FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

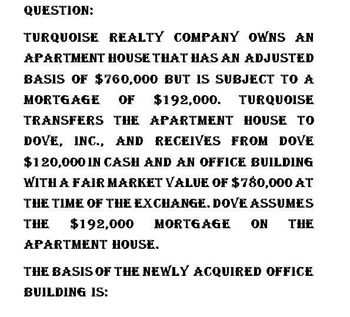

Transcribed Image Text:QUESTION:

TURQUOISE REALTY COMPANY OWNS AN

APARTMENT HOUSE THAT HAS AN ADJUSTED

BASIS OF $760,000 BUT IS SUBJECT TO A

MORTGAGE OF $192,000. TURQUOISE

TRANSFERS THE APARTMENT HOUSE TO

DOVE, INC., AND RECEIVES FROM DOVE

$120,000 IN CASH AND AN OFFICE BUILDING

WITH A FAIR MARKET VALUE OF $780,000 AT

THE TIME OF THE EXCHANGE. DOVE ASSUMES

THE $192,000 MORTGAGE ON THE

APARTMENT HOUSE.

THE BASIS OF THE NEWLY ACQUIRED OFFICE

BUILDING IS:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Subject:- accountingarrow_forwardLand was acquired at a cost of P150,000 in 2013. In June 2018, its current market value was P300,000 when this property was invested by Bambi in a real estate business. Attached to the property was an outstanding mortgage payable of P20,000. If the mortgage was assumed by the real estate business, Bambi, Capital will be credited forarrow_forwardOriole Co. purchases land and constructs a service station and car wash for a total of $472500. At January 2, 2021, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $510000 and immediately leased from the oil company by Oriole. Fair value of the land at time of the sale was $46500. The lease is a 10-year, noncancelable lease. Oriole uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Oriole at termination of the lease. A partial amortization schedule for this lease is as follows: Раyments Interest Amortization Balance Jan. 2, 2021 $510000.00 Dec. 31, 2021 $83000.15 $51000.00 $32000.15 477999.85 Dec. 31, 2022 83000.15 47799.99 35200.16 442799.69 Dec. 31, 2023 83000.15 44279.97 38720.18 404079.51 The total lease-related income recognized by the lessee during 2022 is which of the…arrow_forward

- Nonearrow_forward33. Subject :- Accountingarrow_forward4...new... b... Bonita Leasing Company agrees to lease equipment to Windsor Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $559,000, and the fair value of the asset on January 1, 2020, is $724,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Windsor estimates that the expected residual value at the end of the lease term will be 60,000. Windsor amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Bonita desires a 10% rate of return on its investments. Windsor’s incremental borrowing ra Calculate the amount of the annual rental payment…arrow_forward

- Assume that on December 31, 2024, Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to lease a storage building from Sandhill Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $66.999 beginning on December 31, 2024. 2. The fair value of the building on December 31, 2024, is $490,629. 3. 4. 5. The building has an estimated economic life of 12 years, a guaranteed residual value of $11,000, and an expected residual value of $8,100. Kimberly-Clark depreciates similar buildings on the straight-line method. The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. Kimberly-Clark's incremental borrowing rate is 8% per year. The lessor's implicit rate is not known by Kimberly-Clark Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided) (a) Your answer is partially correct. Prepare the journal…arrow_forwardEdison Leasing leased high-tech electronic equipment to Manufacturers Southern on January 1, 2021. Edison purchased the equipment from International Machines at a cost of $112,080. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate (Also lessee's incremental borrowing rate) 2 years (8 quarterly periods) $15,000 at the beginning of each period 2 years $112,080 88 Required: Prepare a lease amortization schedule and appropriate entries for Edison Leasing from the beginning of the lease through January 1, 2022. Edison's fiscal year ends December 31. Complete this question by entering your answers in the tabs below. Amort Schedule General Journal Prepare a lease amortization schedule for Edison Leasing from the beginning of the lease through January 1, 2022. Edison's fiscal year ends December 31.…arrow_forwardDetermine the income to be reported by ML partnership in 2020 assuming the company opted to report income from improvement using the spread-out method. (PHILIPPINES)arrow_forward

- Firm PO and Corporation QR exchanged the following business real estate: Marvin Gardens (exchanged by PO) $ 1,040,000 (715,000) 325,000 $ FMV Mortgage Equity $ Required A Required B Required: a. If PO's adjusted basis in Marvin Gardens was $403,000, compute PO's realized gain, recognized gain, and basis in Boardwalk. b. If QR's adjusted basis in Boardwalk was $78,000, compute QR's realized gain, recognized gain, and basis in Marvin Gardens. Boardwalk (exchanged Complete this question by entering your answers in the tabs below. Realized gain Recognized gain Basis $ by QR) 325,000 -0- 325,000 If PO's adjusted basis in Marvin Gardens was $403,000, compute PO's realized gain, recognized gain, and basis in Boardwalk. Amountarrow_forwardsaarrow_forwardSuraya wants to Buy a building. He went to apply financing with standard chartered. After proper assessment, standard chartered bank provides a financing facility under Murabahah to the Purchase Orderer principle. Financing amount: RM800,000 Rate of return: 8.2% Financing tenure: 10 years At the end of the contract, Suraya still has an outstanding amount of RM40,000. As part of condition of the Murabahah contract, Suraya will be charged an annual penalty fee of 4% for any outstanding amount due and the amount will be donated to charitable organisation. Question: (a) Record journal entries to record all of the above transactions in standard chartered bank's books (Please show your workings/calculations).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education