Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

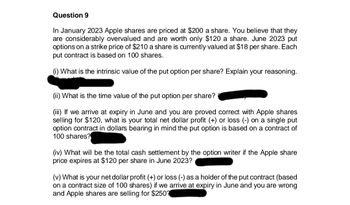

Transcribed Image Text:Question 9

In January 2023 Apple shares are priced at $200 a share. You believe that they

are considerably overvalued and are worth only $120 a share. June 2023 put

options on a strike price of $210 a share is currently valued at $18 per share. Each

put contract is based on 100 shares.

(i) What is the intrinsic value of the put option per share? Explain your reasoning.

(ii) What is the time value of the put option per share?

(iii) If we arrive at expiry in June and you are proved correct with Apple shares

selling for $120, what is your total net dollar profit (+) or loss (-) on a single put

option contract in dollars bearing in mind the put option is based on a contract of

100 shares?

(iv) What will be the total cash settlement by the option writer if the Apple share

price expires at $120 per share in June 2023?

(v) What is your net dollar profit (+) or loss (-) as a holder of the put contract (based

on a contract size of 100 shares) if we arrive at expiry in June and you are wrong

and Apple shares are selling for $250?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you own a put option on Apple stock with a strike price of $150. Suppose it is the expiration date of the option and the current stock price of Apple is $75. What payoff will you receive from making an optimal exercise decision on your option? 1. -$75 2. $0 3. $75arrow_forwardStock Price to Profit You buy an “at the money” April call option on M&M Corp. common stock, which has a strike price of $40 and a premium of $3.15. What must happen to the price of M&M Corp. stock for you to make a profit?arrow_forwardIn January 2023 Apple shares are priced at $200 a share. You believe that they are considerably overvalued and are worth only $120 a share. June 2023 put options on a strike price of $210 a share is currently valued at $18 per share. Each put contract is based on 100 shares. (i) What is the intrinsic value of the put option per share? Explain your reasoning. (ii) What is the time value of the put option per share? (iii) If we arrive at expiry in June and you are proved correct with Apple shares selling for $120, what is your total net dollar profit (+) or loss (-) on a single put option contract in dollars bearing in mind the put option is based on a contract of 100 shares? (iv) What will be the total cash settlement by the option writer if the Apple share price expires at $120 per share in June 2023? (v) What is your net dollar profit (+) or loss (-) as a holder of the put contract (based on a contract size of 100 shares) if we arrive at expiry in June and you are wrong and Apple…arrow_forward

- QUESTION 5 Suppose company XYZ's stock is trading at $53.86. You currently hold a put option with a strike price of $69.95 and premium on the option was $14.39. If today is the expiration date, how much did you gain or lose on the option? (Put the answer in as a negative if it's a loss.)arrow_forwardsa.3arrow_forward5arrow_forward

- F1arrow_forwardIntro A non dividend-paying stock currently trades at $80. You short sell one share of stock, buy a call option and write a put option, both with a strike price of $51. Your immediate cash inflow is $47.84. Both options expire in one year. Part 1 What is the risk-free rate? 3+ decimalsarrow_forwardQuestion 44. You hold a call option on Pear Corp.'s common stock. The call option has a strike price of $81 per share (a total strike price of $8,100), with a maturity date 1 year into the future. The option is exercisable at any time on or before the maturity date, Which of the following is true if you exercise the option when Pear Corp.'s common stock is trading at $90 per share? (A) The market price is $9,000, you lose $900, and the option is out-of-the-money. (B) The market price is $9,000, you make $900, and the option is out-of-the-money. (C) The market price is $9,000, you lose $900, and the option is in-the-money. (D) The market price is $9,000, you make $900, and the option is in-the-money. (E) None of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education