FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

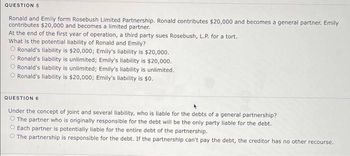

Transcribed Image Text:QUESTION 5

Ronald and Emily form Rosebush Limited Partnership. Ronald contributes $20,000 and becomes a general partner. Emily

contributes $20,000 and becomes a limited partner.

At the end of the first year of operation, a third party sues Rosebush, L.P. for a tort.

What is the potential liability of Ronald and Emily?

O Ronald's liability is $20,000; Emily's liability is $20,000.

O Ronald's liability is unlimited; Emily's liability is $20,000.

O Ronald's liability is unlimited; Emily's liability is unlimited.

O Ronald's liability is $20,000; Emily's liability is $0.

QUESTION 6

Under the concept of joint and several liability, who is liable for the debts of a general partnership?

O The partner who is originally responsible for the debt will be the only party liable for the debt.

O Each partner is potentially liable for the entire debt of the partnership.

The partnership is responsible for the debt. If the partnership can't pay the debt, the creditor has no other recourse.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Help me fast....arrow_forwardDaza, Diaz, and Ditas are partners with capital balances of P80,000, P120,000 and P160,000, respectively. They share profits and losses in the ratio of 3:4:3. Diaz decides to withdraw from the partnership. Diaz receives p150,000 in settlement of his interest. If the bonus method is used, what is the capital balance of Ditas immediately after the retirement of Diaz?arrow_forwardMike and Melissa form the equal MM Partnership. Mike contributes cash of $40,000 and land (fair market value of $100,000, adjusted basis of $136,000), and Melissa contributes the assets of her sole proprietorship (value of $140,000, adjusted basis of $115,000). What are the tax issues that should be considered by Mike, Melissa, and MM on the formation of the partnership? What are the tax consequences of these issues? Continue with the facts presented in Problem 31. Mike purchased the land (value of $100,000; adjusted basis of $136,000) several years ago as an investment (capital) asset. Mike and MM LLC are trying to decide between two alternatives. In Alternative 1, Mike will contribute the land to the LLC. MM will use the property as a § 1231 asset (a parking lot) and then sell it in six years at an estimated $100,000 price. (Disregard any potential improvements to the land.) In Alternative 2, Mike will sell the land immediately to a third party and contribute to MM the $100,000…arrow_forward

- Hector sold his interest in a partnership for $30,000 cash when his outside basis was $6,000. He was relieved of his $15,000 share of partnership liabilities. What is Hector's recognized gain from the sale of his partnership interest? $24,000 $30,000 $39,000 $45,000arrow_forward1. Mann, Haney and Young are partners. Haney, who has a capital balance of $140 000, has decided to retire. On February 1, Mann offers Haney $137 000 for his equity, and Haney accepts. Record the entry to record Haney's departure. 2. The book value of the automobile brought into the partnership (cost minus accumulated depreciation) is $18 000, it was determined by the partners that the fair market value was $16 000. Which value would you record? 3. Assume that Chantel Bertran and Steve Davey have a partnership, and each have $90 000 in their capital account. Lisa Dupuis offers to pay $66000, or $33 000 to each existing partner, for a one third interest in the partnership. Lisa is offering more than the $60 000 it would normally cost, because Chantel and Steve have built a successful business and Lisa feels it is worth an extra $6 000. The entry to record Lisa's admission to the partnership is: 4.S. Mann purchases 50% of R. Cameron's equity in the Williams-Cameron Partnership for…arrow_forwardJerry and Sherry own and operate a partnership. Jerry's capital balance is $50,000 and Sherry's is $55,000. Jerry and Sherry decided to admit a new partner, Allison, to their partnership. By the terms of their partnership agreement, Jerry and Sherry share income/ loss equally, Allison intends to contribute $40,000 to receive a Twenty-five percent interest in the partnership. Required: a. Revalue the partnership assets b. Determine the total equity of the partnership after the new partner is admitted c. Determine the new partner's share of the total equity d. Determine the bonus resulting from Allison's equity of her contribution e. Make journal entries to rccord Allison's admission to the partnershiparrow_forward

- Required Indicate whether each of the following variances is favorable (F) or unfavorable (U). The first one has been done as an example. Note: Select "None" if there is no effect (1.e., zero variance). Item to Classify Sales volume Sales price Materials cost Materials usage Labor cost Labor usage Fixed cost spending Fixed cost per unit (volume) $ $ $ $ $ Standard 40,100 units 3.61 per unit 3.00 per pound 91,100 pounds 10.10 per hour 61,100 hours 401,000 3.21 per unit $ $ $ $ $ Actual 42,100 units 3.64 per unit 3.10 per pound 90,100 pounds 9.70 per hour 61,900 hours 391,000 3.17 per unit Type of Variance Farrow_forwardMike and Jeff still run a law practice in French Polynesia as a general partnership with each partner owning 50%. Mike commits an act of malpráctice in a divorce that he is handling. The client suffers $90,000 in damages. She wishes to sue Mike. What liability does Jeff have to the client? Jeff has no liability to the client Jeff must pay $45,000 Jeff must pay the entire $90,000 Jeff's liability is joint and several with Mike's liability.arrow_forwardNonearrow_forward

- Katrina was an S corporation shareholder. After her initial contributions, she had the following tax bases: 1) Basis in stock: $50,000 2) Basis in personal loan to S corp: $20,000 Over the first two years of the corporation's existence, the corporation experienced significant operating losses and Katrina's pass- through share of these was $60,000. Katrina materially participated in the S corporation's business. Which of the following statements regarding Katrina's tax situation is false? These were deductible losses to Katrina Katrina could deduct only $50,000 of the pass through losses. The remaining $10,000 was suspended. After these losses, Katrina had a $0 basis in stock and a $10,000 basis in loan none of the abovearrow_forward1 24 Susan has a $31,500 basis (including her share of debt) in her 50 percent partnership interest in the Polgar Partnership before receiving any distributions. This year Polgar makes a current distribution to Susan of a parcel of land with a $46,700 fair market value and a $38,100 basis to the partnership. The land is encumbered with a $19,100 mortgage (the partnership's only liability). What is Susan's remaining basis in her partnership interest?arrow_forwardCoy and Matt are equal partners in the Matcoy Partnership. Each partner has a basis in his partnership interest of $33,000 at the end of the current year, prior to any distribution. On December 31, each receives an operating distribution. Coy receives $13,000 cash. Matt receives $3,850 cash and a parcel of land with a $9,150 fair market value and a $5,000 basis to the partnership. Matcoy has no debt or hot assets. a. What is Coy's recognized gain or loss? What is the character of any gain or loss?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education