ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

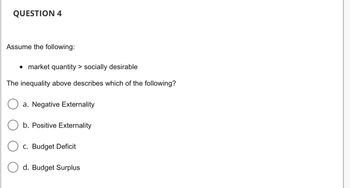

Transcribed Image Text:QUESTION 4

Assume the following:

• market quantity > socially desirable

The inequality above describes which of the following?

a. Negative Externality

b. Positive Externality

C. Budget Deficit

d. Budget Surplus

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Australian government have suggested that they might need to increase GST to help fund the COVID-19 rescue package. GST is a tax on goods and services usually paid at the point of sale. Consider the market for bread. Suppose a loaf costs $4.15 and includes a 15-cent tax per loaf. q5-Why would this tax be both socially inefficient and inegalitarian? Use the concepts of deadweight loss and wealth inequality.arrow_forwardExplain why using the local property tax to finance a given quantity and quality of public schooling can result in low tax rates in rich jurisdictions but high tax rates in poor jurisdictions. How do state governments supplement local finance of education to insure equality of opportunity of education?arrow_forward4, 5arrow_forward

- Most countries today have subsidised the provision of education. Consider an imaginary country, Gondolin. Gondolin pays a subsidy of $10 000 per year to each student enrolled in tertiary education. ADDITIONAL INFO - DONT NEED THIS ANSWERED - Depict, with the help of a figure, the initial market for tertiary education in Gondolin, assume that: 1) education was left to the competitive free market; 2) the marginal private benefit is equal to the marginal social benefit; 3) the marginal private cost is equal to the marginal social cost. Now describe, using the help of the figure, the effect of the government subsidy on the price and quantity traded of tertiary education, where the X axis of the figure should be the quantity of students enrolled in tertiary education. You do not need to use actual numbers – focus on the direction of change in price and quantity traded caused by the subsidy. QUESTION Identify the area of the figure you drew in (a) that depicts the total size of the…arrow_forwardWhich of the following statements is not correct? Select one: a. The economic life cycle theory explains why gifts of goods and services reduce poverty for the very young and the very old. b. Because people can borrow and save to smooth out changes in income, their standard of living in any one year depends more on lifetime income than on a particular year's income. c. The percentage of the population that suffers from long-term poverty is far smaller than the percentage of the population that suffers from short-term poverty because there is a high level of economic mobility in the United States. d. Permanent income is a better measure of a family's ability to buy the necessities of life than is transitory income.arrow_forwardExplain why we have government provision of goods and services instead of using markets. What are the 3 rationales for the government providing goods and services instead of markets?arrow_forward

- The graph illustrates the labor market in a country that does not tax labor income. Suppose the government introduces a Social Security tax of $2 an hour and it is split equally between workers and employers. The number of workers employed is. 14.00- 13.00- 12.00- 11.00- 10.00- 9.00- 8.00- Wage rate (dollars per hour) 10.00 7.00+ 600 700 $900 800 900 Quantity (workers) LS LD 1000 1100 1200 Q Q Garrow_forwardQUESTION 23 Refer to the graph below for a market. ↑Price 48 Supply 44 40 36 32 28 24 20 16 12- 8 4 Demand ++++ Quantity 10 15 20 25 30 35 40 45 50 55 60 Assuming that the government imposes a tax size of AB in the above market, Based on that calculate 1. Consumer surplus after taxes 2. Producer surplus after taxes 3. Tax revenue after taxes 4. Deadweight loss if any after taxes Note: Make sure to calculate the exact dollar amount with the steps. T T T F Paragraph 只i8公 Arial 3 (12pt) O f • Mashups HOO HTML CSS Click Save and Submit to save and submit. Click Save All Answers to save all answers.arrow_forward47. Doctors often complain that the patents of pharmaceutical companies make newer medicines hard to obtain and overpriced for their patients. This describes how the patents cause the new medicines to be artificially scarce common pool goods non-excludable perfectly competitive rival goods 48. What is the most likely goal of a government that enacts a lump-sum subsidy? To increase market competition To decrease market competition To correct for a negative externality To discourage production To encourage productionarrow_forward

- Questions number 1, 2, 4 a and b. I do not understand?arrow_forwardQuestion 2 a. Some goods and services are provided directly by the government, while others are funded publicly but provided privately. What is the difference between these two mechanisms of public financing? Why do you think the same government would use one approach sometimes and the other approach at other times? b. Why does redistribution cause efficiency losses? Why might society choose to redistribute resources from one group to another when doing so reduces the overall size of the economic pie?arrow_forward7 The table shows cost data for producing different amounts of higher education. The market for higher education produces positive externalities in the form of more informed voters and higher rates of technological growth. Use the information in the table to answer the question Supply Price 3 18 33 48 63 27 30 33 36 39 × 39 Private Demand 37 30 23 16 9 Private + Social Demand 57 50 43 36 29 How much higher education would we expect to be produced in the free market?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education