Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

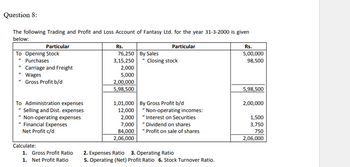

Transcribed Image Text:Question 8:

The following Trading and Profit and Loss Account of Fantasy Ltd. for the year 31-3-2000 is given

below:

Particular

To Opening Stock

"Purchases

"Carriage and Freight

" Wages

Gross Profit b/d

To Administration expenses

"Selling and Dist. expenses

"Non-operating expenses

"Financial Expenses

Net Profit c/d

Calculate:

1. Gross Profit Ratio

1. Net Profit Ratio

Rs.

76,250 By Sales

3,15,250

2,000

5,000

2,00,000

5,98,500

Particular

"Closing stock

1,01,000

By Gross Profit b/d

12,000 "Non-operating incomes:

2,000

"Interest on Securities

7,000

"Dividend on shares

84,000 "Profit on sale of shares

2,06,000

2. Expenses Ratio 3. Operating Ratio

5. Operating (Net) Profit Ratio 6. Stock Turnover Ratio.

Rs.

5,00,000

98,500

5,98,500

2,00,000

1,500

3,750

750

2,06,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- K The balance sheets of Prima Ltd. and Donna Corp. on December 31, Year 5, are shown below: Mc Graw Hill Cash Accounts receivable Inventory Plant Patents Current liabilities Long-term debt Common shares Retained earnings Cash Accounts receivable Inventory Plant Prima $ 374,200 84,200 100,400 514,800 104,400 $1,178,000 Trademarks Patents Current liabilities Long-term debt $ 164,800 262,000 356,800 394,400 $1,178,000 The fair values of the identifiable net assets of Donna Corp. on this date are as follows: $ 10,650 22,800 85,000 197,000 30,000 60,000 36,400 78,000 Donna $ 10,650 26,800 69,600 166,000 26,800 $ 299,850 $36,400 68,000 102,000 93,450 $ 299,850 In addition to the assets identified above, Donna owned a significant number of Internet domain names, which are unique alphanumeric names used to identify a particular numeric Internet address. These domain names can be sold separately and are estimated to be worth a total of $58,000. On January 1, Year 6, Prima Ltd. paid $315,000 in…arrow_forwardMeasures of liquidity, solvency, and profitability answer 10,11,12 The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,704,000 $3,264,000 Net income $ 600,000 $ 550,000 Dividends: On preferred stock (10,000) (10,000) On common stock (100,000) (100,000) Increase in retained earnings $ 490,000 $ 440,000 Retained earnings, December 31 $4,194,000 $3,704,000 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 10,850,000 $10,000,000 Cost of goods sold (6,000,000) (5,450,000) Gross profit $ 4,850,000 $ 4,550,000 Selling expenses $ (2,170,000) $ (2,000,000) Administrative expenses (1,627,500) (1,500,000) Total operating expenses $(3,797,500) $…arrow_forwardPlease help me with all answers I will give upvote thankuarrow_forward

- Presented below are selected account balances for Skysong Co. as of December 31, 20X1. Inventory 12/31/X1 Common Stock Retained Earnings Dividends Sales Returns and Allowances $60,380 73,910 44,880 18,039 Cost of Goods Sold Selling Expenses Administrative Expenses Income Tax Expense $224,260 16,250 37,419 29,860 11,879 Sales Discounts 15,240 Sales Revenue 417,310 Prepare closing entries for Skysong Co. on December 31, 20X1.arrow_forwardplease provide correct and complete answer with compulsory explanation, narrations , calculation for each part ,steps clearly answer in text from remember each part and calculation should have explanation and show working for each calculationarrow_forwardRakesharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education