FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

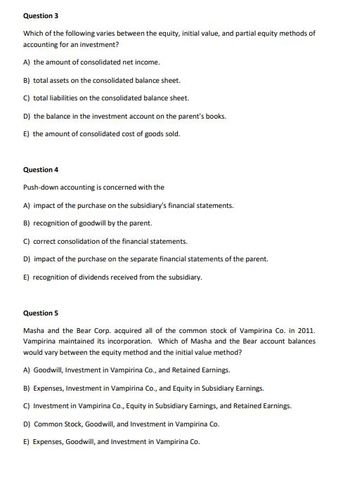

Transcribed Image Text:Question 3

Which of the following varies between the equity, initial value, and partial equity methods of

accounting for an investment?

A) the amount of consolidated net income.

B) total assets on the consolidated balance sheet.

C) total liabilities on the consolidated balance sheet.

D) the balance in the investment account on the parent's books.

E) the amount of consolidated cost of goods sold.

Question 4

Push-down accounting is concerned with the

A) impact of the purchase on the subsidiary's financial statements.

B) recognition of goodwill by the parent.

C) correct consolidation of the financial statements.

D) impact of the purchase on the separate financial statements of the parent.

E) recognition of dividends received from the subsidiary.

Question 5

Masha and the Bear Corp. acquired all of the common stock of Vampirina Co. in 2011.

Vampirina maintained its incorporation. Which of Masha and the Bear account balances

would vary between the equity method and the initial value method?

A) Goodwill, Investment in Vampirina Co., and Retained Earnings.

B) Expenses, Investment in Vampirina Co., and Equity in Subsidiary Earnings.

C) Investment in Vampirina Co., Equity in Subsidiary Earnings, and Retained Earnings.

D) Common Stock, Goodwill, and Investment in Vampirina Co.

E) Expenses, Goodwill, and Investment in Vampirina Co.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which method results in a balance sheet valuation of inventory method farthest away from its economic value? Select one: a. FIFO b. LIFO c. Weighted Average PreviousSave AnswersNextarrow_forwardWhich of the following items affect equity without going through the income statement? Group of answer choices A)Purchase of treasury stock. b)An extraordinary repair. c)A change in the estimated useful of an asset. D)Discontinued operations. e)None of the abovearrow_forwardWhich of the following items in the balance sheet does NOT have a constant relationship with sales in general when we use the percent of sale method to construct pro forma financial statements? Retained earnings Inventory Accounts receivables Accounts payablesarrow_forward

- 1arrow_forwardWhich of the following is not an example of a change in accounting principle? Multiple Choice A change to the equity method of accounting for investments. A change in the useful life of a depreciable asset. A change from LIFO to FIFO for inventory costing. A change to the full costing method in the extractive industries.arrow_forwardWhich of the ratios listed helps to indicate whether current liabilities could be paid without having to sell the inventory? a.Current ratio b.Profit margin c.Quick ratio d.Debt to equityarrow_forward

- Which limitation of an income statement occurs when one company uses an accelerated depreciation method while another company uses straight-line depreciation? O Companies omit from the income statement items they cannot measure reliably. O Income measurement involves judgment. O Income numbers are affected by the accounting methods employed. All of these answer choices are correct.arrow_forward10. Choose the options to correctly complete the following statement. Some balance sheet and income statement accounts that vary directly with sales include: 1. Cost of goods sold II. Depreciation III. Accounts payable IV. Accounts receivable O I, II, III only O I, II, IV only O I, III, IV only O I, II, III, and IVarrow_forwardHandwriting not allow pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education