Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Use table information to get answer

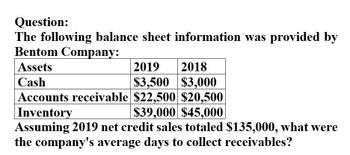

Transcribed Image Text:Question:

The following balance sheet information was provided by

Bentom Company:

Assets

Cash

2019 2018

$3,500 $3,000

Accounts receivable $22,500 $20,500

Inventory

$39,000 $45,000

Assuming 2019 net credit sales totaled $135,000, what were

the company's average days to collect receivables?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardBerry Farms has an accounts receivable balance at the end of 2018 of $425,650. The net credit sales for the year are $924,123. The balance at the end of 2017 was $378,550. What is the number of days sales in receivables ratio for 2018 (round all answers to two decimal places)?arrow_forwardChoose the correct answer and pls provide the formula A Company’s net accounts receivable were P250,000 as of December 31, 2018, and P300,000 as of December 31, 2019. Net cash sales for 2019 were P100,000. The accounts receivable turnover for 2019 was 5.0. What were the Company’s total net sales for 2019? *a. P1,175,000.00b. P1,275,000.00c. P1,375,000.00d. P1,475,000.00e. P1,575,000.00arrow_forward

- The following is select financial statement information from Vortex Computing: Year Net Credit Sales Ending Accounts Receivable 2018 $1,557,200 $398,000 2019 $1,755,310 $444,400 2020 $1,865,170 $500,780 Compute the accounts receivable turnover ratios and the number of days’ sales in receivables ratios for 2019 and 2020 (round answers to two decimal places): 2019 Accounts Receivable Turnover = ["", "", "", ""] times. 2019 Days' Sales in Receivables = ["", "", "", ""] days. 2020 Accounts Receivable Turnover = ["", "", "", ""] times. 2020 Days' Sales in Receivables = ["", "", "", ""] days.arrow_forwardThe following is select financial statement information from Vortex Computing: Year Net Credit Sales Ending Accounts Receivable 2018 $1,557,200 $398,000 2019 $1,755,310 $444,400 2020 $1,865,170 $500,780 Compute the accounts receivable turnover ratios and the number of days’ sales in receivables ratios for 2019 and 2020 (round answers to two decimal places): 2019 Accounts Receivable Turnover = ["", "", "", ""] times. 2019 Days' Sales in Receivables = ["", "", "", ""] days. 2020 Accounts Receivable Turnover = ["", "", "", ""] times. 2020 Days' Sales in Receivables = ["", "", "", ""] days. What do the outcomes tell a potential investor about Vortex Computing, if 2020 industry average for accounts receivable turnover ratio is 4.00 times and days’ sales in receivables ratio is 91.25 days? It takes Vortex Computing ["", "", ""] its competitors in the industry to collect on accounts receivable. If a lender were deciding between companies,…arrow_forwardWhat is the december 31, 2021 net realizable value?arrow_forward

- The financial data for A Company is the following: Balance sheet data (in $ millions) at 12/31 Accounts receivable Less: allowance for doubtful accounts Accounts receivable (net) Income statement data, year ending 12/31 Net sales (assume all on credit) Uncollectible accounts expense 2021 $ 500 150 350 2020 $ 450 140 310 $33,400 $21,500 100 110 1. Compute the accounts receivable turnover ratio for 2021 and 2020. 2. Wat amount of accounts receivable was collected in 2021? 3. How much was the write off of uncollectible accounts in 2021? 2019 $410 160 250 $19,200 95arrow_forwardThe following data are taken from the financial statements of Colby Company. Accounts receivable (net), end of year Net sales on account Terms for all sales are 1/10, n/45 Accounts Receivable turnover Average collection period (b) B I U T₂ T² Ix 2022 $550,000 4,300,000 2022 7.9 times lil 2021 What conclusions about the management of accounts receivable can be drawn from the accounts receivable turnover and the average collections period. € $540,000 4,000,000 2021 46.2 days 48.7 days 7.5 times W 144 144 들 3 99 = á T ¶₁arrow_forwardPlease dont give image format answersarrow_forward

- The following data relate to accounts receivable of Ritsu Company for 2019: Accounts Receivable, Jan. 1 650,000 Credit Sales 2,700,000 Sales Return 75,000 Accounts Written Off 40,000 Collections from customers 2,150,000 Estimated future sales return at December 31 50,000 Estimated uncollectible accounts at 12/31 per aging 110,000 What amount should Ritsu report as net realizable value of accounts receivable on December 31, 2019?arrow_forwardPlease Do not Give image formatarrow_forwardThe following data are taken from the financial statements of Colby Company. Accounts receivable (net), end of year Net sales on account Terms for all sales are 1/10, n/45 Accounts Receivable turnover Average collection period (b) 2022 $550,000 2022 2021 4,300,000 4,000,000 7.9 times $540,000 2021 7.5 times 46.2 days 48.7 days What conclusions about the management of accounts receivable can be drawn from the accounts receivable turnover and the average collections period.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College