FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:: Investing

are-delivery/ua/49002441/774597733/aHROcHM6Ly9mMi5hcHAuZWRtZW50dWOuY29tL2xlYXJuZXItdWkvc2Vjb25kYxJ5L3VzZXItYXNzaWdub...

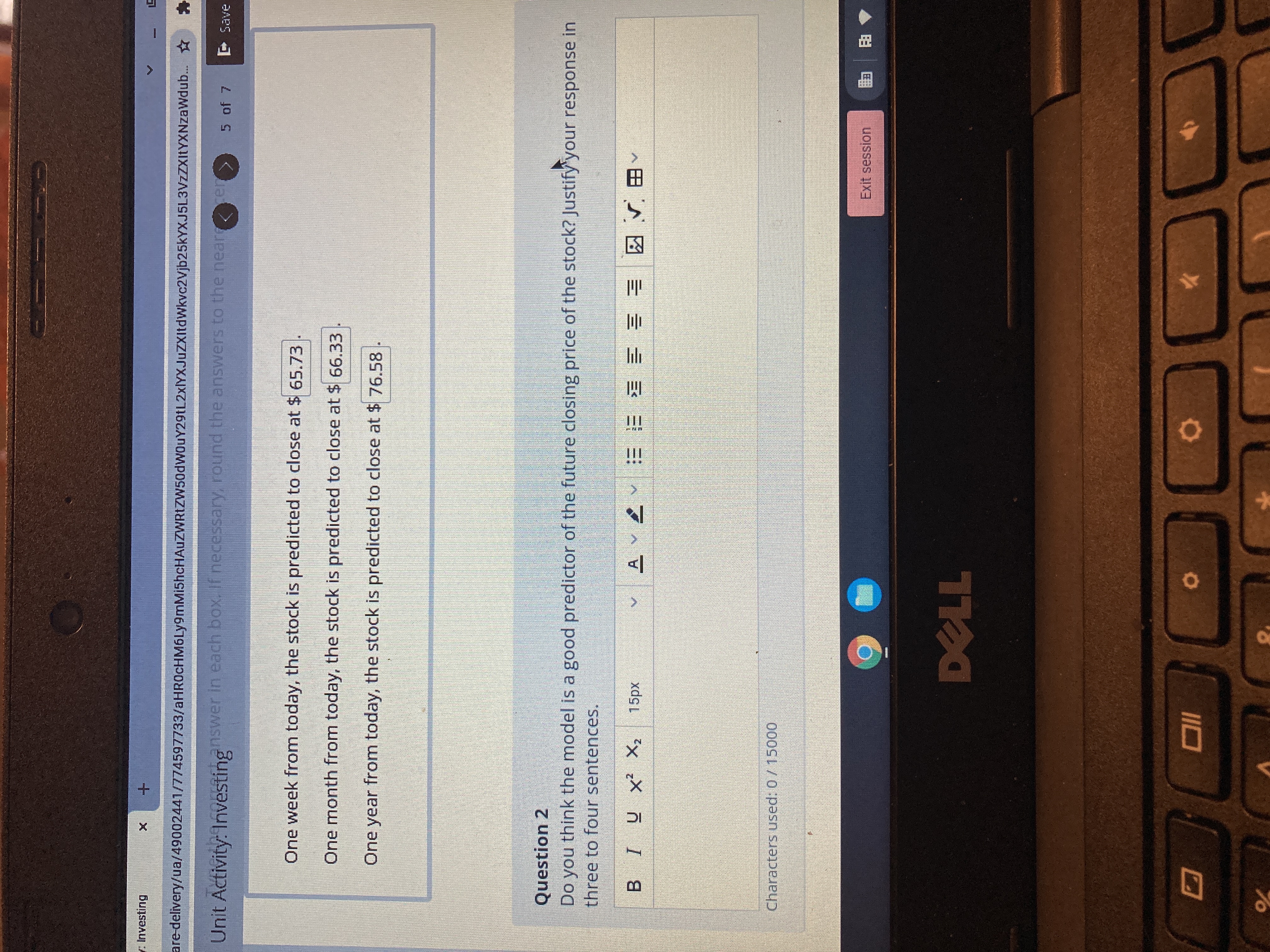

Unit Activity: Investing

ietthe.corein

answer in each box, If necessary, round the answers to the near en 5 of 7

One week from today, the stock is predicted to close at $ 65.73

One month from today, the stock is predicted to close at $ 66.33

One year from today, the stock is predicted to close at $ 76.58

Question 2

Do you think the model is a good predictor of the future closing price of the stock? Justify your response in

three to four sentences.

X ¿X ñ I

田 图=三 = 3 =:ヘマ^マ

Characters used: 0 /15000

Exit session

L

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following information on five stocks, construct: a. A simple price-weighted average b. A value-weighted average c. A geometric average d. What is the percentage increase in each average if the stock prices change to those in Column I? e. What is the percentage increase in each average if the stock prices change from those in the Price column to those in Column II? f. Why were the percentage changes different in parts (d) and (e)? g. If you were managing a fund and wanted a source to compare your results to, which of the three averages would you prefer to use, and why? Stock Price # of Shares I II A B C D E F $12.00 150,000 $14.00 125,000 $11.00 200,000 $ 22.00 80,000 $8.00 30,000 $29.00 140,000 $12.00 $12.00 $14.00 $14.00 $20.00 $11.00 $ 22,00 $ 22.00 $8.00 $15.00 $29.00 $29.00arrow_forward18arrow_forwardWhich of the following will (holding everything else constant) cause the price earnings (P/E) ratio of a stock to decrease: The required return increases The risk-free rate decreases The stock's beta decreases The required return decreasesarrow_forward

- please help with this questionarrow_forwardA4 answer the questions belowarrow_forwardLet's explore the difference between "expected" and "actual" return of a stock. 1) How might we calculate what the expected return of a stock should be? 2) How might we calculate the "actual" return of a stock?arrow_forward

- 20. When we are studying the stock price reactions to earnings announcement, why do we need to know analysts’ earnings forecast consensus?arrow_forwardConsider the following table, which gives a security analyst’s expected return on two stocks and the market index in two scenarios: Scenario Probability Market Return Aggressive Stock Defensive Stock 1 0.5 6% 2.0% 5.0% 2 0.5 20 32 15 Required: a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) b. What is the expected rate of return on each stock?arrow_forwardthis is one question with two parts, could you have it answered pleasearrow_forward

- Required: a-1. If the stock price at option expiration is $143, will you exercise your call? multiple choice 1 Yes No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) b-1. Would you exercise the call if you had bought the November call with the exercise price $130?multiple choice 2 Yes No b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) c-1. What if you had bought the November put with exercise price $140 instead? Would you exercise the put at a stock price of $140?multiple choice 3 Yes No c-2. What is the rate of return on your position? (Negative value should be indicated by a minus…arrow_forwardResearch 3 stocks of your choice and answer the following questions. 1. What is the name of the stock? 2. What is the stock symbol? 3. What is its current price per share? 4. What was the 52 week high price for the stock? 5. What was the 52 week low price for the stock? 6. Why did you pick these stocks?arrow_forwardWhat are some analyzes we can do to predict which stock will go up?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education