ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

uestion

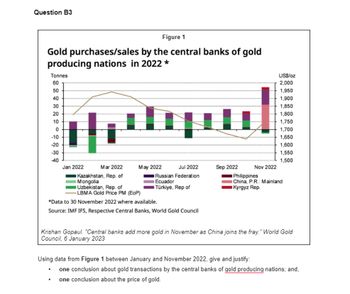

Using data from Figure 1 between January and November 2022,

Question B3

Figure 1

Gold purchases/sales by the central banks of gold

producing nations in 2022 *

*Data to 30 November 2022 where available.

Source: IMF IFS, Respective Central Banks, World Gold Council

Krishan Gopaul. "Central banks add more gold in November as China joins the fray." World Gold

Council, 6 January 2023

Using data from Figure 1 between January and November 2022, give and justify:

one conclusion about gold transactions by the central banks of gold producing nations; and,

one conclusion about the price of gold.

Refer to the Assessment section to consider which assessment points are examined in this question.

50-100 wordsgive and justify:Question B3

Figure 1

Gold purchases/sales by the central banks of gold

producing nations in 2022 *

*Data to 30 November 2022 where available.

Source: IMF IFS, Respective Central Banks, World Gold Council

Krishan Gopaul. "Central banks add more gold in November as China joins the fray." World Gold

Council, 6 January 2023

Using data from Figure 1 between January and November 2022, give and justify:

one conclusion about gold transactions by the central banks of gold producing nations; and,

one conclusion about the price of gold.

one conclusion about gold transactions by the central banks of gold producing nations; and,

one conclusion about the price of gold.

Transcribed Image Text:Question B3

Figure 1

Gold purchases/sales by the central banks of gold

producing nations in 2022 *

Tonnes

60

50

40

30

20

10

0

-10

-20

-30

-40

Jan 2022

Mar 2022

May 2022

Kazakhstan, Rep. of

Mongolia

US$/oz

2,000

1,950

1,900

1,850

1,800

1,750

1,700

1,650

1,600

1,550

1,500

Jul 2022

Sep 2022

Nov 2022

Philippines

China, P.R.: Mainland

Kyrgyz Rep.

Uzbekistan, Rep. of

-LBMA Gold Price PM (EOP)

*Data to 30 November 2022 where available.

Russian Federation

Ecuador

Türkiye, Rep of

Source: IMF IFS, Respective Central Banks, World Gold Council

Krishan Gopaul. "Central banks add more gold in November as China joins the fray." World Gold

Council, 6 January 2023

Using data from Figure 1 between January and November 2022, give and justify:

one conclusion about gold transactions by the central banks of gold producing nations; and,

one conclusion about the price of gold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate e) and f) Thank you.arrow_forwardQUESTION 4 Consider the following two figures. Japanese Yen per 1 uS Dollar Graph Danish Krone per 1 Euro Graph 12 Mar 2018 16:00 UTC - 11 Apr 2018 16:48 UTC 12 Mar 2018 16:00 UTC - 11 Apr 2018 16:10 UTC 107.07591 7.4648491 106, 39703 7.4552022| 1d5.1Ma16 105.03928 7.4359083. 104.36040 7.4262613 Apr9 Mar 12 Mar 12 Mar 19 Mar 26 | Apr 2 Apr 2 | Apr 9 Mar 19 Mar 26 Which of the following statements is correct? A. the left figure describes a fixed exchange rate; the right figure describes a fixed exchange rate O B. the left figure describes a flexible exchange rate; the right figure describes a flexible exchange rate C. the left figure describes a fixed exchange rate; the right figure describes a flexible exchange rate D. the left figure describes a flexible exchange rate; the right figure describes a fixed exchange ratearrow_forward1. Assume the theory of absolute convergence is literally true. The current GDP per capita of Iran is $5000 and the current GDP per capita of Switzerland is $30000. What will happen to the difference between these two countries in the "long run"? 2. What has to be true of the capital account between two countries if the current account is negative? Answer 2nd Questionarrow_forward

- I need all answers plsarrow_forwardQuestion 38 If you go to the bank and notice that a dollar buys more Ghanaian cedis than it used to, then the dollar has appreciated. Other things the same, the appreciation would make Americans less likely to travel to Ghana. O appreciated. Other things the same, the appreciation would make Americans more likely to travel to Ghana. depreciated. Other things the same, the depreciation would make Americans less likely to travel to Ghana. depreciated. Other things the same, the depreciation would make Americans more likely to travel to Ghana.arrow_forwardAnswer this for me mate. Much appreciated.arrow_forward

- D6: Please Discuss/Calculate The Gold Standard System or the GSS (Hint: Chapter 3 in G (e) book/book). Exactly; thus: 1. Define the genesis & evolution of the GSS. 2. Define & exemplify gold parity and gold export-import points. 3. Would you prefer a globalisation GSS for the current world economy? Why? Why not?arrow_forwardQuestion One Provide short answers: Assume the consumer price index in France rises from 250 at the end of the year to 265 at the end of the next year, how much inflation was there in France during that year? Describe the difference between a price level and a price index. Outline the theory of absolute purchasing power parity. During our discussion of absolute purchasing power parity we frequently referred to the law of one price. Write a short note on the logic of the law of one price and consider why this condition may be violated.arrow_forwardSuppose a country's net exports are $400 billion, income receipts on investments are $780 billion, and income payments on investments are $1,200 billion. Suppose unilateral transfers are $250 billion. If all international transactions are recorded accurately in the balance of payments, what is the value of the financial account? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a -$20 billion b d -$270 billion $270 billion Need information on the flows of funds for real and financial investments to answer. Your answerarrow_forward

- When considering two countries, if the currency of one country appreciates, then in all cases, the currency of the other country___________?Group of answer choices 1Appreciates. 2What will happen to the currency of the other country is uncertain. 3Gains value. 4Depreciates.arrow_forwardTyped plzzz And Asap Thanksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education