FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

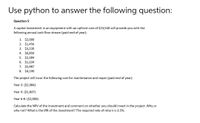

Transcribed Image Text:Use python to answer the following question:

Question 5

A capital investment in an equipment with an upfront cost of $23,540 will provide you with the

following annual cash flow stream (paid end of year):

1. $2,000

2. $1,456

3. $3,230

4. $6,850

5. $2,384

6. $1,234

7. $5,987

8. $4,190

The project will incur the following cost for maintenance and repair (paid end of year):

Year 3: ($2,984)

Year 4: ($1,837)

Year 6-8: ($2,000)

Calculate the NPV of the investment and comment on whether you should invest in the project. Why or

why not? What is the IRR of the investment? The required rate of return is 3.5%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 6 Year a. DORIAN Enterprise has developed a four-year investment plan which is expected to generate the following cash flows: 1 2 3 4 Cash flow GH¢ 30,000 45,000 48,000 50,000 The opportunity cost of capital is 18%. How much is this investment worth today? b. The financial data of DORIAN Enterprise is given as follows: Details Operating income Amount GH¢ Financial expense 275,000 47,000 Net impairment loss, gross loan portfolio 53,000 Operating expense 122,000 Gross loan portfolio 125,000 Delinquency + 1 month or more 14,000 Net subsidy 26,000 Interest rate charged on loans = 18% i. Compute the Subsidy Dependence Index (SDI) ii. Compute the Operational Self Sufficiency (OSS) iii. Compute the Portfolio at Risk (PAR) of DORIAN Ltd. iv. What do the values computed in (a), (b) and (c) represent? c. Below are the details of Accounts Receivable of DORIAN Ltd. Customer Outstanding Balance GH¢ Days outstanding 1 5,000 28 2 8,000 42 3 15,000 30 4 8,500 65 5 6,000 120 6 14,000 73 7…arrow_forwardQUESTION 14 You have a total of $30,000 to invest in a project and are considering the following three projects: Cash Flows Project A ($30,000) $8,500 Year Project B ($30,000) $19,600 Project C ($30,000) $10,400 1 $9,300 $17,300 $4,500 $10,400 $10,400 3. $10,400 4. $11,200 $4,200 $10,400 $12,300 $2,300 $10,400 If the cost of capital (discount rate) is 10%, which project(s) do you invest in and why? A. Project B- it will pay back the quickest OB. Project C- it generates the greatest cash flow C. Project A-it has the highest accounting rate of return D.Project B-it has the highest net present value E. Project A- it has the highest net present value OF. Project C- it has the highest profitability indexarrow_forwardQuestion content area top Part 1 (IRR calculation) Determine the IRR on the following projects: a. An initial outlay of $13,000 resulting in a single free cash flow of $17,165 after 9 years b. An initial outlay of $13,000 resulting in a single free cash flow of $46,394 after 15 years c. An initial outlay of $13,000 resulting in a single free cash flow of $105,001after 25 years d. An initial outlay of $13,000 resulting in a single free cash flow of $13,653 after 4 yearsarrow_forward

- Problem 5-3 Calculating Discounted Payback An investment project has annual cash inflows of $3,500, $4,400, $5,600, and $4,800, for the next four years, respectively. The discount rate is 14 percent. a. What is the discounted payback period for these cash flows if the initial cost is $6,200? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the discounted payback period for these cash flows if the initial cost is $8,300? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the discounted payback period for these cash flows if the initial cost is $11,300? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Discounted payback period b. Discounted payback period c. Discounted payback period years years yearsarrow_forwardBaghibenarrow_forwardQUESTION 10 A project will produce operating cash flows of $57,000 a year for 3 years. During the life of the project, inventory will be lowered by $10,000 and accounts receivable will increase by $20,000. Accounts payable will decrease by $5,000. The project requires the purchase of equipment at an initial cost of $90,000. The equipment will be salvaged at the end of the project creating a $17,000 after-tax cash inflow. At the end of the project, net working capital will return to its normal level. What is the net present value of this project given a required return of 12%? $48,772.08 $54,681.35 $56,209.19 $42,908.17 $44,141.41arrow_forward

- QUESTION 6 Seaborn Co. has identified an investment project with the following cash flows. Year Cash Flow $950 1,050 1,320 1,200 1 2 3 4 If the discount rate is 10 percent, what is the present value of these cash flows? 3542.76 3578.84 3418.66 4470.00 3847.03 Click Save and Submit to save and submit. Click Save All Answers to save all answers. SEP 28 30 tv ♫ Aarrow_forwardCash Flow -$50,000 $ 7,000 $ 4,000 $9,000 $61,000 Year 1 2 3 4 What is the internal rate of return (IRR) for this investment? 17. Using the information above, wha investment using a 10% discount rate? the NPV of thisarrow_forwardquestion 10 What is the present value of investment A, B, and C at an annual discount rate of 22 percent round to nearest cent?arrow_forward

- Investment End of Year A B C 1 $ 13,000 $ 18,000 2 13,000 3 13,000 4 13,000 5 13,000 $ 13,000 6 13,000 54,000 7 13,000 8 13,000 9 13,000 10 13,000 18,000 Assuming an annual discount rate of 23 percent, find the present value of each investment. a. What is the present value of investment A at an annual discount rate of 23 percent? b. What is the present value of investment B at an annual discount rate of 23 percent? c. What is the present value of investment C at an annual discount rate of 23 percent?arrow_forwardProblem 5-29 Calculating Incremental Cash Flows Darin Clay, the CFO of MakeMoney.com, has to decide between the following two projects: Year Project Million Project Billion 0123 -$2,500 0-290 -$10 0+1,050 1.090 1.850 1,850 2,900 The expected rate of return for either of the two projects is 13 percent. What is the range of initial investment (0) for which Project Billion is more financially attractive than Project Million? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Initial investment less thanarrow_forwardQuestion 1 Investment of RM820,000 in new machine to expand production capacity is being consideration by a company. Following are the budgeted cash flows given for next 6 year 1st year 2nd year 3rd year 4th year 5th year 6th year cash flow 80 110 160 250 220 180 1. Calculated discounted payback period Discount factors at the cost of capital of 10% per annum 1st year 2nd year 3rd year 4th year 5th year 6th year 0.909 0.826 0.751 0.683 0.621 0.564 Please donot provide solution in image format provide solution in step by step format and fast solutionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education