FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

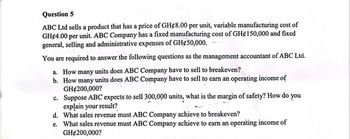

Transcribed Image Text:Question 5

ABC Ltd sells a product that has a price of GH¢8.00 per unit, variable manufacturing cost of

GH 4.00 per unit. ABC Company has a fixed manufacturing cost of GH¢150,000 and fixed

general, selling and administrative expenses of GH¢50,000.

You are required to answer the following questions as the management accountant of ABC Ltd.

a. How many units does ABC Company have to sell to breakeven?

b. How many units does ABC Company have to sell to earn an operating income of

GH$200,000?

c.

d. What sales revenue must ABC Company achieve to breakeven?

e. What sales revenue must ABC Company achieve to earn an operating income of

GH$200,000?

Suppose ABC expects to sell 300,000 units, what is the margin of safety? How do you

explain your result?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please answer ASAP thank you!arrow_forwardPlease do not give solution in image format thankuarrow_forwardComplete this question by entering your answers in the tabs below. Required A Assume that only one product is being sold in each of the four following case situations: (Loss amounts should be indicated by a minus sign.) Case 1 Case 2 Case 3 Case 4 Units sold 8,700 19,200 5,100 Sales $261,000 $300,000 $173,400 Variable expenses 174,000 211,200 Fixed expenses 91,000 174,000 75,000 Net operating income (loss) $6,000 $145,400 $1,500 Contribution margin per unit $12 $12arrow_forward

- Accounting BUY Chapte... Managerial Accounting 15th Edition ISBN: 9781337912020 Author: Carl Warren, Ph.d. Cma William B. Tayler Publisher: South-Western College Pub Problem 5BE Section... Question Sales Mix and Break-Even Analysis Megan Company has fixed costs of $299,700. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Model Selling Price Variable Cost per Unit Contribution Margin per Unit Yankee $210 $120 $90 Zoro 150 100 50 The sales mix for products Yankee and Zoro is 10% and 90%, respectively. Determine the break-even point in units of Yankee and Zoro. a. Product Model Yankee 3,330 X units b. Product Model Zoro < Feedback See similar textbooks units ▼ Check My Work Subtract the combined unit variable cost from the combined unit selling price. Divide the fixed costs by the combined unit contribution margin to find break-even point in units. Units for Yankee and Zoro will be break-even point in units…arrow_forwardQuestion 30: Match each form to its purpose. SS-4 Used to obtain a Social Security number DROP HERE W-4 Provides information to calculate income tax withholding DROP HERE SS-5 Used to obtain an Employer Identification Number DROP HERE 1-9 Verifies employment eligibility DROP HERE Question 12: Which of these is a credit reduction state/territory? Question 15: Union dues are considered a deduction. Answer: Answer: A. O Connecticut A. O cafeteria B. O Ohio B. O insurance C. O Virginia C. O mandatory D. O U.S. Virgin Islands D. O voluntary Question 14: Alejandra owns and operates an appliance store where employees clock in and out for each shift. Per the FLSA, Alejandra rounds employee time worked to the nearest 15-minute increment. On Tuesday this week, Stanley works 4 hours and 9 minutes in the morning and 3 hours and 11 minutes in the afternoon. How does Alejandra record Stanley's time? Answer: A. O 7 hours B. O 7 hours and 15 minutes C. O 7 hours and 20 minutes D. O 7 hours and 30…arrow_forwardSisyphus Inc. records total sales of $657,500 in the current period, with a cost of goods sold of $389,000 . Sisyphus expects 4% of sales to be returned. How much in net sales will Sisyphus recognize for the current period? Group of answer choices $373,400 $268,500 $631,200 $657,500 $257,760 The Sisyphus Inc’s (SSY) Company’s annual statement of cash flows reported the following (in millions): Net cash from financing activities $63,864 Net cash from investing activities -62,512 Cash at the beginning of the year 13,152 Cash at the end of the year 18,948 What did SSY report for “Net cash from operating activities” during the year? Group of answer choices $71,220 million cash inflow None of the above $4,444 million cash outflow $4,444 million cash inflow $71,220 million cash outflowarrow_forward

- Subject: accountingarrow_forwardQuestion 6 Kennish Company sold 5840 units for $46 each. Variable costs were $27 per unit and total fixed expenses were $23860. What is Kennish's net income?arrow_forwardQuestion 3 Ashale Botwe Ltd has the following cost and expense data for the year ending December 31, 2022. Direct materials (GHC) Work in process (GH¢) Finished goods (GH¢) Insurance factory Property taxes on factory building Materials purchases Sales Indirect materials Delivery expenses Sales commissions Indirect labour 1/1/22 Factory machinery rent Factory utilities Direct labour 30,000 80,000 110,000 Other items of revenue and cost during the year are as follows: (GHC) 31/12/22 20,000 50,000 120,000 Direct materials used b) Total manufacturing cost c) Statement of cost of goods manufactured d) Prime cost e) Conversion cost f) Cost of goods available for sale g) Cost of goods sold h) Gross profit i) Period cost j) Net income 14,000 6,000 205,000 1,500,000 15,000 100,000 150,000 90,000 40,000 ARI 65,000 350,000 24,000 35,000 300,000 Depreciation, factory building Factory manager's salary Administrative expenses For the year 2022, you are required to compute the following:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education