International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Pls don't use gpt pls. Thanks!

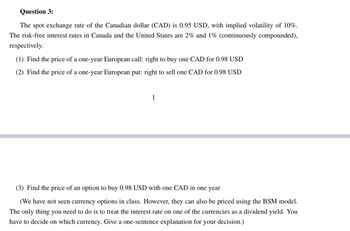

Transcribed Image Text:Question 3:

The spot exchange rate of the Canadian dollar (CAD) is 0.95 USD, with implied volatility of 10%.

The risk-free interest rates in Canada and the United States are 2% and 1% (continuously compounded),

respectively.

(1) Find the price of a one-year European call: right to buy one CAD for 0.98 USD

(2) Find the price of a one-year European put: right to sell one CAD for 0.98 USD

1

(3) Find the price of an option to buy 0.98 USD with one CAD in one year

(We have not seen currency options in class. However, they can also be priced using the BSM model.

The only thing you need to do is to treat the interest rate on one of the currencies as a dividend yield. You

have to decide on which currency. Give a one-sentence explanation for your decision.)

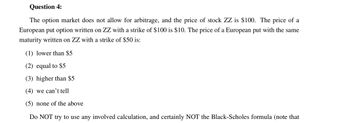

Transcribed Image Text:Question 4:

The option market does not allow for arbitrage, and the price of stock ZZ is $100. The price of a

European put option written on ZZ with a strike of $100 is $10. The price of a European put with the same

maturity written on ZZ with a strike of $50 is:

(1) lower than $5

(2) equal to $5

(3) higher than $5

(4) we can't tell

(5) none of the above

Do NOT try to use any involved calculation, and certainly NOT the Black-Scholes formula (note that

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 7arrow_forward1.arrow_forward(Problem 3) Currently, the spot exchange rate is $1.50/£ and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000. 1. Determine whether the interest rate parity is currently holding (just enter either yes or no): 2. If the IRP is not holding, compute and enter the total amount of arbitrage profit in dollars round to zero decimal. A positive number means profit. A negative number means loss) 3. If the IRP is not holding, compute and enter the total amount of arbitrage profit in pound i.e., round to zero decimal. A positive number means profit. A negative number means loss) (just enter yes or no) (if your profit is $2,000.00, just enter "2,000", i.e., (if your profit is 2,000.00 pound, just enter "2,000",arrow_forward

- If the interest rate in USD is 1%, and is 1.2% for Canadian Dollar deposits, find the forward price of a Canadian Dollar when the current exchange rate is 1.1, and expiration is three years from signing? b) If the Forward price of a Canadian dollar is currently 1.2, how could you use the synthetic to do arbitrage?arrow_forwardQuestion 3 The spot dollar-euro rate is $1.20/€1 and the forward rate is $1.15/€1. You expect the spot dollar-euro rate to be $1.05/€1 in one year's time. You have €1 million to speculate with using the forward exchange market. (iii) What is your profit in both euros and dollars if you are correct and the spot dollar- euro rate is $1.05/€1 in one year's time? (iv) What is your loss in both euros and dollars if you are wrong and the spot dollar-euro rate is $1.40/€1 in one year's timearrow_forwardUse the information below to answer the following questions. Currency per U.S. $ 1.2380 1.2353 Australia dollar 6-months forward Japan Yen 6-months forward U.K. Pound 6-months forward 100.3600 100.0200 .6789 .6784 Suppose interest rate parity holds, and the current six month risk-free rate in the United States is 5 percent. Use the approximate interest rate parity equation to answer the following questions. a. What must the six-month risk-free rate be in Australia? (Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What must the six-month risk-free rate be in Japan? (Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Australian risk-free rate b. Japanese risk-free rate c. Great Britain risk-free rate c. What must the six-month risk-free rate be in Great Britain? (Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) % % %arrow_forward

- 2. Suppose today's exchange rate is $1.23/€. The three-month interest rates on dollars and euros are 6% and 3 % (both anual rates), respectively. The three-month forward rate is $1.25. A foreign exchange advisory service has predicted that the euro will appreciate to $1.27 within three months. Consider 1 million euros. a.. How would you use forward contracts to speculate in the above situation? b. How would you use money market instruments (borrowing and lending) to speculate? C. Which alternatives (forward contracts or money market instruments) would you prefer? Why? d. Can you make profits without risks? If so, explain and calculate how you do that.arrow_forwardSubject:- financearrow_forwardUse the information below to answer the following questions. Canada dollar 6-months forward Japan Yen 6-months forward U.K. Pound 6-months forward Currency per U.S. $ 1.2375 1.2358 100.3100 100.0700 0.6794 0.6779 Suppose interest rate parity holds, and the current risk-free rate in the United States is 4 percent per six months. Requirement 1: What must the six-month risk-free rate be in Canada? [Select] [Select] Requirement 2: What must the six-month risk-free rate be in Japan? [Select] Requirement 3: What must the six-month risk-free rate be in Great Britain?arrow_forward

- klp.3arrow_forwardSuppose that the exchange rate is $0.92/Euro. The dollar-denominatedinterest rate is 4% and the euro-denominated interest rate is 3%.u = 1.2, d = 0.9, T = 0.75, n = 3, and K = $1.00.a. What is the price of a 9-month European put?b. What is the price of a 9-month American put?arrow_forward5. A U.S. firm expects a receivable (cash inflow) of €1,000,000 in six months. The current exchange rate is $1.125/€. Firm wants to sell euros in six months (to convert the inflow into dollars). Consider 3 possible spot prices in six months. 1. $1.195/€ 2. $1.100/€ 3. $1.025/€ What kind of option, put or call, is appropriate to hedge with? In each scenario, what is the total amount of the firm's NET receivable? NET receivable implies you should consider the receivable as well as the hedging costs of buying the option. (Assume an option exercise price of $1.130/€ and option premium of $.016/€) | 1. 2. 3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning