Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

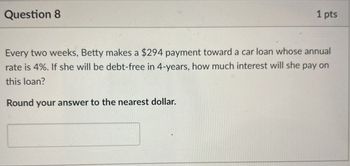

Transcribed Image Text:Question 8

1 pts

Every two weeks, Betty makes a $294 payment toward a car loan whose annual

rate is 4%. If she will be debt-free in 4-years, how much interest will she pay on

this loan?

Round your answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- vv.1arrow_forwardQUESTION 13 You are looking to buy a car. You can afford $610 in monthly payments for five years. In addition to the loan, you can make a $710 down payment. If interest rates are 9.00 percent APR, what price of car can you afford (loan plus down payment)? (Do not round intermediate calculations and round your final answer to 2 decimal places.) PRESENT VALUEarrow_forwardP/Y = 12 PV C/Y = 12 PMT = $200.61 PMT: END BEGIN Monthly payment would be $ 200.61 After making payments for 19 months, Natasha decides to repay the loan in full. Use this information and the monthly payment, found above, to calculate her payoff amount (PV) on the loan. How many payments does Natasha have left (Use this as N in the TVM Solver below)? Calculate the payoff amount (PV). N C/Y = FV = 1% = P/Y = PV = N = 5 years PMT = FV = 10,500 PMT: END BEGIN 1% = 5.51%arrow_forward

- QUESTION 1 Liam can afford $175 per month as a car payment. If Liam can get an auto loan at 4% interest for 5 years, how expensive of a car can Liam afford? Give your answer to the nearest dollar.arrow_forwardNonearrow_forwardQuestion 5 of 10 You plan to save money for a down payment of $37,000 to purchase an apartment. You can only afford to save $1,250 at the end of every quarter into an account that earns interest at 3.71% compounded annually. How long will it take you to save the planned amount? o years o months Express the answer in years and months, rounded to the next payment period SUBMIT QUESTION k SU 1 O 0 SAVE PROGRESSarrow_forward

- Question Two ii. ii. Ms. Duke is borrowing 12,000 at a compound annual interest rate of 17%. Determine the annual payment to amortize the loan, if she is offered 7 years. At 8% compounded annually, how long will it take 750 to double? A friend plans to buy a big-screen TV/entertainment system and can afford to set aside 1,320 toward the purchase today. If your friend can earn 15%, compounded yearly, how much can your friend spend in four years on the purchase? What would you pay to own a guaranteed income of C1500 per year to be received forever, if interest rates are 14%? At what rate must 500 be compounded annually for it to grow to ¢716.40 in 5 years? Explain the concept of time value of money in line with the financial manager" corporate objective Sarrow_forward:00 Phoebe realizes that she has charged too much on her credit card and has racked up $6,600 in debt. If she can pay $200 each month and the card charges 18 percent APR (compounded monthly), how long will it take her to pay off the debt? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Time to pay off the debt monthsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education