Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:x

2:08

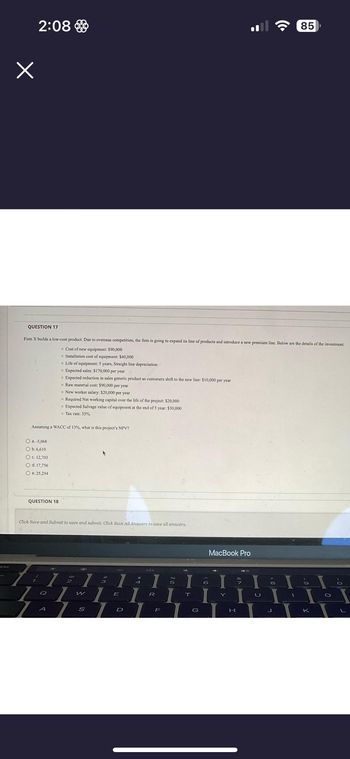

QUESTION 17

Firm X builds a low-cost product. Due to overseas competition, the firm is going to expand its line of products and introduce a new premium line. Below are the details of the investment.

Cost of new equipment: $90,000

Installation cost of equipment: $40,000

O a.-5,068

O b.6,610

O c. 12,703

O d. 17,756

O e. 25,294

Assuming a WACC of 13%, what is this project's NPV?

QUESTION 18

7

4

1

Click Save and Submit to save and submit. Click Save All Answers to save all answers.

Q

Life of equipment: 5 years, Straight line depreciation

Expected sales: $170,000 per year

• Expected reduction in sales generic product as customers shift to the new line: $10,000 per year

A

Raw material cost: $90,000 per year

New worker salary: $20,000 per year

Required Networking capital over the life of the project: $20,000

Expected Salvage value of equipment at the end of 5 year: $30,000

Tax rate: 35%

1

400

2

7

**

W

S

40

3

7

I

1

E

D

4

%

1 5

R

F

I

T

G

MacBook Pro

T

Y

H

1

U

8

((.

11

J

85

1

O

I

K

O

L

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Q25arrow_forwardexcel break even point Schweser Satellites Inc. produces satellite earth stations that sell for $95,000 each. The firm's fixed costs, F, are $2 million, 50 earth stations are produced and sold each year, profits total $400,000; and the firm's assets (all equity financed) are $4 million. The firm estimates that it can change its production process, adding $3 million to investment and $360,000 to fixed operating costs. This change will (1) reduce variable costs per unit by $12,000 and (2) increase output by 23 units, but (3) the sales price on all units will have to be lowered to $84,000 to permit sales of the additional output. The firm has tax loss carry forwards that render its tax rate zero,arrow_forwardQuestion 2 Kosova Itd is a new formed firm which intends to penetrate in the international market. The newly formed firm produces car radios, which currently it sells to car manufacturers for £60 each. Next year the business plans to make and sell 20,000 radios. The business's costs are as follows: Manufacturing Variable materials £20 per radio £14 per radio £12 per radio Variable labour Other variable costs Fixed cost £80,000 per year Administration and selling Variable £3 per radio £60,000 per year Fixed Required: (a) Calculate the break-even point for next year, expressed both in quantity of radios and sales value. (b) Calculate the operating leverage for next year, and discuss why operating leverage is useful. value.arrow_forward

- need correct answerarrow_forwarda1arrow_forwardPage 266 MINICASE Flowton Products enjoys a steady demand for stainless steel infiltrators used in a number of chemical processes. Revenues from the infiltrator division are $50 million a year, and production costs are $47.5 million. However, the 10 high-precision Munster stamping machines that are used in the production process are coming to the end of their useful life. One possibility is simply to replace each existing machine with a new Munster. These machines would cost $800,000 each and would not involve any additional operating costs. The alternative is to buy 10 centrally controlled Skilboro stampers. Skilboros cost $1.25 million each, but compared with the Munster, they would produce a total saving in operator and material costs of $500,000 a year. Moreover, the Skilboro is sturdily built and would last 10 years, compared with an estimated seven-year life for the Munster. Analysts in the infiltrator division have produced the accompanying summary table, which shows the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education