Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

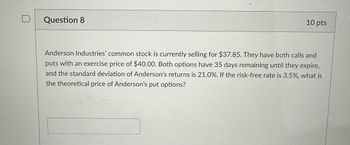

Transcribed Image Text:Question 8

10 pts

Anderson Industries' common stock is currently selling for $37.85. They have both calls and

puts with an exercise price of $40.00. Both options have 35 days remaining until they expire,

and the standard deviation of Anderson's returns is 21.0%. If the risk-free rate is 3.5%, what is

the theoretical price of Anderson's put options?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- D3arrow_forward15. Find the implied volatility (to 2 decimals, for example, σ = 8.23%) of a Put option with a time to expiration of 11 months and a price of $6.13 2 The stock is currently trading at $47. The riskless rate is 2% per annum, and the strike/exercise price of the option is $50. 3 Hint: compute the Put price using the same formula as in exercise 4, as a function of the volatility σ. Then use Solver to change the volatility cell in order to obtain a price of $6.13 4 5 6 d1 = -0.0614997 7 d2 = 8 9 10 N(d1)= 11 N(d2)= 12 13 N(-d1)= 14 N(-d2)= 15 16 17 18 P = 27.41 19 So= 47 K= 50 r = 2% σ = 2.74% T= 0.91666667arrow_forwardff2arrow_forward

- Suppose that call options on XYZ stock with time to expiration 3 months and strike price $90 are selling at an implied volatility of 30% ExxonMobil stock price is $90 per share, and the risk free rate is 4%. Required: a1 If you believe the true volatility of the stock is 32%, would you want to buy or sell call options? a2-Now you want to hedge your option position against changes in the stock price. How many shares of stock will you hold for each option contract purchased or sold?arrow_forwardQuestion 5: A call option on a stock that expires in a year has a strike price of $99. The current stock price is $100 and the one-year risk free interest rate is 10%. The price of this call is $6. a) Is arbitrage possible? What is the arbitrage position? b) do you het this minimum? Find the minimum arbitrage profit for this strategy. Whenarrow_forward4. A stock is selling today for $100. The stock has an annual volatility of 45 percent and the annual risk-free interest rate is 12 percent. A 1 year European put option with an exercise price of $90 is available to an investor .a.Use Excel’s data table feature to construct a Two-Way Data Table to demonstrate the impact of the risk free rate of interest and the volatility on the price of this put option: i. Risk Free Rates of 5%, 7%, 9%, 12%, 15% and 18%. ii. Volatility of 35%, 45%, 55%, and 65%. b. How is the put option price impacted by varying the risk free rate of interest? c.How is the put option price impacted by varying the volatility?arrow_forward

- Suppose that call options on ExxonMobil stock with time to expiration 3 months and strike price $104 are selling at an implied volatility of 28%. ExxonMobil stock price is $104 per share, and the risk-free rate is 6%. a. If you believe the true volatility of the stock is 30%, would you want to buy or sell call options? Buy call options Sell call options b. Now you want to hedge your option position against changes in the stock price. How many shares of stock will you hold for each option contract purchased or sold? (Round your answer to 4 decimal places.) X Answer is complete but not entirely correct. Number of 0.5753 X sharesarrow_forwardklp.3arrow_forwardי The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black- Scholes model was used to obtain the prices. Calls Puts Strike March June March June 45 6.84 8.41 1.18 2.09 50 55 3.82 1.89 5.58 3.08 4.13 3.54 6.08 6.93 Answer questions below a calendar spread based on the assumption that stock prices are expected to remain fairly constant. Use the June/March 50 call spread. Assume one contract of each. 5 What will the spread cost?arrow_forward

- Suppose a stock is currently trading for $35, and in one period it will either increase to $38 or decrease to $33. If the one-period risk-free rate is 6%, what is the price of a European put option that expires in one period and has an exercise price of $35? $0.51 $2.32 $1.55 $3.00 $0.76arrow_forwardIBM stock currently sells for 64 dollars per share. The implied volatility equals 40.0. The risk - free rate of interest is 5.5 percent continuously compounded. What is the delta of a call option with strike price 69 and maturity 9 months? Group of answer choices 0.4702 0.0751 0.5319 0.2574arrow_forwardaa.3 43.3: Consider a chooser option on a stock. The stock currently trades for $50 and pays dividend at the continuously compounded yield of 8%. The choice date is two years from now. The underlying European options expire in four years from now and have a strike price of $45. The continuously compounded risk-free rate is 5% and the volatility of the prepaid forward price of the stock is 30%. Find the delta of the chooser option. [answer:0.1303]arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT