ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

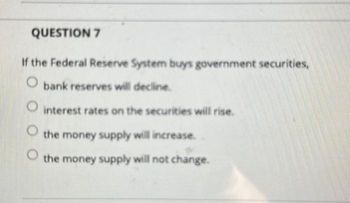

Transcribed Image Text:QUESTION 7

If the Federal Reserve System buys government securities,

bank reserves will decline.

interest rates on the securities will rise.

the money supply will increase.

the money supply will not change.

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 24 LAST CHANCE BANK OF TOMBSTONE BALANCE SHEET ASSETS LIABILITIES & NET WORTH $900,000 $100,000 $300,000 $3,700,000 $2.000.000 cash in the vault: demand deposits: $5,000,000 deposits at Fed US treasury bonds: loans: Building: capital stock: $2,000,000 TOTALS: $7,000,000 TOTALS: $7,000,000 24. Given a reserve requirement ratio of 10%, what will be the maximum effect on quantity of money in circulation of a Federal Reserve sale of $100,000 worth of government securities directly to a bank? an increase of $100,000 a decrease of $1,000,000 a decrease of $100,000 an increase of $1,000,000arrow_forwardI'd like help on b,c,darrow_forwardIf the Federal Reserve increases the discount rate from 14 percent to 16 percent banks will borrow Multiple Choice fewer reserves from the Fed and lending will increase. fewer reserves from the Fed and lending will decrease. more reserves from the Fed and lending will increase. more reserves from the Fed and lending will decrease.arrow_forward

- #27. Reserve requirements are regulations concerning a the interest rate at which banks can borrow from the Fed. b the amount banks are allowed to borrow from the Fed. c the amount of reserves banks must hold against deposits. d reserves banks must hold based on the number and type of loans they make.arrow_forwardIn a system of 100-percent-reserve banking, a. banks do not accept deposits. b. banks do not influence the supply of money. c. loans are the only asset item for banks. d. banks can increase the money supply.arrow_forwardPart 2 hand written plzz The Federal Reserve sells $26.00 million in Treasury securities. If the required reserve ratio is 10.00%, and all currency is deposited into the banking system, and banks hold excess reserves of 10%, then the maximum amount the money supply can decrease is $ million. (Insert your answer in millions, and round your answer to two decimal places.)arrow_forward

- 1. Which of these is a basic goal of the Federal Reserve System? a. export promotion b. zero interest rates c. a balanced federal budget d. full employmentarrow_forwardThe discount rate refers to the price of the Federal reserve System charges for a.Loans to banks b.Newly printed currency c.Loans to state or local governments d.U.S. Treasury bonds e.Goods and servicesarrow_forwardMatch the term with the definition: What the bank is holding - or it's reserve deposit A. Primary Reserve Occurs if the bank holds more than the required minimum on reserve B. Secondary Reserve The minimum amount of vault cash and deposits at the Federal Reserve district bank that must be held C. Required Reserve A bank's vault cash and it's deposits at the Federal Reserve D. Actual Reserves Treasury bills, notes, certificates, and bonds that will mature in less than a year Excess Reservesarrow_forward

- 40. If the Fed pursues expansionary monetary policy then Group of answer choices the money supply will increase, interest rates will fall and GDP will rise the money supply will decrease, interest rates will rise and GDP will fall. the money supply will decrease, interest rates will rise and GDP will fall. the money supply will increase, interest rates will rise and GDP will rise.arrow_forwardMjarrow_forwardWhen the Fed wishes to decrease the money supply, it can a. increase the required reserve ratio. b. decrease the required reserve ratio. c. ask people to buy more bonds. d. turn additional funds over to the Treasury.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education