ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

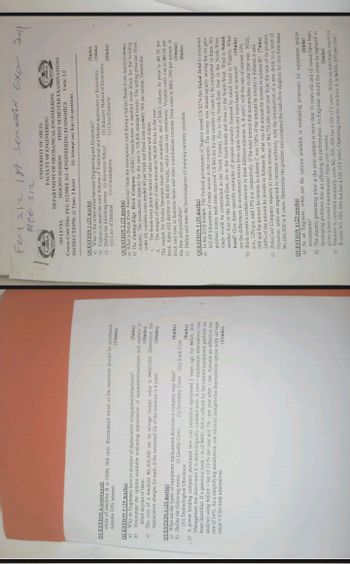

Transcribed Image Text:QUESTION 4 (continued)

while of machine B is N300, 000 only. Recommend which of the machines should be purchased.

Assume 10% interest.

(13mks)

QUESTION 5 (25 marks)

a) Why do Engineers have to monitor of depreciation of equipment/machines?

(5mks)

b)

Enumerate the options available evaluating depreciation of equipment/machines and explain in

detail anyone of them.

(10mks)

c)

The cost of a machine N1,600,000 ant its salvage (scrap) value is N400,000. Determine the

depreciation charges for each, if the estimated life of the machine is 4 years.

(10mks)

QUESTION 6 (25 marks)

(6mks)

(ii) Inventory Costs (iii) Sunk Cost

(8mks)

a) What are the types of equipment replacement decisions a company may face?

b) Define the following terms: (i) Quality Costs

(iv) Technological Obsolesce

, c) A power holding company purchased new coal extraction equipment 3 years ago for N600,000.

Management has discovered it is technologically outdated now. A new equipment alternative) has

been identified. If a generous trade-in of N400, 000 is offered for the current equipment perform an

analysis using before-tax of 10 % per year and 7% per year after-tax. Assume an effective tax

rate of 34%. As a simplifying assumption, use classical straight-line depreciation option with salvage

value = 0 for both alternatives.

(11mks)

FECT 312 1st Semester Exa

MEE 312

300 LEVEL

UNIVERSITY OF ABUJA

FACULTY OF ENGINEERING

DEPARTMENT OF MECHANICAL ENGINEERING

2018/2019 SESSION

FIRST SEMESTER EXAMINATIONS

Course Code/Title: FEG 312/MEE 312-ENGINEERING ECONOMICS

INSTRUCTIONS: (i) Time: 2 hours (ii) Attempt any four (4) questions.

QUESTION 1 (25 marks)

a) What is the relationship between Engineering and Economics?

Units: 2.0

(5mks)

2-11

b) Explain in detail the main features of Traditional and Modern approaches to Economics. (10mks)

e) Define the following terms: (i) Keynesian School

(iii) Law of Demand (iv) Consumption

QUESTION 2 (25 marks)

(ii) Inductive Method of Economics

(v) Cross Elasticity

(10mks)

- a) What is Break Even Analysis? State the assumptions used during a typical Break Even Analysis (smks)

b) The Cutting-Edge Brick Company (CEBC) manufactures a standard stone block for the building

industry. The production capacity for the year is 100,000 standard blocks. The selling price per block

is-1.60, variable costs are-N0.60 per brick and fixed costs are-N60, 000 per annum. Determine:

1.

The break-even point in terms of sales revenue and output.

The margin of safety if sales amount to 90,000 bricks in the year.

The market for blocks becomes much more competitive, and (CEBC) reduces its price to №1.50 per

brick. Sales still decline to 80,000 bricks, whilst costs rise relentlessly. Variable costs rise to 0.66 per

brick and rises in business taxes and other contributions increase fixed costs to 80, 000 per annum. Is

the firm still profitable?

c) Define and state the levels/degrees of dumping currently available.

QUESTION 3 (25 marks)

(10mks)

(8mks)

a) In the 2018 budget, The Federal government of Nigeria issued US $274.6m Sukuk bond to construct

642.69 kilometres of roads across in the country. The money was shared equally among the six geo-

political zones; each zone received US $45.6m for the number of roads to be completed in them. Six

roads would be constructed in the North Central, five in the North-East, four in the North-West,

another four in the South-East, six in the South-South and three in the South-West. What is Sukuk

bond? Give three specific examples of projects currently financed by sukuk bond in Nigeria. What

are the differences in investment returns from sukuk bonds and loans based on interest? (10mks)

b) Shola invests a certain amount in three different schemes A, B and C with the rate of interest 10%

p.a., 12% p.a. and 15% p.a. respectively. If the total interest that accumulates in one year was N320,.

000 and the amount he invests in scheme C was 150% of the amount he invests in Scheme A and

240% of the amount he invests in Scheme B, what was the amount he invests in scheme B? (7mks)

c) ZoboCool Company expects to realize revenue of N4,750,000 next year from the sale of its product.

However, sales are expected to increase uniformly with the introduction of a new drink to a level of

N1,000,000 in 8 years. Determine the gradient and construct the cash-flow diagram for this firm (8mks)

QUESTION 4 (25 marks)

investments?

a) As an Engineer, what are the options available in evaluating proposals for equipment and/or

(6mks)

b) The electric generating plant at the mini campus is more than 10 years old and of recent have been

developing problems that are affecting its performance. As Engineer should the plant be replaced or

(6mks)

given a turn round maintenance? State your reasons.

c) Machine A, operated manually costs N2, 000, 000 has a life of 3 years. While an automatic machine

B costs N5, 000, 000 but has a life of 6 years. Operating cost for machine A is N400,000 per year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 15 images

Knowledge Booster

Similar questions

- part E ) The book value at end of 2017 based on ADD depreciations is $ ( round to the nearest dollararrow_forward2.11 Asphalt Pavers,Inc, Purchases a loader to use at its asphalt plant. The Purchase price delivered is $326000. Tires for this machine cost $26000. The company believes it can sell the loader after 6 years (2800 hr/ yr ) of service for $ 75000. There will be no major overhauls. The compny's cost- of - capital is 6.31%. What is the depreciation part of this machines's ownership cost ? Use the time value method to calculate deprecition. ($18.191/ hr)arrow_forwardElectronic Games is moving very quickly to introduce a new interrelated set of video games. The initial investment for equipment to produce the necessary electronic components is $9 million. The salvage value after 6 years is $700,000. Anticipated net contribution to income is $6 million the first year, decreasing by $1 million each year for 6 years, with all dollar amounts expressed in real dollars. Depreciation follows MACRS 5-year property, taxes are 40 percent, the real MARR is 18 percent, and inflation is 4 percent. g. Determine the real IRR of the after-tax cash flows. h. Determine the real ERR of the after-tax cash flows.arrow_forward

- 11- Global Fitters, an international clothing company, has purchased material handling equipment that cost $100,000 37 and a salvage value of $18,000 after 10 years. Determine the book value of the equipment after 3 years using: E (a) Straight-line depreciation (b) 150% declining balance depreciation (c) 100% bonus depreciation (d) 7-year MACRS depreciation (e) Global Fitters uses low-cost labor in emerging world economies to manufacture its products. List three potential ethical issues that are associated with the use of this labor pool.arrow_forwardA trucking company computes depreciation on its vehicles by a mileage basis.Suppose a delivery truck has a cost of $20.000. a sa lvage value of $2.000. andan estimated useful life of 200.000 miles. Determine the depreciation rateper mile.(a) $0.08(b) $0.09(c) $0.10(d) $0.11arrow_forward7 A fixed asset costing $80,000 and having an estimated salvage value of $6000 has a life expectancy of 10 years. Compare the results of Double declining, Sum of the year digits depreciation methods by filling in below columns: Sum of the year's Digits method: Year Depreciation Expense Accumulated Depreciation Book value End of the year 1 2 3 4 Double Declining Method: Year Depreciation Expense Accumulated Depreciation Book value End of the year 1 2 3 4arrow_forward

- Suppose that you placed a commercial building (warehouse) in service inJanuary. The cost of property is $300,000, which includes the $100,000 value of land. Determine the amount of depreciation that is allowed during the first year of ownership.(a) $7,692(b) $5,128(c) $7,372(d)$4,915arrow_forwardIn a large plant that has life of 12 years, the management is considering two different pumps. Which of pumps should they purchase? The data on the pumps is given in the following Table. Minimum attractive interest rate is 15%. You can use net present worth (cost) criteria with common multiple life which is 6. Do before tax analysis which means do not account for tax and depreciation. Operating Cost (S/year) 50,000 40,000 Pump Alternatives TCI ($) Life of alternatives (years) 100,000 150,000 3arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Depreciation: Te'Andra has a computer system that she bought for $5000. Each year, the computer system loses one-fifth of its then current value. How much money will the computer system be worth after 6 years?arrow_forwardCost of an asset is $1250 and having a life of 3 years and a salvage value of $350. Calculate the depreciation by Straight Line, SOYD and one and half declining balance methods. Show results in a table including annual depreciation and end of year value.arrow_forwardEquipment Depreciation A new piece of equipment cost acompany $15,000. Each year, for tax purposes, the companydepreciates the value by 15%. What value should thecompany give the equipment after 5 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education