Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 10 of 12

< >

View Policies

- / 12.5

III

⠀

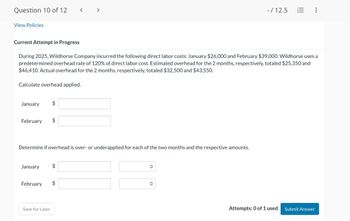

Current Attempt in Progress

During 2025, Wildhorse Company incurred the following direct labor costs: January $26,000 and February $39,000. Wildhorse uses a

predetermined overhead rate of 120% of direct labor cost. Estimated overhead for the 2 months, respectively, totaled $25,350 and

$46,410. Actual overhead for the 2 months, respectively, totaled $32,500 and $43,550.

Calculate overhead applied.

January

February

$

Determine if overhead is over- or underapplied for each of the two months and the respective amounts.

January $

February

$

Save for Later

<>

<>

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pocono Cement Forms expects $900,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 60,000 or its expected machine hours of 30,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,550 in direct material cost, 90 direct labor hours, and 75 machine hours. Wages are paid at $16 per hour.arrow_forwardWhen setting its predetermined overhead application rate. Tasty Turtle estimated its overhead would be $75,000 and manufacturing would require 25,000 machine hours in the next year. At the end of the year, it found that actual overhead was $74,000 and manufacturing required 24,000 machine hours. Determine the predetermined overhead rate. What is the overhead applied during the year? Prepare the journal entry to eliminate the under- or over applied overhead.arrow_forwardA company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forward

- Coops Stoops estimated its annual overhead to be $85,000 and based its predetermined overhead rate on 24,286 direct labor hours. At the end of the year, actual overhead was $90,000 and the total direct labor hours were 24,100. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardQuestionarrow_forwardGeneral accounting questionarrow_forward

- Determine and Use Consulting Rate Oxford Consulting, Inc., expects the following costs and expenses during the coming year: Direct labor (@ $20/hr.) $1,344,000 Sales commissions 288,000 1,512,000 Overhead a. Compute a predetermined overhead rate applied on the basis of direct labor hours. Round to two decimal places if applicable. $0 b. Prepare a general journal entry to apply overhead during an interim period when 14,000 direct labor hours were worked. General Journal Description Debit ◆ ♦ 0 0 0 0 c. What amount of overhead would be assigned to Job 325, to which $1,216 in direct labor had been charged? Round to two decimal places, if applicable. $0 Credit Please answer all parts of the question.arrow_forwardWarren manufacturing bases its solution general accounting questionarrow_forwardpredetermined overhead rat?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College