Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

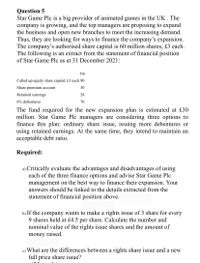

Transcribed Image Text:Question 5

Star Game Plc is a big provider of animated games in the UK . The

company is growing, and the top managers are proposing to expand

the business and open new branches to meet the increasing demand.

Thus, they are looking for ways to finance the company's expansion.

The company's authorised share capital is 60 million shares, £3 each.

The following is an extract from the statement of financial position

of Star Game Plc as at 31 December 2021:

£m

Called up equity share capital, £3 each 90

Share premium account

30

Retained earnings

28

6% debentures

70

The fund required for the new expansion plan is estimated at £30

million. Star Game Plc managers are considering three options to

finance this plan: ordinary share issue, issuing more debentures or

using retained earnings. At the same time, they intend to maintain an

acceptable debt ratio.

Required:

a) Critically evaluate the advantages and disadvantages of using

each of the three finance options and advise Star Game Plc

management on the best way to finance their expansion. Your

answers should be linked to the details extracted from the

statement of financial position above.

b) If the company wants to make a rights issue of 3 share for every

9 shares held at £4.5 per share. Calculate the number and

nominal value of the rights issue shares and the amount of

money raised.

c) What are the differences between a rights share issue and a new

full price share issue?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need solutionarrow_forwardQUESTION 7 "Consider the situation faced by the CFO of a company with a market capitalization of $700 Millions of USD, e.g. the firm has 100 million shares outstanding, so the shares are trading at $7 per share. The CFO needs to raise $500 Millions of USDs and announces a rights issue. Each existing shareholder is sent 5 right for every share he or she owns. The CFO has not decided how many rights will be required to purchase a share of new stock. At the current price per share, what is the maximum amount of rights the CFO can require stockholders for purchasing a share of new stock and so be able to raise the $500 Millions of USDs?"arrow_forward15arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardQuestion content area top Part 1 Assume Gillette Corporation will pay an annual dividend of $ 0.66 one year from now. Analysts expect this dividend to grow at 11.2 % per year thereafter until the fifth year. Thereafter, growth will level off at 1.6 % per year. According to the DDM, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.3 % ? Question content area bottom Part 1 The value of Gillette's stock is $ enter your response here. (Round to the nearest cent.arrow_forwardQuestion 10 (2 points) A firm has 1 million shares outstanding. After-tax earnings have been constant at $5 per share. The firm retains 40% of earnings and pays out the rest in dividend. The shareholder's required rate of return is 15%. Calculate the current share price. $50 $20 $30 $10 $40arrow_forward

- QUESTION 7 Manchester plc is expected to pay annual dividends of £1.50, £1.75 and £2.00 per share at the end of each of the next three years (i.e., from t-1 to t=3). After year 3, annual dividends are expected to grow at a rate of 2% forever. Assuming that shareholders of Manchester plc. require a rate of return equal to 5% per year, what is the fair value for the share of Manchester plc.? O £95.52 £64.70 O £48.37 O £63.48arrow_forwardOnly typed answerarrow_forwardJitu Full solutionarrow_forward

- Question 5 FLAG QUESTION 1 Scooter Madness (SM) has 10,000 shares outstanding and is expected to have Net Income of $70,000 in year 1. SM expects to retain 35% of its earnings to invest in projects at the end of year 1. If the expected share price 1 year from today after any dividend issued is $65 and SM's return on equity capital is 16%, what would you expect the share price to be today? (round to the nearest cent: $x.xx) Answers 1-1 1. VERSION 2M.6.4 Previousarrow_forwardQuestion 2 You have been appointed as a financial consultant by the directors of Baron Holdings. They require you to determine the cost of capital of the company. The following information is available on the capital structure of the company: ü 1 500 000 ordinary shares, with a market price of R3 per share. The latest dividend declared was 86 cents per share. A dividend growth of 15% was maintained for the past 5 years. ü 1 000 000 11%, R1 preference shares, with a market value of R3 per share. ü R1 000 000 9%, debentures due in 7 years and the current yield-to-maturity is 10%. Note that the current price of the debenture is R951 356 ü R700 000 14%, bank loan, due in December 2021. Additional information: - The company has a tax rate of 30%. - The beta of the company is 1.7, a risk free rate of 5% and the return on the market is 14%. Required: 2.1 Calculate the weighted average cost of capital. Use the Gordon Growth Model to calculate the cost of equity 2.2 Calculate the cost of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education