FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

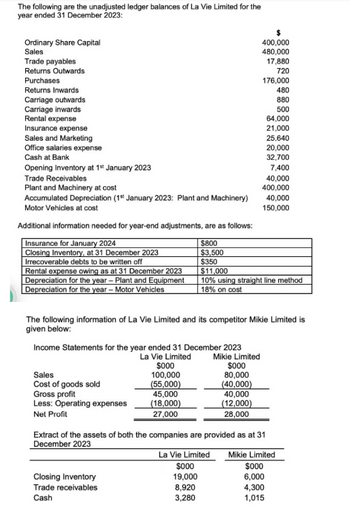

Transcribed Image Text:The following are the unadjusted ledger balances of La Vie Limited for the

year ended 31 December 2023:

Ordinary Share Capital

Sales

Trade payables

Returns Outwards

Purchases

Returns Inwards

Carriage outwards

Carriage inwards

Rental expense

Insurance expense

Sales and Marketing

Office salaries expense

Cash at Bank

Opening Inventory at 1st January 2023

Trade Receivables

Plant and Machinery at cost

Accumulated Depreciation (1st January 2023: Plant and Machinery)

Motor Vehicles at cost

Rental expense owing as at 31 December 2023

Depreciation for the year - Plant and Equipment

Depreciation for the year - Motor Vehicles

Income Statements for the year ended 31 December 2023

La Vie Limited

Mikie Limited

Sales

Cost of goods sold

Additional information needed for year-end adjustments, are as follows:

Insurance for January 2024

$800

Closing Inventory, at 31 December 2023

$3,500

Irrecoverable debts to be written off

$350

$11,000

10% using straight line method

18% on cost

Gross profit

Less: Operating expenses

Net Profit

The following information of La Vie Limited and its competitor Mikie Limited is

given below:

$000

100,000

(55,000)

45,000

(18,000)

27,000

Closing Inventory

Trade receivables

Cash

400,000

480,000

17,880

720

176,000

480

880

500

$000

80,000

(40,000)

40,000

(12,000)

28,000

$000

19,000

8,920

3,280

64,000

21,000

25,640

20,000

32,700

7,400

40,000

400,000

40,000

150,000

Extract of the assets of both the companies are provided as at 31

December 2023

La Vie Limited Mikie Limited

$000

6,000

4,300

1,015

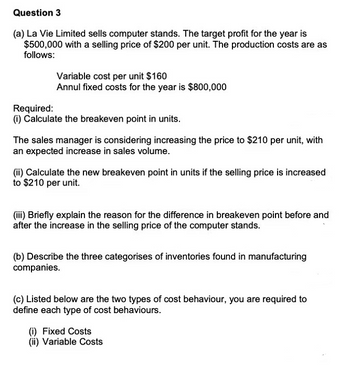

Transcribed Image Text:Question 3

(a) La Vie Limited sells computer stands. The target profit for the year is

$500,000 with a selling price of $200 per unit. The production costs are as

follows:

Variable cost per unit $160

Annul fixed costs for the year is $800,000

Required:

(i) Calculate the breakeven point in units.

The sales manager is considering increasing the price to $210 per unit, with

an expected increase in sales volume.

(ii) Calculate the new breakeven point in units if the selling price is increased

to $210 per unit.

(iii) Briefly explain the reason for the difference in breakeven point before and

after the increase in the selling price of the computer stands.

(b) Describe the three categorises of inventories found in manufacturing

companies.

(c) Listed below are the two types of cost behaviour, you are required to

define each type of cost behaviours.

(i) Fixed Costs

(ii) Variable Costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define break even point

VIEW Step 2: Calculation of Break Even Point in Unit

VIEW Step 3: Calculation of New Break Even Point

VIEW Step 4: Explain the reason of difference in break even point

VIEW Step 5: Describe three categories of inventory

VIEW Step 6: Describe Cost behavior

VIEW Solution

VIEW Step by stepSolved in 7 steps

Knowledge Booster

Similar questions

- Your Company is considering the addition of a new product to its current product lines. The expected cost and revenue data for the new product are as follows: Annual sales in units 3,000 Selling price per unit $309 Variable costs per unit: Production $130 Selling $50 Traceable annual fixed costs: Production $51,000 Selling $75,000 Allocated annual fixed cost $54,000 If the new product is added to the existing product line, then sales of existing products will decline. As a consequence, the contribution margin of the existing product lines is expected to drop $78,000 per year. What is the increase in net income if the new product is added next year? This is a reverse drop the segment. New CM is positive and new FC and lost CM are negative.arrow_forwardA company wants to expand by offering a new product. Expected cost and revenue data for this product are: Annual sales 5,000 units Unit selling price ? Unit variable costs: Production $ 30.20 Selling 6. Incremental fixed costs per year: 32:16 Production $35,000 Selling $45,000 If the company adds this new product, sales of its other product lines will be impacted, causing the contribution margin of other product lines to drop by $18,500 per year. What is the lowest price the company could charge for its new product without affecting the company's total profits? Multiple Choice $39.90 $52.20arrow_forward< Break-Even Point Hilton Inc. sells a product for $100 per unit. The variable cost is $50 per unit, while fixed costs are $962,500. Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $105 per unit. a. Break-even point in sales units b. Break-even point if the selling price were increased to $105 per unit units unitsarrow_forward

- Helparrow_forwardD) Brolin Company sells a single product. The product has a selling price of $50 and variable expenses of 80% of sales. If the company's fixed expenses total $150,000 per year, what is the company's break-even point in sales dollars? per unit $750,000 A) $187,500 B) $15,000 C) $3,750 D) Page 2 of 4 O 48°F Sunny re to searcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education