FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

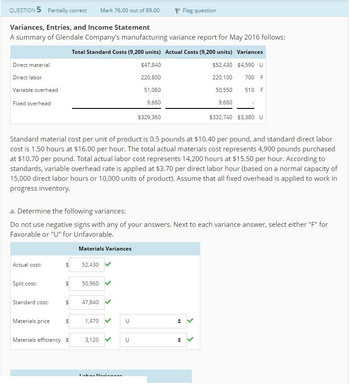

Transcribed Image Text:QUESTION 5 Partially correct Mark 76.00 out of 89.00

Variances, Entries, and Income Statement

Flag question

A summary of Glendale Company's manufacturing variance report for May 2016 follows:

Total Standard Costs (9,200 units) Actual Costs (9,200 units) Variances

Direct material

Direct labor

Variable overhead

Fixed overhead

$47,840

$52,430 $4,590 U

220,800

220,100 700 F

51,060

50,550 510 F

9,660

9,660

$329,360

$332,740 $3,380 U

Standard material cost per unit of product is 0.5 pounds at $10.40 per pound, and standard direct labor

cost is 1.50 hours at $16.00 per hour. The total actual materials cost represents 4,900 pounds purchased

at $10.70 per pound. Total actual labor cost represents 14,200 hours at $15.50 per hour. According to

standards, variable overhead rate is applied at $3.70 per direct labor hour (based on a normal capacity of

15,000 direct labor hours or 10,000 units of product). Assume that all fixed overhead is applied to work in

progress inventory.

a. Determine the following variances:

Do not use negative signs with any of your answers. Next to each variance answer, select either "F" for

Favorable or "U" for Unfavorable.

Materials Variances

Actual cost:

$

52,430

Split cost:

$

50,960

Standard cost:

$

47,840

Materials price

$

1,470

U

Materials efficiency $

3,120

U

Inhar Vavinnan

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 9 part 1arrow_forwardRequired 1 Required 2 Calculate the activity variances for March. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Utilities Maintenance Supplies Indirect labor Depreciation Total FAB Corporation Activity Variances For the Month Ended March 31 Show Transcribed Text Required 1 Required 2 FAB Corporation Spending Variances For the Month Ended March 31arrow_forwardFactory Overhead Volume Variance Bellingham Company produced 4,200 units of product that required 1.5 standard direct labor hours per unit. The standard fixed overhead cost per unit is $2.25 per direct labor hour at 6,700 hours, which is 100% of normal capacity. Determine the fixed factory overhead volume variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. $fill in the blank 1arrow_forward

- 5arrow_forward9 part 2arrow_forwardVariances, Entries, and Income Statement A summary of Martindale Company's manufacturing variance report for May follows: Direct material Direct labor Variable overhead Fixed overhead Total Standard Costs (9,200 units) $38,640 193,200 22,080 9,660 $263,580 Actual Costs (9,200 units) Variances $41,760 $3,120 U 191,760 1,440 F 23,230 1,150 U 9,660 $266,410 $2,830 U Standard materials cost per unit of product is 0.5 pounds at $8.40 per pound, and standard direct labor cost is 1.5 hours at $14.00 per hour. The total actual materials cost represents 4,800 pounds purchased at $8.70 per pound. Total actual labor cost represents 14,100 hours at $13.60 per hour. According to standards, variable overhead rate is applied at $1.60 per direct labor hour (based on a normal capacity of 15,000 direct labor hours or 10,000 units of product). Assume that all fixed overhead is applied to work-in-progress inventory.arrow_forward

- Factory Overhead Controllable Variance Bellingham Company produced 5,100 units of product that required 8 standard direct labor hours per unit. The standard variable overhead cost per unit is $5.40 per direct labor hour. The actual variable factory overhead was $214,810. Determine the variable factory overhead controllable variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. $fill in the blank 1arrow_forwardTotal Fixed Overhead Variance Bulger Company provided the following data: Standard fixed overhead rate (SFOR) $8 per direct labor hour Actual fixed overhead costs $985,300 Standard hours allowed per unit 6 hours Actual production 20,000 units Required: 1. Calculate the standard hours allowed for actual production. fill in the blank 1 hours 2. Calculate the applied fixed overhead. $fill in the blank 2 3. Calculate the total fixed overhead variance. Enter the amount as a positive number and select Favorable or Unfavorable. $fill in the blank 3arrow_forward-1-202310-10876 gnment i (Basic guitar built from veneered wood.) (Bridge and strings attached; guitar tuned and inspected.) Saved Each finished guitar contains seven pounds of veneered wood. In addition, one pound of wood is typically wasted in the production process. The veneered wood used in the guitars has a standard price of $14 per pound. The other parts needed to complete each guitar, such as the bridge and strings, cost $17 per guitar. The labor standards for Springsteen's two production departments are as follows: Construction Department: 5 hours of direct labor at $20 per hour Finishing Department: 3 hours of direct labor at $17 per hour The following pertains to the month of July. 1. There were no beginning or ending work-in-process inventories in either production department. 2. There was no beginning finished-goods inventory. Problem 10-47 Part 2 3. Actual production was 690 guitars, and 490 guitars were sold on account for $495 each. 4. The company purchased 7,900 pounds…arrow_forward

- Aaha Inc. produces premium protective automotive covers. The direct materials and direct labour standards for one car cover are as follows: Standard Quantity or Hours Direct materials Direct labour 7.00 metres of cloth 0.30 hours Standard Price or Rate $8 per metre $ 16 per hour Standard Cost $56.00 $4.80 In September, the following activity was recorded: 17,500 metres of cloth were purchased at a cost of $7.50 per metre All of the purchased material was used to produce 2,500 car covers. 520 direct labour-hours were recorded at a total labour cost of $8,320. Required: 1. Compute all direct materials variances for September (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (ie., zero variance).) Answer is complete and correct. Direct materials price variance Direct materials quantity variance Total direct material cost variance $ 8,750 F $ $ 8,750 ( 0 None F 000arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education