FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

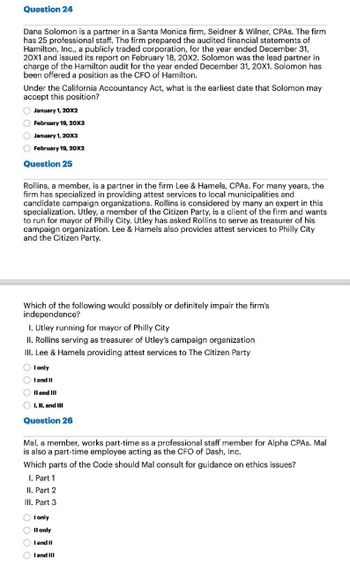

Transcribed Image Text:Question 24

Dana Solomon is a partner in a Santa Monica firm, Seidner & Wilner, CPAs. The firm

has 25 professional staff. The firm prepared the audited financial statements of

Hamilton, Inc., a publicly traded corporation, for the year ended December 31,

20X1 and issued its report on February 18, 20X2. Solomon was the lead partner in

charge of the Hamilton audit for the year ended December 31, 20X1. Solomon has

been offered a position as the CFO of Hamilton.

Under the California Accountancy Act, what is the earliest date that Solomon may

accept this position?

January 1, 20X2

February 19, 20X3

January 1, 20X3

February 19, 20X2

Question 25

Rollins, a member, is a partner in the firm Lee & Hamels, CPAs. For many years, the

firm has specialized in providing attest services to local municipalities and

candidate campaign organizations. Rollins is considered by many an expert in this

specialization. Utley, a member of the Citizen Party, is a client of the firm and wants

to run for mayor of Philly City. Utley has asked Rollins to serve as treasurer of his

campaign organization. Lee & Hamels also provides attest services to Philly City

and the Citizen Party.

Which of the following would possibly or definitely impair the firm's

independence?

I. Utley running for mayor of Philly City

II. Rollins serving as treasurer of Utley's campaign organization

III. Lee & Hamels providing attest services to The Citizen Party

I only

I and II

II and III

I, II, and III

Question 26

Mal, a member, works part-time as a professional staff member for Alpha CPAs. Mal

is also a part-time employee acting as the CFO of Dash, Inc.

Which parts of the Code should Mal consult for guidance on ethics issues?

I. Part 1

II. Part 2

III. Part 3

0000

I only

II only

I and II

I and III

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education