FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

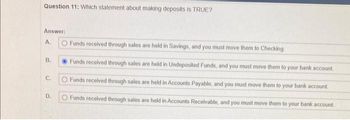

Transcribed Image Text:Question 11: Which statement about making deposits is TRUE?

Answer:

A.

B.

C.

D.

O Funds received through sales are held in Savings, and you must move them to Checking.

Funds received through sales are held in Undeposited Funds, and you must move them to your bank account.

O Funds received through sales are held in Accounts Payable, and you must move them to your bank account.

Funds received through sales are held in Accounts Receivable, and you must move them to your bank account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the Excel worksheet are the T- accounts for cash and other accounts need to record the bank reconciliation. Also, the format for the bank reconciliation is provided. Complete the bank reconciliation, using formulas when possible.arrow_forwardQuestion 13 If you want to group together multiple payments into one deposit, what account should be used when receiving a payment? Uncategorized Asset/Funds to categorize O Checking/Savings Uncategorized Funds/Funds to deposit Undeposited Funds/Payments to depositarrow_forwardIndicate with Yes or No whether each of items should be included in the cash balance presented on the balance sheet. If yes is selected for the Included in Cash Balance column for NSF checks, Savings account,Compensating balance,post dated checks,IOU,cash on hand,cash in sinking fund, travel advance, bank draft and prepaid debit card. Include the Classification items excluded?arrow_forward

- Are 1 year certificates of deposit recorded on bank reconciliation?arrow_forwardA prenumbered document that tells the bank to pay the designated party a specific amount is a A. check B. deposit ticket C. routing number D. remittance advicearrow_forwardPetty Cash Fund Question, When it comes to making payments from the petty cash fund, why isn't there an accounting/journal entry for it? Please Explain.arrow_forward

- Items on Company's Bank Statement The following items may appear on a bank statement: 1. Bank correction of an error from posting another customer's check (disbursement) to the company's account 2. EFT deposit 3. Loan proceeds 4. NSF check Indicate whether each item would appear as a debit or credit memo on the bank statement and whether the item would increase or decrease the balance of the company's account: Item Appears on the Bank Statementas a Debit or Credit Memo Increases or Decreases theBalance of the Company's Bank Account 1. Bank correction of an error from posting another customer's check (disbursement) to the company's account 2. EFT deposit 3. Loan proceeds 4. NSF checkarrow_forward6 When preparing a bank deposit which of the following is a best practice? Select one: a. Deposit all customer payments one at a time using the Bank Deposit form b. Group all customer payments with the same payment method together in one deposit c. Leave payments in the undeposited funds account d. Group customer payments with the payment method of checks and credit card payments in one deposit and group all the cash payment methods in a separate depositarrow_forwardHello, How do I solve this? Thanksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education