ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

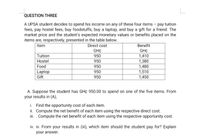

Transcribed Image Text:QUESTION THREE

A UPSA student decides to spend his income on any of these four items - pay tuition

fees, pay hostel fees, buy foodstuffs, buy a laptop, and buy a gift for a friend. The

market price and the student's expected monetary values or benefits placed on the

items are, respectively, presented in the table below.

Benefit

GH¢

1,410

1,380

1,480

1,510

1,450

Item

Direct cost

GH¢

Tuition

Hostel

950

950

Food

950

Laptop

Gift

950

950

A. Suppose the student has GH¢ 950.00 to spend on one of the five items. From

your results in (A),

i. Find the opportunity cost of each item.

ii. Compute the net benefit of each item using the respective direct cost.

iii. . Compute the net benefit of each item using the respective opportunity cost.

iv. iv. From your results in (ii), which item should the student pay for? Explain

your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardA recent college graduate has received the annual salaries shown in the following table over the past four years. During this time, the Consumer Price Index (CPI) has performed as indicated in the table below. Determine the annual salaries in year-zero Sterling Pound £ (b = 0), using the CPI as the indicator of general price inflation. End of Year Salary (Actual £) Consumer Price Index (CPI) 1 £34,000 2.4% 2 £36,200 1.9% 3 £38,800 3.3% 4 £41,500 3.4%arrow_forwardIn 2011, Kevin Jones, Texas Tigers quarterback, agreed to an eight-year, $50 million contract that at the time made him the highest-paid player in professional football history. The contract included a signing bonus of $11 million and called for annual salaries of $2.5 million in 2011, $1.75 million in 2012, $4.15 million in 2013, $4.90 million in 2014, $5.25 million in 2015, $6.2 million in 2016, $6.75 million in 2017, and $7.5 million in 2018. The $11 million signing bonus was prorated over the course of the contract so that an additional $1.375 million was paid each year over the eight-year contract period. With the salary paid at the beginning of each season, what is the worth of his contract at an interest rate of 6%?arrow_forward

- Mary's job position is being transferred to Lexington, Kentucky from Orlando, Florida. She and her husband George are currently renting their home in Orlando, but they have decided that they want to purchase a home in Lexington. Mary's annual salary is $48,500. George has also been able to find employment in Lexington at a factory making $39,000 per year. Mary is a planner and has saved $6200 that she can use towards the down payment on the new house. Use the above information to answer the following questions. Round all answers to 2 decimal places. To save the down payment, Mary deposited monthly in a savings account earning 2.5% compounded monthly. If it took Mary 5 years to save up the down payment, how much money was Mary depositing each month?arrow_forwardA company has two wings producing two products - Product 1 and Product 2. P and P2 are price per unit for Product 1 and Product 2 respectively. Similarly, q1 and q2 are the respective amount of units produced for Product 1 and Product 2. Pj and P2 are related to qı and q2 by the equations P = 155q2 + 26q – $92, P2 = 295q1 + 18q{ – 9ź91- The total cost of production for the company is given by, C = 100q192. The total relative profit is R =total profit/total cost , where total profit =total revenue – total cost; and total revenue = ( Price per unit of product 1* quantity of product 1) + (Price per unit of product 2 * quantity of product 2) a. Find the relative profit Ras a function of q1 and q2 and simplify the expression. b. Given that the company produces q1 units of Product 1 what amount of units q of Product 2 will maximize the total relative profit Rfor the company. c. Given that the company produces q2 units of Product 2 what amount of hits q Product 1 will maximize the total…arrow_forwardQuestion Your borrower is being relocated and needs to close on the purchase of their new home in thirty days. Their spouse will not be moving for another six months. How much income can be used for qualifying if the relocating borrower is earning $120,000 annually and the trailing spouse is earning $43,000 annually? (FHLMC) Choices: $13,583 $10,000 $11,791 $13,500arrow_forward

- What companies have failed to adequately respond and adapt to the COVID-19 economy?arrow_forwardQuestion 20 X Table 6.1 QD 24 50 98 114 P 137 107 77 52 17 140 Refer to Table 6.1. As price increase from 77 to 107 and using the mid-point formula, what is the value of G? % change in P A В C D E Selected Answer: 0-1.99 Correct Answer: ✔-64.86 +5% % change in QD F G H I Ed K L M N Oarrow_forwardYour work-out seems different then mine, Is my work-out correct or yours? Greatly Appreciated!!arrow_forward

- [Use Excel] You are planning to buy a new car before you move to a new place for a job after graduation. You are given two options. The first one is the Toyota Prius which has an initial cost of $25,000 with miles per gallon (MPG) of 50. The second option is a regular sedan car with an initial cost of $18,000 and an MPG of 25. If the gasoline price is $ 4.50/gallon, the annual effective interest rate is 8%, beyond which annual mileage of the car you will choose Prius over the regular car. The car is supposed to stay for 10 years. [Round the final answer to an integer by round(answer,0) command]arrow_forwardQt 79: Which of the following is the most likely consequence of implementing the ‘Unified Payments Interface (UPI)’?(a) Mobile wallets will not be necessary for online payments.(b) Digital currency will totally replace the physical currency in about two decades.(c) FDI inflows will drastically increase.(d) Direct transfer of subsidies to poor people will become very effective.arrow_forwardYou and two friends find yourself craving a fresh pizza while preparing for the final exam on the engineering economy. You can't spend time picking up the pizza and you have to have it shipped. 'Pick-up-Sticks' offers 1-1/4-inch thick (including toppings), 20-inch square pizza with your option of two toppings for $15 plus 5 percent sales tax, and $1.50 delivery fee (no sales tax on delivery price). "Fred's" offers Sasquatch round, deep-dish, which is 20 inches in diameter. It is 1-3/4 inches thick, contains two toppings, and costs $17.25 plus sales tax of 5 percent and free delivery. (1) What is the problem in this situation? Please state that clearly and specifically. (2) Apply the seven principles of engineering economy systematically to the problem you set out in Part (1) (3) If your common unit of measurement is dollars (i.e., cost), what is the better value for having a pizza based on the criterion of reducing cost per unit volume? (4) What other criteria might be used to select…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education