Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Questions attached

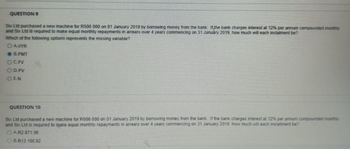

Transcribed Image Text:QUESTION 9

Six Ltd purchased a new machine for R500 000 on 01 January 2019 by borrowing money from the bank. Itthe bank charges interest at 12% per annum compounded monthly

and Six Ltd is required to make equal monthly repayments in arrears over 4 years commencing on 31 January 2019, how much will each instalment be?

Which of the following options represents the missing variable?

OAVYR

● B.PMT

OC.FV

OD.PV

OEN

QUESTION 10

Six Ltd purchased a new machine for R500 000 on 01 January 2019 by borrowing money from the bank. If the bank charges interest at 12% per annum compounded monthly

and Six Ltd is required to make equal monthly repayments in arrears over 4 years commencing on 31 January 2019. How much will each installment be?

ⒸAR2 871.06

OBR13 166.92

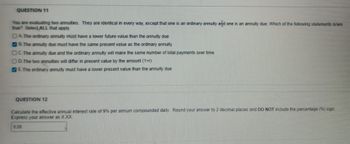

Transcribed Image Text:QUESTION 11

You are evaluating two annuities. They are identical in every way, except that one is an ordinary annuity arid one is an annuity due. Which of the following statements is/are

true? Select ALL that apply.

DA. The ordinary annuity must have a lower future value than the annuity due

B. The annuity due must have the same present value as the ordinary annuity

C. The annuity due and the ordinary annuity will make the same number of total payments over time

OD. The two annuities will differ in present value by the amount (1+r)

E. The ordinary annuity must have a lower present value than the annuity due

QUESTION 12

Calculate the effective annual interest rate of 9% per annum compounded daily Round your answer to 2 decimal places and DO NOT include the percentage (%) sign.

Express your answer as X.XX.

9,06

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Similar questions

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education