Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is your net dollar sales projection for this year?

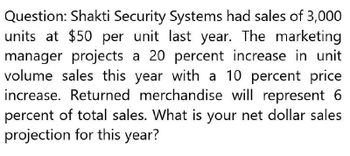

Transcribed Image Text:Question: Shakti Security Systems had sales of 3,000

units at $50 per unit last year. The marketing

manager projects a 20 percent increase in unit

volume sales this year with a 10 percent price

increase. Returned merchandise will represent 6

percent of total sales. What is your net dollar sales

projection for this year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate net dollar sales and give answerarrow_forwardAnswer this questionarrow_forwardCyber Security Systems had sales of 4,600 units at $65 per unit last year. The marketing manager projects a 30 percent increase in unit volume sales this year with a 40 percent price increase. Returned merchandise will represent 5 percent of total sales. What is your net dollar sales projection for this year?arrow_forward

- Central Networks had sales of 3,600 units at $80 per unit last year. The marketing manager projects a 10 percent increase in unit- volume sales this year with a 10 percent increase in price. Returned merchandise will represent 10 percent of total sales. What is your net dollar sales projection for this year? Net salesarrow_forwardDodge Ball Bearings had sales of 12,000 units at $80 per unit last year. The marketing manager projects a 30 percent increase in unit volume sales this year with a 15 percent price decrease (due to a price reduction by a competitor). Returned merchandise will represent 7 percent of total sales. What is your net dollar sales projection for this year?arrow_forwardDodge Ball Bearings had sales of 14,000 units at $70 per unit last year. The marketing manager projects a 15 percent increase in unit volume sales this year with a 10 percent price decrease (due to a price reduction by a competitor). Returned merchandise will represent 10 percent of total sales. What is your net dollar sales projection for this year? Net salesarrow_forward

- Your company has sales of $97,200 this year and cost of goods sold of $71,200. You forecast sales to increase to $113,100 next year. Using the percent of sales method, forecast next year's cost of goods sold.arrow_forwardSharpe Knife Company expects sales next year to be $1,620,000 if the economy is strong, $860,000 if the economy is steady, and $620,000 if the economy is weak. Ms. Sharpe believes there is a 30 percent probability the economy will be strong, a 40 percent probability of a steady economy, and a 30 percent probability of a weak economy. What is the expected level of sales for the next year?arrow_forwardLewellen Products has projected the following sales for the coming year: 01 02 03 04 Sales $940 $1,020 $980 $1,080 Sales in the year following this one are projected to be 20 percent greater in each quarter a. Calculate payments to suppliers assuming that the company places orders during each quarter equal to 30 percent of projected sales for the next quarter. Assume that the company pays immediately. What is the payables period in this case? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate payments to suppliers assuming a 90-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate payments to suppliers assuming a 60-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. b. Payment of accounts Payment of accounts Payment of accounts 01 02 Q3 Q4arrow_forward

- Estimate Larson’s sales revenues from this model of backpack for the coming year.arrow_forwardAnswer the following lettered questions on the basis of the information in this table: Amount of R&D, $ Millions Expected Rate of Return on R&D, % $ 10 16 20 14 30 12 40 10 50 8 60 6 Instructions: Enter your answer as a whole number. a. If the interest-rate cost of funds is 8 percent, what is this firm's optimal amount of R&D spending? million %24arrow_forwarda. Assume that the cost of goods sold is 60% and that the monthly discount rate is 1%. Looking at the values in the exhibit above, you note that the average monthly revenue for a subscribed customer rises as the company sends more emails. In addition, the average monthly revenue for an unsubscribed customer also rises as the company sends more emails. What could explain both of these patterns? b. Calculate the 6-month LTV for each of the four tested email frequencies. Please show the spreadsheet with your calculations and be clear about any assumptions you are making. c. Based on this test, how many emails-per-week should the company be sending to its customers? This email frequency should apply to all customers; the company doesn't want to implement a different email frequency for different kinds of peoplearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning