FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Q1,1

Transcribed Image Text:**Question List**

**Question 1**

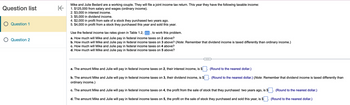

Mike and Julie Bedard are a working couple. They will file a joint income tax return. This year they have the following taxable income:

1. $125,000 from salary and wages (ordinary income).

2. $3,000 in interest income.

3. $5,000 in dividend income.

4. $2,000 in profit from the sale of a stock they purchased two years ago.

5. $4,000 in profit from a stock they purchased this year and sold this year.

Use the federal income tax rates given in Table 1.2 to work this problem.

a. How much will Mike and Julie pay in federal income taxes on 2 above?

b. How much will Mike and Julie pay in federal income taxes on 3 above? (Note: Remember that dividend income is taxed differently than ordinary income.)

c. How much will Mike and Julie pay in federal income taxes on 4 above?

d. How much will Mike and Julie pay in federal income taxes on 5 above?

---

a. The amount Mike and Julie will pay in federal income taxes on 2, their interest income, is $_____. (Round to the nearest dollar.)

b. The amount Mike and Julie will pay in federal income taxes on 3, their dividend income, is $_____. (Round to the nearest dollar.) (Note: Remember that dividend income is taxed differently than ordinary income.)

c. The amount Mike and Julie will pay in federal income taxes on 4, the profit from the sale of stock that they purchased two years ago, is $_____. (Round to the nearest dollar.)

d. The amount Mike and Julie will pay in federal income taxes on 5, the profit on the sale of stock they purchased and sold this year, is $_____. (Round to the nearest dollar.)

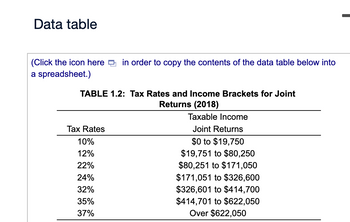

Transcribed Image Text:# Tax Rates and Income Brackets for Joint Returns (2018)

This table provides an overview of federal tax rates for different taxable income brackets for joint returns in 2018. The table is structured into two columns: Tax Rates and Taxable Income (Joint Returns).

### Tax Rates and Corresponding Brackets:

- **10% Tax Rate**: Applicable to income from $0 to $19,750

- **12% Tax Rate**: Applicable to income from $19,751 to $80,250

- **22% Tax Rate**: Applicable to income from $80,251 to $171,050

- **24% Tax Rate**: Applicable to income from $171,051 to $326,600

- **32% Tax Rate**: Applicable to income from $326,601 to $414,700

- **35% Tax Rate**: Applicable to income from $414,701 to $622,050

- **37% Tax Rate**: Applicable to income over $622,050

This table can help taxpayers understand their potential federal tax obligations based on their joint income.

(Note: There is an option to click an icon to copy the table contents into a spreadsheet for further analysis.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Define Taxation for Filing Return Jointly

VIEW Step 2: a) The calculation of the amount of tax on ordinary income is as follows-

VIEW Step 3: b) Tax on dividend income is as follows-

VIEW Step 4: c) The calculation on tax Long-term capital gains is as follows-

VIEW Step 5: d) The calculation on tax Long-term capital gains is as follows-

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education