Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

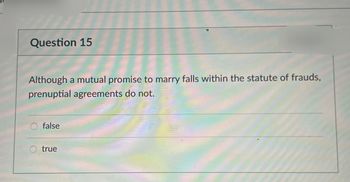

Transcribed Image Text:Question 15

Although a mutual promise to marry falls within the statute of frauds,

prenuptial agreements do not.

false

true

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A5arrow_forwardS1: Forming a partnership requires two or more people agreeing partners Contributing all their personal properties. S2: Oral agreement partners are not allowed. * A. Statement 2 is true. B. Statement 1 is true. C. Both statements are false. D. Both statements are true. S1: A joint arrangement that is structured without a separate vehicle should be accounted as Joint Venture. S2: A joint arrangement that is structured without a separate vehicle should be accounted as Joint Operation? A. S2 True; S1 False B. Both statements are false C. s1 True; S2 False D. Both statements are true The interest of the retiring or withdrawing partner is usually measured by his capital balance before his retirement or withdrawal adjusted by the following adjustments except? A. profit or loss from the operation from the last closing date of the date of his retirement or withdrawal B. profit or loss after the date of the partner's withdrawal or retirement C. errors in net income in prior years D.…arrow_forwardList the instances when a partnership is terminated.arrow_forward

- 12 Which type of contract contingency is most likely to only be accepted by the seller if they have had very few offers on the property? Financing contingency. B Partner approval contingency. Appraisal contingency. DO Inspection contingency.arrow_forward2) For IRC §704 a) What determines the partner's distributive share? What is a partner's distributive share? b) What if the partnership agreement does not provide for the partner's distributive share? c) Under Treas. Reg. §1.704-2, define a nonrecourse liability (the actual definition not the cite of where it is defined)? Cite where it is defined.arrow_forwardA general partnership, unlike a limited partnership, is an entity that legally functions separate and apart from its owners. True Falsearrow_forward

- Assess the truth of this statement: One of the rules of debits and credits and account balances for a partnership is that increases in expense accounts are always debited to the expense account. This statement is true. O This statement is false. O There is not enough information to determine whether or not this statement is true. O This statement is not applicable to accounting concepts.arrow_forwardThe outside basis is defined in the internal revenue code as a partner's basis in the partnership interest. True Falsearrow_forwardPLEASE ANSWER ALL OF THE QUESTIONSarrow_forward

- Which of the following mistakes that does NOT render an agreement defective? A) identity of the party or parties B) identity of the subject matter C) terms of the contract D) existence of the subject matterarrow_forwardAssess the truth of this statement: The transaction of a partnership that is recording cash invested by a partner should be recorded as a debit to cash and a credit to the individual partner's drawing account. O This statement is true. O This statement is false. O There is not enough information to determine whether or not this statement is true. O This statement is not applicable to accounting concepts.arrow_forwardTRUE OR FALSEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education