FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

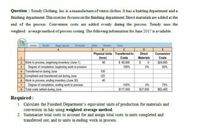

Transcribed Image Text:Question : Trendy Clothing, Inc. is amanufacturer of winter clothes. It has a knitting department and a

finishing department. This exercise focuses on the finishing department Direct matenials are added at the

end of the process. Conversion costs are added evenly during the process. Trendy uses the

weighted average method of process costing. The following infomation for June 2017 is available.

Home Insert Page Layout Formulas,

Data

Review

View

Physical Units Transferred-in

Direct

Conversion

Costs

(tons)

Costs

Materials

$24.000

2 Work in process, beginning inventory (June 1)

Degree of completion, beginning work in process

4 Transferred-in during June

5 Completed and transferred out during June

6 Work in process, ending inventory (June 30)

7 Degree of completion, ending work in process

8 Total costs added during June

60

$ 60.000

100%

0%

50%

100

120

40

100%

$117.000

$27,000

0%

75%

$62,400

Required:

1. Calculate the Finished Department's equivalent units of production for materials and

conversion in July using weighted average method.

2. Summarize total costs to account for and assign total costs to units completed and

transferred out, and to units in ending work in process.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain how you get the answer. Thanksarrow_forwardrecord the transfer of costs from the blending department to the finishing department (i.e., provide the journal entry with debits/increases and credits/decreases in the accounts, etc.).arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please do not give solution in image formatarrow_forwardSaved Help Save & Exis A company has two manufacturing departments, Forming and Painting. The company uses the weighted-average method and it reports the following data. Units completed in the Forming department are transferred to the Painting department. Units 52 Units completed and transferred out Ending work in process inventory 120,000 40,000 Direct materials Percent Complete 100% Conversion Percent Complete 100% 20% 60% Determine the equivalent units of production for the Forming department for direct materials and conversion costs assuming the weighted average method. Multiple Choice 120,000 direct materials; 120,000 conversion 120,000 direct materials; 160,000 conversion 128,000 direct materials; 120,000 conversion 128,000 direct materials; 144,000 conversion 128,000 direct materials; 184,000 conversionarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please answer this questions expert help me I am struggling with this questions I have tried but can't do . Answer all the subs partsarrow_forwardmin.4arrow_forwardFor March 2024, The Jacksonville shirt company compiled the following data for the Cutting and sewing department Department Item Amount units Cutting Beginning Balance $0 0 Shirts Started in march 1200 shirts Direct Materials added in March 1,920 Conversion costs 1,320 Completed and transferred to sewing ??? 1,200 Shirts Ending Balance 0 0 shirts Sewing Beginning Balance, transferred in, $1,350; conversion costs, $650 $2000 500 shirts Transferred in from cutting ??? ??? Conversion costs added in March 1,196 Completed and transferred to finished goods ??? 1,000 shirts Ending Balance, 60% complete ??? ??? 1. Complete a production cost report for the Cutting Department and the Sewing department. What is the cost of one basic shirt?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education