ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question C2

The Australian Competition and Consumer Commission (ACCC) has opened an

investigation regarding collusion between the two major firms producing fire protection

gear for bush firefighters. The firms - Azure Associates and Blue Guard - contend that

they are quantity competitors and that the prices they are charging are a result of an

increase in price by their suppliers.

As part of the case, the ACCC has noted that the Australian firefighters typically purchase

their own protective gear and are thus price takers in the market. Both the ACCC and the

two firms under investigation agree that the market demand can be described by the

inverse demand function:

P(Q)=240-Q,

where Q is the total quantity provided by the two firms (i.e., Q=q₁ + 9B, where is the

9A

amount produced by Azure Associates and q, is the amount produced by Blue Guard).

All parties also agree that the two firms have identical production technologies and that

the two firms have the same constant marginal cost of production of c. In court, however,

the firms argue that their marginal costs are high while the ACC argues that they are low.

Question C2.1

Azure Associates and Blue Guard contend that the two firms are competing as an oligopoly

and that they compete by simultaneously choosing quantity. They argue that their

marginal costs of production are equal to c= 75. Based on this marginal cost, the two

firms have the following profit functions:

c=75

TA(9₁9B)=(240-9₁-9B)9₁-759₁

TB (94,9B)=(240-9₁-9B)9B-759B

Using these profit functions, find the best-response function for each firm based on the

other firm's quantity choice. Use these best-response functions to calculate the

equilibrium price and quantity that would arise in the market.

Question C2.2

The ACCC maintains that the two firms are acting in a collusive agreement and that the

marginal cost of production is 10. Using these assumptions, calculate the predicted

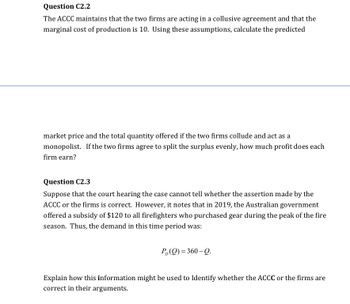

Transcribed Image Text:Question C2.2

The ACCC maintains that the two firms are acting in a collusive agreement and that the

marginal cost of production is 10. Using these assumptions, calculate the predicted

market price and the total quantity offered if the two firms collude and act as a

monopolist. If the two firms agree to split the surplus evenly, how much profit does each

firm earn?

Question C2.3

Suppose that the court hearing the case cannot tell whether the assertion made by the

ACCC or the firms is correct. However, it notes that in 2019, the Australian government

offered a subsidy of $120 to all firefighters who purchased gear during the peak of the fire

season. Thus, the demand in this time period was:

P₂(Q)=360-Q.

Explain how this information might be used to Identify whether the ACCC or the firms are

correct in their arguments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 15 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Le Jouet is a French firm, and it is the only seller of toy trains in France and Russia. Suppose that when the price of toy trains increases, Russian children more readily replace them with toy airplanes than French children. Thus, the demand for toy trains in Russia is more elastic than in France. The following graphs show the demand curves for toy trains in France (Dr) and Russia (DR) and marginal revenue curves in France (MRF) and Russia (MRR). Le Jouet's marginal cost of production (MC), depicted as the grey horizontal line in both graphs, is $12, and the resale of toy trains from Russia to France is prohibited. Assume there are no fixed costs in production, so marginal cost equals average total cost (ATC). PRICE (Dollars per toy train) 40 36 32 28 Total 24 20 16 12 8 4 0 Country France Russia France MR Price (Dollars per toy train) 20 20 2 4 6 8 10 12 14 16 18 20 QUANTITY (Millions of toy trains) N/A O True MC-ATC OF O False N/A (?) Single Price Quantity Sold (Millions of toy…arrow_forwardTwo firms produce goods that are imperfect substitutes. If firm 1 charges price p1 and firm 2 charges price p2, then their respective demands are q1 = 12 - 2p1 + p2 and q2 = 12 + p1 - 2p2 So this is like Bertrand competition, except that when p1 > p2, firm 1 still gets a positive demand for its product. Regulation does not allow either firm to charge a price higher than 20. Both firms have a constant marginal cost c = 4. (a) Construct the best reply function BR1(p2) for firm 1. That is, p1 = BR1(p2) is the optimal price for firm 1 if it is known that firm 2 charges a price p2. Construct a Nash equilibrium in pure strategies for this game. Are there any Nash equilibria in mixed strategies? If yes, construct one; if no provide a justification. (b) Notice that for any given price p1, firm 1’s demand increases with p2, so firm 1 is better off when firm 2 charges a high price p2. What is the best reply to p2 = 20? What is the best reply to p2 = 0 (c) What prices for firm 1 are…arrow_forwardIn the late 1990s, Vanguard Airlines operated as a low-cost carrier, offering low prices and limited services, out of Kansas City, Missouri. Not long after its inception, Vanguard began offering a significant number of flights based out of Midway International Airport in Chicago, Illinois, as well. When Vanguard expanded to Midway, incumbent airlines, such as Delta, quickly responded to its low fares by offering many competing flights at comparably low prices. The intense price competition ultimately caused Vanguard to exit Midway in 2000 and file for bankruptcy in 2002. At varying points in time, the airline industry has been described as a contestable market; does the example of Vanguard support or refute this characterization of the airline industry? Explainarrow_forward

- Please answer each step clearly and how to do it. Thank youarrow_forwardThe AC and MC values for firms in a perfectly competitive industry are as follows: Q AC MC 1 12 2 8 20 3 12 4 16 36 5 20 8 24 52 7 28 60 8 32 68 36 76 Suppose that there are 70 firms operating in the industry. Using the MC curve, find out how much output in total is delivered to the market at each price (you only need to consider prices equal to the MC values above). Now assume that the market demand curve is given by p 305 .5Q, where p is the market price. For purposes of this problem, it is helpful to "invert" the demand curve, writing Q in terms of p. This gives Q=610 2p a) Verify that when p 44 the market has O A. excess supply O B. excess demand equal to units. When p 68, the market has O A. excess demand O B. excess supply equal to units. and profit per firm equals(don't include S signs in b) Find the market equilibrium price, and compute output per firm and profit per firm at this price (you need only check prices corresponding to the above MC values. The equilibrium price is p…arrow_forwardQ16 Suppose we are referring to OPEC, the oil cartel. Which would make it easier to maintain an effective collusive agreement among OPEC members? Multiple Choice the emergence of a number of potential entrant firms a decrease in the elasticity of demand for the OPEC's oil a new method of pricing that makes it more difficult for cartel members to determine the prices at which other cartel members are selling oil an increase in the number of substitutes for the oil produced by the OPEC cartel a pledge of allegiance to the cartelarrow_forward

- OC makes and sells an executive game for two distinct markets in which it currently has a monopoly. The fixed costs of production per month are $20,000, and variable costs per unit produced, and sold, are $40. The monthly sales can be thought of as X, where X = X1 + X2, with X1 and X2 denoting monthly sales in their respective markets. Detailed market research has revealed the demand functions in the markets to be as follows, with prices shown as P1 and P2: Market 1: P1 = 55 - 0.05X1 Market 2: P2 = 200 - 0.2X2 The management accountant believes there should be price discrimination; the price is currently $50 per game in either market. Required: a) What is the optimum price to charge in Market 1? b) What is the optimum quantity to produce in Market 2? c) The following statements have been made about price discrimination: 1) Price discrimination should be used if a business wishes to discourage new entrants into a market. 2) Price discrimination can be difficult to implement in…arrow_forwardTwo firms produce goods that are imperfect substitutes. If firm 1 charges price p1 and firm 2 charges price p2, then their respective demands are q1 = 12 - 2p1 + p2 and q2 = 12 + p1 - 2p2 So this is like Bertrand competition, except that when p1 > p2, firm 1 still gets a positive demand for its product. Regulation does not allow either firm to charge a price higher than 20. Both firms have a constant marginal cost c = 4. (a) Construct the best reply function BR1(p2) for firm 1. That is, p1 = BR1(p2) is the optimal price for firm 1 if it is known that firm 2 charges a price p2. Construct a Nash equilibrium in pure strategies for this game. Are there any Nash equilibria in mixed strategies? If yes, construct one; if no provide a justification. (b) Notice that for any given price p1, firm 1’s demand increases with p2, so firm 1 is better off when firm 2 charges a high price p2. What is the best reply to p2 = 20? What is the best reply to p2 = 0 (c) What prices for firm 1 are…arrow_forwardIn India, Cisco’s market share of the Ethernet switch and router market is approximately 67 percent. Juniper and HP each have market shares of about 6.5 percent, and several other firms have somewhat smaller market shares. Draw a diagram showing the equilibrium in this dominant firm market. Identify the equilibrium price and the equilibrium quantity produced by the dominant firm and the competitive fringe firms. Illustrate what happens to the equilibrium price and the equilibrium quantity produced by the dominant firm and the competitive fringe firms if additional fringe firms enter the marketarrow_forward

- The firm ACME, Inc. operates in a competitive market because OACME, Inc. is one of a few firms and entry in this market is easy OACME, Inc. can influence the market price and sells a product different from other firms in the market OACME, Inc. is one of many firms selling the same product and, market entry is easy OACME, Inc. is one of many firms selling the same product and, market entry is blockedarrow_forwardSuppose Mattel, the producer of Barble dolls and accessorles (sold separately), has two types of consumers who purchase Its dolls: low-value consumers and high-value consumers. Each of the low-value consumers tends to purchase one doll and one accessory, with a total willingness to pay of $44. Each of the high-value consumers buys one doll and two accessorles and Is willing to pay $82 In total. Mattel Is currently considering two pricing strategles: • Strategy 1: Sell each doll for $22 and each accessory for $22 • Strategy 2: Sell each doll for $6 and each accessory for $38 In the following table, Indicate the revenue for a low-value and a high-value customer under strategy I and strategy 2. Then, assuming each strategy is applied to one low-value and one high-value customer, indicate the total revenue for each strategy. Revenue from Low-Value Revenue from High-Value Total Revenue from Customers Customers Strategy $44 Value, 1 Accessory S82 Value, 2 Accessories (s) ($) (s) Strategy 1…arrow_forwardThe Jakarta Post - Coordinating Maritime Affairs Minister Luhut Pandjaitan said he wants to push for the emergence of a new player in the jet fuel or avtur business in an effort to lower airfares. The market is currently dominated by state-owned energy company Pertamina. Previously, President Joko Widodo criticized Pertamina for “monopolizing” the avtur business that was blamed for the high price of the commodity. “Because of a monopolistic market, the price isn’t competitive. Many want to sell avtur, and it will lead to lower prices and encourage efficiency.” Jokowi said. Do you agree with the statements? ? Use a relevant graph to help explain your answer. (Hint: Use graphical analysis to compare the condition under perfect competition and monopoly markets in your answer)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education