Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

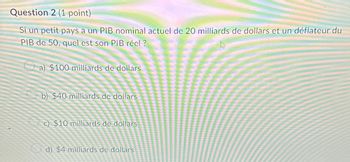

Transcribed Image Text:Question 2 (1 point)

Si un petit pays a un PIB nominal actuel de 20 milliards de dollars et un déflateur du

PIB de 50, quel est son PIB réel?

a) $100 milliards de dollars

b) $40 milliards de dollars

c) $10 milliards de dollars

d) $4 milliards de dollars

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Table 22.4 shows the fruit prices that the typing college student purchased from 2001 to 2004. What is the amount spent each year on the basket of fruit with the quantities shown in column 2?arrow_forwardDescribe some buyers and some sellers in the market for U.S. dollars.arrow_forwardHow do you convert a series of nominal economic data over time to real terms?arrow_forward

- With in 1 or 2 percentage points, what has the U.S. inflation rate been during the last 20 years? Draw a graph to show the data.arrow_forwardWhy do you mink the U.S. experience with inflation over the last 50 years has been so much milder than in many other countries?arrow_forwardIf you receive 500 in simple interest on a loan that you made for 10,000 for five years, what was the interest rate you charged?arrow_forward

- Rosalie the Retiree knows that when she retires in 16 years, her company will give her a one-time payment of 20,000. However, if the inflation rate is 6 per year, how much buying power will that 20,000 have when measured in todays dollars? Hint: Start by calculating the rise in the price level over the 16 years.arrow_forwardImagine that you are in the position of buying loans in the secondary market (that is, buying the right to collect the payments on loans) for a bank or other financial services company. Explain why you would be willing to pay more or less for a given loan If: The borrower has been late on a number of loan payments Interest rates In the economy as a whole have risen since the bank made the loan The borrower Is a firm that has just declared a high level of profits Interest rates in the economy as a whole have fallen since the bank made the loanarrow_forwardImagine that you are a barber in a world without money. Explain why it would be tricky to obtain groceries, clothing, and a place to live.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:Cengage Learning