Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

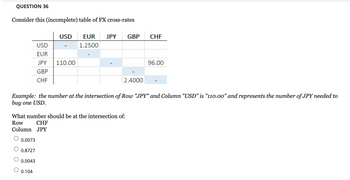

Transcribed Image Text:QUESTION 36

Consider this (incomplete) table of FX cross-rates

CHF

Column JPY

0.0073

0.8727

USD

USD

EUR

JPY 110.00

GBP

CHF

0.0043

What number should be at the intersection of:

Row

0.104

EUR JPY

1.2500

Example: the number at the intersection of Row "JPY" and Column "USD" is "110.00" and represents the number of JPY needed to

buy one USD.

GBP

2.4000

CHF

96.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Question content area top Part 1 (Related to Checkpoint 9.6) (Inflation and interest rates) What would you expect the nominal rate of interest to be if the real rate is 3.9 percent and the expected inflation rate is 6.8 percent? Question content area bottom Part 1 The nominal rate of interest would be enter your response here%. (Round to two decimal places.)arrow_forwardA В C D E F 1 A В C D Market Capitalization, in millions 3 2 YUM ZTS AAPL Market (OEX) 4 3 31/01/18 28506.29 37389.63 369899.4 15851230 4 5 Monthly prices 7 6 Dates YUM ZTS ΑΑPL Market (OEX) 8 31/01/18 28/02/18 7 84.59 76.73 87.3 1251.42 9. 8 10 81.38 80.86 75.74 1201.87 9. 11 30/03/18 85.13 83.51 74.61 1157.37 10 30/04/18 87.1 83.48 77.75 1160.73 12 11 31/05/18 81.33 83.7 81.24 1188.91 13 29/06/18 31/07/18 31/08/18 12 78.22 85.19 82.73 1194.5 14 13 79.29 86.48 81.51 1241.76 15 16 | 14 15 86.89 90.6 80.17 1286.9 28/09/18 90.91 91.56 85.02 1294.27 17 18 Please show full working 19 What is the (annualized) variance (population) for each stock and the market (arithmetic only)arrow_forwardGiven: So = INR 83/US$ F90 days = INR 83.2834/US$ 90-day iIndia = 6.91% 90-day ius = 5.34% a. there is no interest rate parity O b. there is total interest rate parity Oc. there is a possibility of triangle arbitrage O d. there is approximate interest rate parityarrow_forward

- Yen: Spot and Forward (\/$) Mid Rates Bid Spot Rates 129.87 Forward Rates 1 month 129.68 6 months 128.53 129.82 -20 -136 Ask 129.92 -18 -132 Pound: Spot and Forward ($/£) Mid Rates Bid 1.4484 1.4459 1.4327 1.4481 -26 -160 Ask 1.4487 -24 -154 According to the information provided in the table, the 6-month yen is selling at forward premium or discount? Please show your calculation and show the numbers of premium(or discount) in percentage.arrow_forwardCarter Company is considering a project with an initial investment of $600,500 that is expected to produce cash inflows of $131,000 for ten years. Carter's required rate of return is 16%. E (Click on the icon to view Present Value of $1 table.) (Click on the icon to view Present Value of Ordinary Annuity of $1 table.) 14. What is the NPV of the project? 15. What is the IRR of the project? Is this an acceptable project for Carter? 16. 14. What is the NPV of the project? (Enter the factor amount to three decimal places, X.XXX. Round the present value of the annuity to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Annuity PV Factor (i=16%, n=10) Net Cash Present Years Inflow Value 1- 10 Present value of annuity Investment Net present valuearrow_forwardL10arrow_forward

- Use the NPV method to determine whether Root Products should invest in the following projects: • Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B: Costs $380,000 and offers 9 annual net cash inflows of $74,000. Root Products demands an annual return of 10% on investments of this nature. E(Click the icon to view Present Value of $1 table.) E (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Annuity PV Factor Present Years Inflow (i=12%, n=8) Value 1-8 Present value of…arrow_forwardbdhdhdjdjdjjdis plz dont answer current ration in the following: Current Asset $20000., Current Liability $20000arrow_forwardThese are the quotes from the spot market. Citigroup Credit Suisse Deutsche Bank ¥122/€ ¥126/$ $0.99/€ If you have $1,000,000 to arbitrage, your profit is $_____________ (Please keep at least two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education