FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

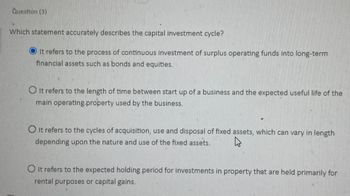

Transcribed Image Text:Question (3)

Which statement accurately describes the capital investment cycle?

It refers to the process of continuous investment of surplus operating funds into long-term

financial assets such as bonds and equities.

It refers to the length of time between start up of a business and the expected useful life of the

main operating property used by the business.

It refers to the cycles of acquisition, use and disposal of fixed assets, which can vary in length

depending upon the nature and use of the fixed assets.

OIt refers to the expected holding period for investments in property that are held primarily for

rental purposes or capital gains.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Capital investment (sometimes also referred to as capital budgeting) is a company’s contribution of funds toward the acquisition of long-lived (long-term or capital) assets for further growth. True / Falsearrow_forwardYou are an investor trying to determine the total value of a firm's assets (recall that one way to summarize the value of a company is the total value of its assets). Which of the following best describes the true "market value of the firm's assets that you would be looking for as a potential investor seeking to find the value of the firm? A. The assets' total market value is the cost associated with acquiring those assets. B. The assets' total market value can be found by adding up all of the individual asset values on the firm's balance sheet. C. The market value of the firm's assets is the total value the firm could get if it sold all of its tangible assets (machines, buildings, etc.) to the highest bidder. D. The assets' total market value is the present value of all of the cash flows that they can generate within the firm. Both C and D are correct.arrow_forwardLong-term investments that involve the purchase of a significant portion of the stock of another company may be held for a strategic purpose, such as O a. the receipt of dividends O b. the receipt of interest revenue O c. the gains from the increase in market value O d. expansion into new marketsarrow_forward

- The selection and management of short term assets and liabilities by the firm is called: O Working capital management O Depreciation cost recovery Asset class cost analysis O Capital structure choice O Capital budgetingarrow_forwardCapital allocation process The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries, companies, mutual funds, and other market participants. In a developed market economy, capital flows freely between entities that want to supply capital to those who want it. This flow of capital can be classified in three ways. In the table below, identify the nature of capital transfer given in the scenario with its appropriate classification: Scenario Direct Transfers Indirect Transfers through Investment Banks Indirect Transfers through Financial Intermediaries Elliot invests $25,000 by purchasing 1,000 shares of an emerging markets mutual fund. This mutual fund invests in companies in Brazil, India, and China. He bought the mutual fund from the mutual fund company. Steve’s grandfather loans him $30,000 to start a small coffee shop in the East Village in…arrow_forwardThe process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called capital investment analysis. True O Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education