Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

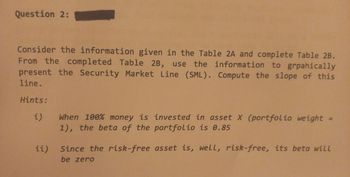

Transcribed Image Text:Question 2:

Consider the information given in the Table 2A and complete Table 2B.

From the completed Table 2B, use the information to grpahically

present the Security Market Line (SML). Compute the slope of this

line.

Hints:

i)

ii)

When 100% money is invested in asset X (portfolio weight

1), the beta of the portfolio is 0.85

Since the risk-free asset is, well, risk-free, its beta will

be zero

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sami Abbasi Health Food stocks five loaves of Vita-Bread. The probability distribution for the sales of VitaBread is listed in the following table. How many loaves will Sami sell on the average?Number of Loaves Sold Probability0 .051 .152 .203 .254 .205 .15arrow_forward3arrow_forwardb. Indicate where in the risk matrix the following example of risks would fall. Suggest how each of the risks could be handled by the organisation.i. Working from heights in a construction company. (3 marks)ii. The cashier might steal coins from the cash box to buy airtime. (3 marks)iii. A University catching fire and being burnt down. (3 marks)iv. People in the University neighbourhood will complain due to noise made by students during a fashion show at the university. (3 marks)v. Identify any four risks faced by an organisation when cleaners perform their duties. (4 marks.arrow_forward

- 3arrow_forwardNo probabilities are known for the occurrence of the nature states. Compare the solutions obtained by each of the following criteria: Hurwitz (assume that alpha = 0.8)arrow_forwardSaving Plan Options An insurance company offers a saving plan that has two options for the insured to withdraw money after maturity. Option A consists of a guaranteed payment of £1500 at the end of each month for 15 years. Alternatively, under option B, the insured receives a lump-sum payment equal to the present value of the payments described under option A. (a) Find the sum of the payments under option A. (b) Find the lump-sum payment under option B if it is determined by using an interest rate of 2.25% compounded monthly. Round the answer to the nearest pound. C. Which option is better? Why?arrow_forward

- true or false 6. Certainty-equivalence methods were found to yield greater risk seeking than probability-equivalence methods.arrow_forward1. You have been äsked to estimate the probability of default of a manufacturing company, which has corporate bonds publicly traded. Please list two approaches you can potentially consider.arrow_forwardA5arrow_forward

- Evaluate the following statements:S1. Any investment income of general borrowing is deducted from capitalizable borrowing cost.S2. If the asset is financed by specific borrowing but a portion is used for working capital purposes, the borrowing shall be treated as general borrowing in determining capitalizable borrowing cost. a.False, False b.False, True c.True, True d.True, Falsearrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON