Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Tutor need your help

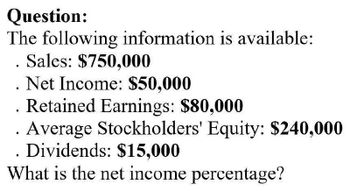

Transcribed Image Text:Question:

The following information is available:

. Sales: $750,000

Net Income: $50,000

Retained Earnings: $80,000

Average Stockholders' Equity: $240,000

. Dividends: $15,000

What is the net income percentage?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need answerarrow_forwardDetermine the following measures for 20Y2, rounding to one decimal place including, percentage, except for per-share amounts. 5. Number of days sales in receivables 7. number of days sale in inventory 12. return on total asset 14. return on common stockholders equity 17. dividends per share of common stock 18. dividend yield i need help on these questions i have provided please please pleasearrow_forwardWhat is the net income percentage?arrow_forward

- The net income is $800,000, the stock market price is $20, the shares outstanding is 200,000, please calculate PE ratio.a. 5b. 0.2c. 4 d. 0.25arrow_forwardCommon Stockholders' Profitability Analysis A company reports the following: Net income$135,000Preferred dividends5,400Average stockholders' equity1,022,727Average common stockholders' equity651,256 Determine (a) the return on stockholders’ equity and (b) the return on common stockholders’ equity. If required, round your answers to one decimal place. a. Return on Stockholders' Equityfill in the blank 1 %b. Return on Common Stockholders’ Equityfill in the blank 2 % Please dont provide solution in an image based thanksarrow_forwardA company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forward

- Using the following balance sheet and income statement data, what is the current ratio? Current assets $20400 Net income $47100 Stockholders' Current liabilities 10000 62600 equity Average assets 130000 Total liabilities 26600 Total assets 85000 Average common shares outstanding was 19000. O 0.77:1 0.62:1 O 2.04:1 O 3.20:1arrow_forwardWhat is the Days Payables Outstanding? Use the attached financial data to calculate the ratios. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 42.3 days, 37.0 days OB. 76.1 days, 89.4 days OC. 89.4 days, 37.0 days OD. 76.1 days, 97.7 days 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forwardWhat is the company's price earnings ratio for this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning