FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

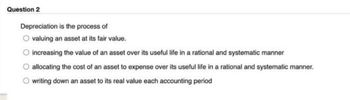

Transcribed Image Text:Question 2

Depreciation is the process of

valuing an asset at its fair value.

increasing the value of an asset over its useful life in a rational and systematic manner

allocating the cost of an asset to expense over its useful life in a rational and systematic manner.

writing down an asset to its real value each accounting period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A gain or loss on the sale of a plant asset is determined by comparing the: A. Asset's original cost with the sales proceeds B. Asset's book value with the sales proceeds C. Asset's original cost with the asset's book value. D. Initial estimate of the asset's salvage value with the sales proceeds. E. None of these.arrow_forwardWhich of the following is a current asset? Question 3 options: goodwill prepaid expenses accrued liabilities deferred revenuearrow_forwardQ: Accumulated depreciation represents: Select one: O a. The depreciation taken on fixed assets for one year O b. The decline in value on Property, Plant, and Equipment O c. The depreciation taken since the asset was purchased O d. The loss from damage on an assetarrow_forward

- Which depreciation method would result in the same depreciation expense amount regardless of the partial period cor Select one: a. Sum-of-the-years'-digits b. Declining-balance c. Units-of-production d. Straight-linearrow_forwardWhich of the following is true? O The book value at the end of an asset's useful life will be the same under all the depreciation methods allowed under generally accepted accounting principles. The annual depreciation expense will usually differ under the various depreciation methods. The total depreciation in the accumulated depreciation account will be the same at the end of the asset's useful life under all the methods allowed under generally accepted accounting principles. O All are true.arrow_forwardTRUE OR FALSE The term used to describe the mechanical process of allocating the cost of an intangible asset to expense over the shorter of the legal life or estimated useful life is called amortization.arrow_forward

- How would accumulated depreciation be classified on the balance sheet? current asset fixed asset current liability O long term liabilityarrow_forwardQuestion 29 Replacement cost of an asset is related to: A. Market value B. Current costs C. Capabilities of the old asset D. Opportunity costsarrow_forwardWhich depreciation method ignores residual value when computing the depreciable base of an asset? a. sum-of-the-year's-digits b. double-declining-balance c. composite depreciation d. group depreciationarrow_forward

- Which of the following best describes depreciation?A It is a means of spreading the payment for the asset over its total estimated lifeB It represents the decline in the market value of the assetC It is a means of spreading the cost of an asset over its estimated useful lifeD It is a way of estimating the cash needed to replace the asset in the futurearrow_forwardOf the following, what information is required to calculate depreciation allowances under MACRSGDS? I. Useful life II. First cost. III. Salvage value. IV. Property class a. II and IV only. b. II, III, and IV only. c. I, II, and IV only. d. I, II, III, and IV.arrow_forwardWhat is the effective life of an asset? a. The total period of ownership of the asset, including when it is not installed and ready for use.. b. The period prior to the asset being abandoned or scrapped. c. The period that the asset can be used for income-producing purposes. d. All of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education