FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

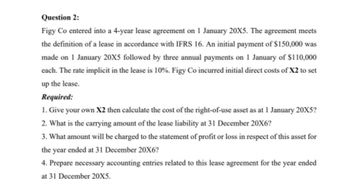

Transcribed Image Text:Question 2:

Figy Co entered into a 4-year lease agreement on 1 January 20X5. The agreement meets

the definition of a lease in accordance with IFRS 16. An initial payment of $150,000 was

made on 1 January 20X5 followed by three annual payments on 1 January of $110,000

each. The rate implicit in the lease is 10%. Figy Co incurred initial direct costs of X2 to set

up the lease.

Required:

1. Give your own X2 then calculate the cost of the right-of-use asset as at 1 January 20X5?

2. What is the carrying amount of the lease liability at 31 December 20X6?

3. What amount will be charged to the statement of profit or loss in respect of this asset for

the year ended at 31 December 20X6?

4. Prepare necessary accounting entries related to this lease agreement for the year ended

at 31 December 20X5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 13. Euro Co. leased vehicles from Winters Co. on January 1, 2021, which is classified as an operating lease. The present value of the lease payments discounted at 11% was $91,500. Ten annual lease payments of $14,000 are due at each January 1 beginning January 1, 2021. The amortization of the right-of-use asset for the reporting year ending December 31, 2021, would be:arrow_forwardApplying New Lease Accounting Standards for Operating Leases On January 1 of the current year, CCH Corporation entered into the following lease contract. Based on the facts, CCH Corporation classifies the lease as an operating lease. Details of lease contract Leased asset Office space Lease term 5 years Annual lease payment $115,487 Upfront fees $10,000 Cost of debt capital 5% a. Determine the amount of the lease liability that CCH will add to its balance sheet at the inception of the lease. Amount of lease liability b. What amount will be added to the balance sheet as an asset? Amount added as an asset The rest of the questions are given in pictures below. please answer all parts correctly. i will upvote. thank you!!arrow_forward2...new.continue...c The following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Crane Company, a lessee. Commencement date January 1, Annual lease payment due at the beginning of each year, beginning with January 1, $104,218 Residual value of equipment at end of lease term, guaranteed by the lessee $51,000 Expected residual value of equipment at end of lease term $46,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, $540,000 Lessor’s implicit rate 9 % Lessee’s incremental borrowing rate 9 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Suppose Crane received a lease incentive of $5,000 from Faldo Leasing to enter the lease. How would the initial measurement of the lease liability and right-of-use asset be affected? Right-of-use asset $enter a…arrow_forward

- Classifying Leases The following separate scenarios relate to a 5-year lease, pertaining to equipment with a fair value of $50,000. Assume in all scenarios that payments are made at the beginning of the period. 1. Lease payments include a fixed payment of $10,000 per year. 2. Lease payments include a fixed payment of $10,000 per year, plus $500 for insurance and $600 for a maintenance contract. 3. Lease payments will be $10,000 in the first year and will increase by 3% (calculated on the previous year's payment) for each of the following 4 years. 4. Lease payments will be $10,000 in the first year and will increase each of the following years by the increase in the CPI from the preceding year. The current CPI is 120 and is expected to increase to 122 at the end of the next year. 5. Lease payments will be $10,000 in the first year and will increase each of the following years by (a) the increase in the CPI from the preceding year, or (b) 3%, whichever is greater. The current CPI is 120…arrow_forward6. Explosive Leasing acquires equipment and leases it to customers under long-term sales-type leases. Explosive earns interest under these arrangements at a 6% annual rate. Explosive purchased a device and then leased it for $342,400 under an arrangement that specified annual payments to be received for five years, beginning at the commencement of the lease. The lessee had the option to purchase the device at the end of the lease term for $49,650 when it was expected to have a residual value of $99,300. Calculate the amount of the annual lease payments. (Do not round intermediate calculations. Round your answer to nearest whole dollar amount.)The present value of $1: n = 5, i = 6% is 0.74726.The present value of an ordinary annuity of $1: n = 5, i = 6% is 4.21236.The present value of an annuity due of $1: n = 5, i = 6% is 4.46511.arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education