ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working

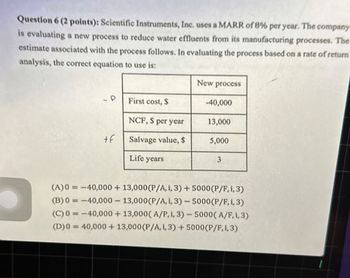

Transcribed Image Text:Question 6 (2 points): Scientific Instruments, Inc. uses a MARR of 8% per year. The company

is evaluating a new process to reduce water effluents from its manufacturing processes. The

estimate associated with the process follows. In evaluating the process based on a rate of return

analysis, the correct equation to use is:

New process

First cost, $

-40,000

NCF, $ per year

13,000

+f

Salvage value, $

5,000

Life years

3

(A)0=-40,000+ 13,000 (P/A, 1,3) + 5000 (P/F, 1, 3)

(B) 0=-40,000 - 13,000 (P/A, i, 3) - 5000 (P/F, 1, 3)

(C) 0=-40,000+ 13,000(A/P, i, 3) - 5000(A/F, 1,3)

(D)0=40,000+ 13,000 (P/A, i, 3) + 5000 (P/F, 1,3)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Utilities Some rental units have certain expenses included with the rent. Water, electricity, and heating are often referred to as utilities. Some tenancy agreements require the tenant to pay for utilities. 7. a) Bianca and Sarah rent a semi-detached house. They pay for utilities as well as rent. Complete the chart to determine their estimated annual cost for utilities. Average Billing Frequency Estimated Amount Billed Annual Cost Item Natural gas Monthly $118 Electricity Bi-monthly $140 Water Quarterly $120 Estimated Total Annual Cost b) A news report claimed that utility costs would rise by an average of 10% next year. Estimate how much Bianca and Sarah can expect to pay for utilities next year. 0arrow_forwardPrepare a flow chart for a typical family of 4 (3 drivers), taking a two-week (Monday is 1st-14th is a Sunday) vacation driving from New York to Orlando in August. Your return to workday is 15th of the month which is a Monday. Discuss areas of concerned revealed by the flow chart.arrow_forwardWhat are the five main types of engineering economic decisions?arrow_forward

- Solve all the parts and add explanation and check answer twicearrow_forwardAutoSave File Document! Word Chris Navo Home Insert Draw Design Layout References Mailings Review View MathType Help Acrobat Graphs Format Cobb and Douglas used economic data published by the government to obtain Table 2. Year P Year 1899 100 100 DOL 1911 148 216 1900 101 105 107 1912 155 1901 112 110 114 1912 1902 122 117 122 1014 169 152 244 1903 124 122 131 1915 109 156 266 1904 122 121 138 1916 225 183 1905 143 125 149 1917 227 1905 152 124 163 1915 223 201 1907 151 140 170 1919 218 19.08 126 123 485 1920 231 104 407 19.09 155 143 198 1921 179 146 417 1910 159 208 1922 240 161 431 Table 2 Swords et Predictions. The Cobb Douglass formula is P(L, K) = bLa K¹-a Determine monetary value of all the goods produced in 1 year or simply the production level in 1920 for a=.20 and b=1.01. Round to one decimal place.arrow_forwardGive example of engineering economics in our daily lifearrow_forward

- Typed plz Please provide me a solution stp by step i want quality solution also tske care of plagiarism alsoarrow_forwardi need this all in words not handwritten no pic just Rewrite itarrow_forwardPlease help Why is basic understanding of global geography important? Just q&a DO NOT COPY FROM OTHER WEBSITES Upvote guarenteed for a correct and detailed answer. Thank you!!!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education