Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

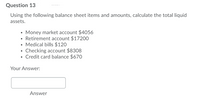

Transcribed Image Text:Question 13

Using the following balance sheet items and amounts, calculate the total liquid

assets.

• Money market account $4056

• Retirement account $17200

• Medical bills $120

• Checking account $8308

• Credit card balance $670

Your Answer:

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Explainations would help :Darrow_forwardProblem 10 You are assigned to assess the collectibility of the receivables carried in the books Goliath Company, your company's audit client. The working trial balance are prepared at December 31, 2021 showed the following balances: Notes Receivable 6,000,000 Accounts Receivable 4,000,000 In the course of your examination, you discovered the following: Notes Receivable from Company A Notes Receivable from Company B 2,000,000 3,000,000 Notes Receivable from Company C 1,000,000 No interest has yet been recorded by Goliath during 2021 on any of the notes above. Company A is undergoing bankruptcy proceedings and has negotiated for a restructuring of its notes receivable. The note was for a four-year period and interest of 10% is collectible annually. All interest accrued before 2021 has been collected. The note matured on December 31, 2021. Collection of Interest was last made on December 31, 2020. The restructuring agreement with Company A calls for annual payment of P550,000 starting…arrow_forwardneck my wor Income: Assets: Checking account Savings account $ 1,940 9,150 Gross income $69,000 Interest income 450 Total $69,450 Automobile 1,800 Personal property 14,900 Total $27,790 Expenses: Living Insurance premium $24,200 Liabilities: 400 Note to bank 5,200 Таxes 15,200 Net worth $22,590 ($27,790 - $5,200) Medical 630 Investment 3,500 Total $43,930 Net worth = Assets - Liabilities (own) (owe) Paula believes her gross income will double in 2019 but her interest income will decrease $150. She plans to reduce her 2019 living expenses by one-fifth. Paula's insurance company wrote a letter announcing that her insurance premiums would triple in 2019. Her accountant estimates her taxes will decrease $250 and her medical costs will increase $41O. Paula also hopes to cut her investments expenses by one-fourth. Paula's accountant projects that her savings and checking accounts will each triple in value. On January 2, 2019, Paula sold her automobile and began to use public transportation.…arrow_forward

- QUESTION 1 The following debtor control account and debtors list were prepared by the owner of Siyadula Traders. The owner is unsure if he has correctly prepared it. REQUIRED: Jse the following information to prepare the correct account and list: Debtors control account for January 2021 Debtors list at 31 January 2021. General Ledger DEBTORS CONTROL ACCOUNT Jan 01 Balance b/d 54 300 Jan 31 Bank and discount CRJ5 36 200 Sales Returns SRJ 6 200 Sales SJ 62 110 Balance c/d 37 810 98 310 98 310 Feb 01 Balance b/d 37 810 Debtors List as at 31 January 2021 Debit Credit B. Afleck 12 525 M. Damon 19 085 J. Peter 18 100 A. Paul 9 200 D. Carter 17 900 76 810arrow_forwardTB 08 - 56 Accounts receivable accounts for specific cu... Accounts receivable accounts for specific customers are important because they show Multiple Choice How much each customer paid All of the choices are correct How much each customer still owes The basis for sending bills to customers How much each customer purchasesarrow_forwardOrearrow_forward

- Problem 9-03 Fill in the blanks below with the correct entries. Round your answers to the nearest dollar. Assets Liabilities and Stockholders’ Equity Current Assets Current liabilities Cash $ 240,000 Accounts payable $ 530,000 Accounts receivable Notes payable to banks 80,000 ($ less allowance for Accrued wages doubtful accounts of $15,000) 1,040,000 Taxes owed 170,000 Inventory 1,470,000 Total current liabilities $ 1,220,000 Total current assets $ Long-term debt Land Stockholders’ equity Plant and equipment Common stock ($2,410,000 less ($1 par, 670,000 accumulated depreciation shares authorized, $ ) 1,580,000 640,000 outstanding) Total assets $ 4,670,000 Retained earnings Total stockholders’ equity $ 2,660,000 Total liabilities and equity $arrow_forward7arrow_forward#9 Item Prior year Current year Accounts payable 8,123.00 7,716.00 Accounts receivable 6,048.00 6,607.00 Accruals 997.00 1,500.00 Cash ??? ??? Common Stock 10,094.00 11,603.00 COGS 12,653.00 18,393.00 Current portion long-term debt 4,911.00 5,090.00 Depreciation expense 2,500 2,763.00 Interest expense 733 417 Inventories 4,245.00 4,824.00 Long-term debt 14,141.00 13,226.00 Net fixed assets 51,826.00 54,004.00 Notes payable 4,339.00 9,940.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,688.00 30,532.00 Sales 35,119 45,044.00 Taxes 2,084 2,775 What is the firm's cash flow from financing? Answer format: Number: Round to: 0 decimal places.arrow_forward

- Chapter 5 Exercises i Saved 49 Required information Part 4 of 7 (The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Debit Credit 1 $ 26,100 14,700 Cash points Accounts Receivable Allowance for Uncollectible Accounts $ 3,000 Supplies Notes Receivable (6, due in 2 years) Land Skipped 3,600 15,000 80,000 Accounts Payable Conmon Stock Retained Earnings 7,900 95,000 33,500 eBook Totals $139,400 $139,400 Print During January 2021, the following transactions occur: 2 Provide services to customers for cash, $46,100. 6 Provide services to customers on account, $83,400. January January January 15 write off accounts receivable as uncollectible, $2,500. January 20 Pay cash for salaries, $32, 500. January 22 Receive cash on accounts receivable, $81,000. January 25 Pay cash on accounts payable, $6,600. January 30 Pay cash for utilities during January, $14,800. References…arrow_forwardBank Statement Responsible Bank 210 2nd Street 3. If Andre deposits $100 in this account after $ Checking Account Statement Page: 1 of 1 Anytown, MH 06930 buying the music player, will he still be in debt? How do Andre Person 1729 Euclid Ave Anytown, MH 06930 Statement Pernd 2017-10-01 to 2017-11.01 Accourt No. 1120635978 you know? Date Description Withdrawals Deposits Balance Your answer here 2017-10-03 Previous Balance 2017-10-05 Check Number 256 2017-10-06 ATM Deposit- Cash 2017-10-10 Wire Transfer 2017.10.17 Point of Sale Grocery Store 2017-10-25 Funds Transfer from Savings 2017.10-28 Check Number 257 2017-10-29 Online Payment Phone Services 39.87 11.37 56.37 18.46 203 52 03 10.03 6247 28.50 45.00 37.91 16.43 50.00 42 00 7250 %24arrow_forwardProblem 5-3A Record transactions related to accounts receivable (LO5-3, 5-4, 5-5) [The following information applies to the questions displayed below.]The following events occur for The Underwood Corporation during 2021 and 2022, its first two years of operations. June 12, 2021 Provide services to customers on account for $41,000. September 17, 2021 Receive $25,000 from customers on account. December 31, 2021 Estimate that 45% of accounts receivable at the end of the year will not be received. March 4, 2022 Provide services to customers on account for $56,000. May 20, 2022 Receive $10,000 from customers for services provided in 2021. July 2, 2022 Write off the remaining amounts owed from services provided in 2021. October 19, 2022 Receive $45,000 from customers for services provided in 2022. December 31, 2022 Estimate that 45% of accounts receivable at the end of the year will not be received. Problem 5-3A…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education