Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is ridgeway company's total equity?

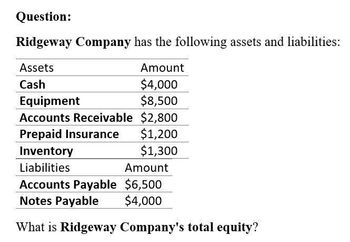

Transcribed Image Text:Question:

Ridgeway Company has the following assets and liabilities:

Assets

Cash

Equipment

Amount

$4,000

$8,500

Accounts Receivable $2,800

Prepaid Insurance $1,200

Inventory

$1,300

Liabilities

Amount

Accounts Payable $6,500

Notes Payable

$4,000

What is Ridgeway Company's total equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assets: Cash Accounts receivable (net) Investments Inventory Prepaid rent Total current assets Property & Equipment, (net) Total assets $66 179 55 200 28 528 264 $792 Liabilities and Stockholder's Equity: Accounts payable Other liabilities Total current liabilities Long-term liabilities Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and equity What is the debt to equity ratio? (Round your answer to two decimal places.) $246 81 327 118 445 156 191 347 $792arrow_forwardCalculate the following for Co. XYZ: a. Current ratio b. Debt ratio Assets: Cash and marketable securities $400,000 Accounts receivable 1,415,000 Inventories 1,847,500 Prepaid expenses 24,000 Total current assets $3,686,500 Fixed assets 2,800,000 Less: accumulated depreciation 1,087,500 Net fixed assets $1,712,500 Total assets $5,399,000 Liabilities: Accounts payable $600,000 Notes payable 875,000 Accrued taxes Total current liabilities $1,567,000 Long-term debt 900,000 Owner's equity Total liabilities and owner's equity Co. XYZ Income Statement: Net sales (all credit) $6,375,000 Less: Cost of goods sold 4,375,000 Selling and administrative expense 1,000,500 Depreciation expense 135,000 Interest expense Earnings before taxes $765,000 Income taxes Net income Common stock dividends $230,000 Change in retained earningsarrow_forwardFind BEP.arrow_forward

- Please show calculationarrow_forwardCategory. Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 429,735.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 55,152.00 Interest expense 40,500 42,662.00 Inventories 279,000 288,000 Long-term debt 339,349.00 400,985.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 161,641.00 Retained earnings 306,000 342,000 Sales 639,000 848,846.00 Тахes 24,750 47,931.00arrow_forwardWhat is the debit to asset ratio?arrow_forward

- Consider this simplified balance sheet for Geomorph Trading: Current assets Long-term assets $ 245 Current liabilities Long-term debt 630 Other liabilities Equity $ 875 Required: a. What is the company's debt-equity ratio? (Hint: debt = Current liabilities, Long-term debt, and Other liabilities) Note: Round your answer to 2 decimal places. b. What is the ratio of total long-term debt to total long-term capital? Note: Round your answer to 2 decimal places. c. What is its net working capital? d. What is its current ratio? Note: Round your answer to 2 decimal places. $ 170 215 140 350 $ 875 a Debt-equity ratio b. Long-term debt-to-capital ratio c. Net working capital d. Current ratioarrow_forwardPlease provide correct answer this question general accountingarrow_forwardPlease fill X'sarrow_forward

- K. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets Liabilities and owners' equity. Accounts payable ST Notes payable Long-term debt Owners' Equity Total liabilities and owner's equity Balance Sheet $250,000 450.000 500,000 2.100,000 $3,300.000 $100.000 450.000 1,050,000 1,700.000 $3,300,000 Income Statement Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4.000.000) (2,900,000) (150,000) (380,000) $570,000 Based on the information for K. Jackson Corporation, the current and acid-test ratios are, respectively. OA2.37 and 1.39. OB2 37 and 1.27 OC2 18 and 1.39 OD.2 18 and 1.27 OE None of the above.arrow_forwardI need this question answer general Accountingarrow_forwardCalculate the ratio of debt to equity??? General accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,