Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

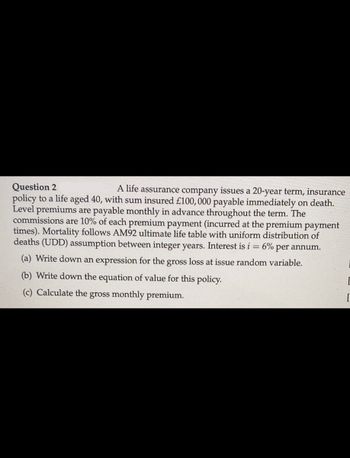

Transcribed Image Text:Question 2

A life assurance company issues a 20-year term, insurance

policy to a life aged 40, with sum insured £100,000 payable immediately on death.

Level premiums are payable monthly in advance throughout the term. The

commissions are 10% of each premium payment (incurred at the premium payment

times). Mortality follows AM92 ultimate life table with uniform distribution of

deaths (UDD) assumption between integer years. Interest is i = 6% per annum.

(a) Write down an expression for the gross loss at issue random variable.

(b) Write down the equation of value for this policy.

(c) Calculate the gross monthly premium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- On the basis of how long he has until retirement and his comfort with investment risk, Connor has decided that he wants to allocate the money in his retirement account as follows: 70% to equities, 15% to fixed income, and 15% to cash. If Connor assumes that each asset class provides the low end of the rates of return shown in the table below, what overall rate of return would he expect to earn over the long term? Asset Class Degree of Risk Historical Average Rate of Return Equities High 8% - 12% Fixed Income Moderate 4% - 7% Cash Minimal 2% - 5% Group of answer choices 4.34% 6.50% 1.43% 7.25%arrow_forwardTable 1: Accumulated Interest Year 1 Lower-Risk Customer Higher-Risk Customer ACCUMULATED INTEREST Figure 1: Accumulated Interest 14,000.00 12,000.00 10,000.00 8,000.00 6,000.00 4,000.00 2,000.00 0 1 1,396.55 2,605.48 2 3,190.68 3,190.68 6,096.38 8,628.07 10,668.88 1,396.55 Accumulated Interest 2 6,096.38 Ⓒ2,605.48 3 Lower-Risk Customer 3,602.39 4,359.66 4,846.10 3 8,628.07 4 3,602.39 YEAR Ⓒ10,668.88 Ⓒ4,359.66 Higher-Risk Customer 5 Ⓒ12,065.44 5 Ⓒ4,846.10 12,065.44 12,616.45 5,026.46 6 6 Ⓒ12,616.45 5,026.46 4) Using the graph in 3), calculate the difference in the accumulated interest amount earned in year 5 by the credit card company charging 27.5 % versus 12.3% nominal annual rate of interest. 7arrow_forwardCalculate the periodic rate of interest and total number of periods in each case: 12% p.a. compounded monthly for 38 months. 5% p.a. compounded quarterly for 30 months. 8% p.a. compounded semi-annually for 2 years and 8 months. 5% p.a. compounded daily for 2 years and 10 months and 12 days.arrow_forward

- Kier Company issued $740,000 in bonds on January 1, Year 1. The bonds were issued at face value and carried a 3-year term to maturity. They had a 5.50% stated rate of interest that was payable in cash on December 31st. Based on this information alone, the amount of interest expense shown on the December 31, Year 1 income statement and the cash flow from operating activities shown on the December 31, Year 1 statement of cash flows would be: Interest Expense Cash Outflow A. $40,700 zero B. zero $40,700 C. $40,700 $40,700 D. zero zero Multiple Choice Choice A Choice B Choice C Choice Darrow_forwardDetermine the final account balance of an investment if $300 is invested at an intrest rate of 6.75% compounded semiannually for 20 years.arrow_forwarda) Find the amount P that needs to be invested at a rate of 5% compounded quarterly for 6 years to give a final amount of $2000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,