FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

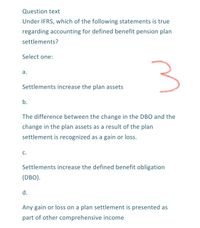

Transcribed Image Text:Question text

Under IFRS, which of the following statements is true

regarding accounting for defined benefit pension plan

settlements?

Select one:

а.

Settlements increase the plan assets

b.

The difference between the change in the DBO and the

change in the plan assets as a result of the plan

settlement is recognized as a gain or loss.

c.

Settlements increase the defined benefit obligation

(DBO).

d.

Any gain or loss on a plan settlement is presented as

part of other comprehensive income

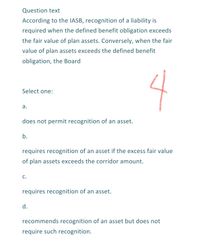

Transcribed Image Text:Question text

According to the IASB, recognition of a liability is

required when the defined benefit obligation exceeds

the fair value of plan assets. Conversely, when the fair

value of plan assets exceeds the defined benefit

obligation, the Board

4

Select one:

а.

does not permit recognition of an asset.

b.

requires recognition of an asset if the excess fair value

of plan assets exceeds the corridor amount.

C.

requires recognition of an asset.

d.

recommends recognition of an asset but does not

require such recognition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- parrow_forwardS1: Under a defined contribution plan, the amount of a participant’s future benefits is determined by the contributions paid by the employer, the participant, or both, and the operating efficiency and investment earnings of the fund. S2: Under a defined benefit plan, the payment of promised retirement benefits depends on the financial position of the plan and the ability of contributors to make future contributions to the plan as well as the investment performance and operating efficiency of the plan. Only S1 is true None is true Only S2 is true Both are truearrow_forwardThe two main types of pension plans are defined benefit plans and defined contribution plans. Explain the difference between the two. How does the accounting for each differ?arrow_forward

- Annual additions to qualified retirement plans include interest and dividend income. forfeitures reallocated to plan participants. employee contributions. employer contributions. A) I, II, and III B) II, III, and IV C) I, II, III, and IV D) II and IVarrow_forwardHow is the pension expense influenced by changes in the pension liability and plan assets?arrow_forwardAny past service costs should be included in the a) pension expense of past periods. b) pension expense of the current period. c) pension expense of current and future periods. d) plan assets.arrow_forward

- 33. In a defined-benefit plan, the process of funding refers to determining the projected benefit obligation. determining the amount that might be reported for pension expense. determining the accumulated benefit obligation. making the periodic contributions to a funding agency to ensure that funds are available to meet retirees' claims.arrow_forwardA company that sponsors a defined benefit plan records an entry to debit OCI-Pension Gain/Loss for $5,000 and credit Plan Assets. The company uses the corridor approach to amortize Accumulated OCI-Pension Gain/Loss. This entry indicates that Select one: O a. The expected return on plan assets exceeded actual return on plan assets. O b. The actual return on plan assets exceeded the expected return on plan assets. O c. The beginning balance in Accumulated OCI-Pension Gain/Loss exceeded the corridor. O d. The beginning balance in Accumulated OCI-Pension Gain/Loss did not exceed the corridor. e. a and c f. b and d OOarrow_forwardQuestion text In determining the present value of the prospective benefits (often referred to as the defined benefit obligation), the following are considered by the actuary: Select one: а. retirement and mortality rate. b. benefit provisions of the plan. c. all of these factors d. interest rates.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education