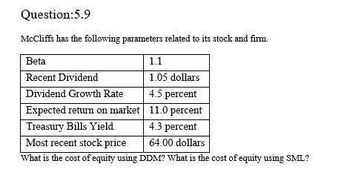

Transcribed Image Text:Question:5.9

McCliffs has the following parameters related to its stock and firm.

Beta

Recent Dividend

1.1

1.05 dollars

Dividend Growth Rate

4.5 percent

Expected return on market

11.0 percent

Treasury Bills Yield

4.3 percent

64.00 dollars

Most recent stock price

What is the cost of equity using DDM? What is the cost of equity using SML?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The dividend yield (i.e. D1/P0) is a good measure of the expected return on a common stock under which of the following circumstances? g = 0 g > 0 g < 0 g is expected to remain constant over time under no circumstancesarrow_forwardThe constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference between the required return and dividend growth rate as follows: D1 PO (rs g) Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? The capital gains yield on a stock that the investor already owns has a direct relationship with the firm's expected future stock price. The capital gains yield on a stock that the investor already owns has an inverse relationship with the firm's expected future stock price. Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $2.85 at the end of the year. Its dividend is expected to grow at a constant rate of 6.00% per year. If Walter's stock currently trades for $26.00 per share, what is the expected rate of return? 6.10% 6.77% 16.96% 13.36% Which of the following statements will always hold true? The constant growth valuation formula…arrow_forwardthe last question, please.arrow_forward

- Please give me true answer this financial accounting questionarrow_forwardanswer question #6&7arrow_forwardThe formula for calculating the cost of equity capital using the dividend growth model approach is Blank______. (RE denotes the cost of equity, D1 is the next period’s projected dividend, g is the growth rate, and P0 is the current stock price.) Multiple choice question. RE = D1 /(P0 + g) RE = (D1 /P0) /g RE = D1 /P0 + g RE = D1 /P0 – garrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning