FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 12 of 16

View Policies

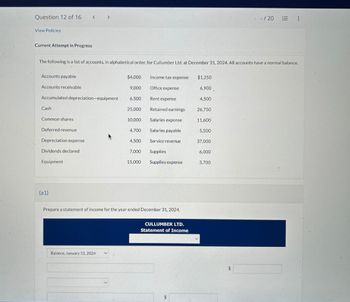

Current Attempt in Progress

Accounts payable

Accounts receivable

Cash

The following is a list of accounts, in alphabetical order, for Cullumber Ltd. at December 31, 2024. All accounts have a normal balance.

Accumulated depreciation-equipment

Common shares.

Deferred revenue

Depreciation expense

<

Dividends declared

Equipment.

(a1)

>

Balance, January 31, 2024

$4,000

9,000

6,500

25,000

10,000

4,700

4,500

7,000

15,000

Income tax expense

Office expense

Rent expense

Retained earnings

Salaries expense

Salaries payable

Service revenue

Supplies

Supplies expense

Prepare a statement of income for the year ended December 31, 2024.

CULLUMBER LTD.

Statement of Income

$

$1,250

6,900.

4,500

26,750

11,600

5,500

37,000

V

6,000

3,700

- /20

$

⠀

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 5arrow_forwardQuestion 70 Using Financial Statements for 2018-2019, the amount of cash and marketable securities at the end of the year is $4,202,000. TRUE OR FALSE?arrow_forwardCP 14-8Assume the following income statement and balance sheet information:Service revenue (all cash) Operating expenses Salaries (all cash) Net income$17585$90Current assets 2020 2019 Cash $1,250 $1,600 Short-term invest. 100 200 $1,350 $1,800 Liabilities Borrowings 600 1,000 Stockholders' equity Common stock 200 300 Retained earnings 550 500 750 800 $1,350 $1,800Other information: The short-term investments are riskless and will be converted to a known amount of cash in 60 days. Borrowings are non-current. No gain or loss occurred when common stock was repurchased.Required: 1. Calculate cash flow from operating activities. 2. Prepare the 2020 statement of changes in equity. 3. Calculate cash flow from financing activities. 4. (Appendix) Prepare a cash flow table. Show that cash effects net to a $450 outflow.arrow_forward

- 3 ook rences Exercise 16-21B (Algo) Direct: Preparing statement of cash flows and supporting note LO P5 Cash and cash equivalents, December 31 prior year-end Cash and cash equivalents, December 31 current year-end Cash received as interest Cash paid for salaries Bonds payable retired by issuing common stock (no gain or loss on retirement) Cash paid to retire long-term notes payable Cash received from sale of equipment Land purchased by issuing long-term notes payable Cash paid for store equipment Cash dividends paid Cash paid for other expenses Cash received from customers Cash paid for inventory FERRON COMPANY Statement of Cash Flows For Year Ended December 31 Use the above information about Ferron Company to prepare a complete statement of cash flows (direct method) for the current year ended December 31. Use a note disclosure for any noncash investing and financing activities. Note: Amounts to be deducted should be indicated with a minus sign. Cash flows from operating activities $…arrow_forwardim.3arrow_forwardSafari 4:22 PM Tue Jan 30 < HW Set 1 (Ch 2 and 3) Template Calibri (Body) fx Enter text or formula here A 1 E 2.16 2 Information for Montgomery, Inc. 3 4 5 6 7 Cash 8 Accounts Receivable 9 Inventory 10 PP&E, net 11 Goodwill NOPAT for 2020 12 Other operating assets 13 A/P 14 Accrued Expenses and other 15 Unearned revenues 16 Long-term debt 17 Common stock 18 19 20 a. 21 NOA for 2019 22 NOA for 2020 23 24 b. 25 26 27 28 29 30 31 32 33 34 35 Retained earnings 2020 FCF E 2.16 E 2.17 E 3.15 11 B HE E 3.18 Home Insert $ BIU C 3,150 2019 3,590 5,650 10,240 21,840 13,160 3,450 10,400 10,350 3,120 7,680 18,840 7,540 + Draw Page Layout ABC 2020 4,260 8,340 11,460 26,110 14,310 4,720 13,310 13,740 4,770 8,350 18,930 10,100 ch LL F Formulas Data G Review View General H < E < H: AH L O M Σ ☎: 50% |||| Oarrow_forward

- What are the cash balance and the total current assets balance?arrow_forwardView Policies Current Attempt in Progress On June 1, 2022, Pharoah Company was started with an initial investment in the company of $21,250 cash. Here are the assets, liabilities, and common stock of the company at June 30, 2022, and the revenues and expenses for the month of June, its first month of operations: Cash Accounts receivable Service revenue Supplies Advertising expense Equipment Common stock $ 5,600 4,400 8,500 2,342 (a1) 400 26,800 21,250 Notes payable Accounts payable Supplies expense Maintenance and repairs expense Utilities expense Salaries and wages expense Prepare an income statement for the month of June. PHAROAH COMPANY Income Statement During June, the company issued no additional stock but paid dividends of $1,683. LA $14,000 पी 900 1,125 690 210 1,400 $arrow_forwardshj.3arrow_forward

- Balance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts. Receivable $5,268,485 $10,268,485 Inventory $529,062 $696,685 Current Assets $8,371,777 $13,279,842 Less $2,574,230 $2,314,672 Gross Fixed Assets $16,251,665 $20,567,330 Accum.Depreciation Total Assets $7,460,897 $10,117,819 Accounts Payable Notes. Payable Current Liabilities Calculate the net working capital in 2022. Long Termi Debt Total Liabilities, None of these options are correct $10,572,740 $5,664,675 $8,854,338 $3,946,273 Total $17,162,545 $23,729,353 Liabilities and Equity Capital Surplus Retained. Earnings 2021 2022 $1,673,992 $2,438,271 Common Net Fixed Assets $8,790,768 $10,449,511 Stock ($0.50 $1,300,000 $1,600,000 par) $1,033,110 $1,987,233 $2,707,102 $4,425,504 $9,242,830 $11,468,302 $11,949,932 $15,893,806 $1,148,120 $1,800,969 $2,764,493 $4,434,578 $17,162,545 $23,729,353arrow_forwardCamaro GTO Torino Cash $ 2,400 $ 230 $ 1,300 Short-term investments 0 0 600 Current receivables 260 510 500 Inventory 2,175 2,020 3,050 Prepaid expenses 300 600 900 Total current assets $ 5,135 $ 3,360 $ 6,350 Current liabilities $ 2,220 $ 1,320 $ 3,550 a. Compute the acid-test ratio for each of the separate cases above.b. Which company is in the best position to meet short-term obligations?arrow_forwardRequired information [The following information applies to the questions displayed below] Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit. (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable. Inventory Total current assets GOLDEN CORPORATION Comparative Balance Sheets December 31 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable. Income taxes payable. Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity GOLDEN CORPORATION Income Statement For Current Year Ended…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education