Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

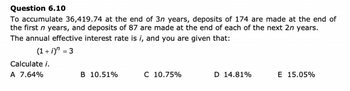

Transcribed Image Text:Question 6.10

To accumulate 36,419.74 at the end of 3n years, deposits of 174 are made at the end of

the first n years, and deposits of 87 are made at the end of each of the next 2n years.

The annual effective interest rate is i, and you are given that:

(1+1)" = 3

Calculate /.

A 7.64%

B 10.51%

C 10.75%

D 14.81%

E 15.05%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- please help with this Qarrow_forwardEconomics Soru 4 12.5 Puan From a bank, an engineer borrows $18000 that is to be repaid in 2 years with end-of-month payments at $827.29. The bank exposes the engineer to a monthly compounding interest. What is the nominal interest rate? Choose the closest value to your answer. (A) 8.4% B) 8.0% c) 9.6% D) 8.8% E) 9.2%arrow_forwardChapter 7 Self Test Problem #2arrow_forward

- QUESTION 8 Given a 3 percent interest rate, compute the year 6 future value of deposits made in years 1, 2, 3, and 4 of $1,400, $1,600, $1,600, and $1,900, respectively. (Do not round intermediate calculations and round your final answer to 2 decimal places.) FUTURE VALUE?arrow_forward11. Semiannualand other compounding periods Monthly compounding implies that interest is compounded 12 You have deposited $96,780 into an account that will earn an interest rate of 15% compounded semiannually. How much will you have in this account at the end of seven years? $266,381.54 $199,786.15 $293,019.69 times per year. $173,148.00arrow_forwardQUESTION 5 Hansco borrowed $5635 paying interest at 4.05% compounded annually. If the loan is repaid by payments of $279 made at the end of each year. Find the number of payments. Round your answer to 8 decimal places. Sample input 6.43215678arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education