Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

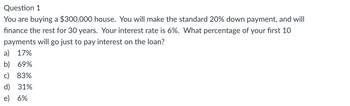

Transcribed Image Text:Question 1

You are buying a $300,000 house. You will make the standard 20% down payment, and will

finance the rest for 30 years. Your interest rate is 6%. What percentage of your first 10

payments will go just to pay interest on the loan?

a) 17%

b) 69%

c) 83%

d) 31%

e) 6%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Differential Equations You buy a house for $380000 and you take out a 30-year mortgage at 7% interest. For simplicity, assume that interest compounds continuously. i) What will be your annual mortgage payment, P? ii) Suppose that regular wages at your job allow you to increase your annual payment by 3% each year. For simplicity, assume this is a nominal rate, and your payment amount increases continuously. How long will it take to pay off the mortgage?arrow_forwardQUESTION 1 You have a sum of $100,000 and wish to withdrawa certain (unknown) amount in year 1 and increase that by 4%6 each year for 20 years. How much can the first withdrawal be if the interest rate is 5%.arrow_forwardProblem 6 What is the annual equal amount of money you have to set aside to guarantee yourself an annual income to perpetuity of $15,000 starting in 41 years from now? You make the first payment in three years from now and the last payment in 40 years. Assume an interest rate of 7% (EAR).arrow_forward

- Economics You deposit $2,000 one year and $1000 next year starting year 1 until year 30 with an interest rate of 5% one year and 7% other year. How much money will you have at the end of year thirty if there are different interest rates after year 30 as shown in the diagram below? 1 2 3 26 27 28 29 30 5% 7% 5% 7% 5% 7% 5% %7 F? 2000 1000 2000 1000 1000 2000 1000 2000 1000 Select one: O a. 117724 O b. 90000 O c. 120408 O d. 106141 O e. 18050arrow_forwardV5.Loan amount $75000 interest rate - 3.15 % if I earn a salary of $40000 with 4% growth for 10 years . how long will it take to pay of the loanarrow_forward8. Suppose that you want to take a five-year loan of $80,000. The interest rate is 9% per year, and the loan calls for equal annual payments. How much do you need to pay each year? A. $17,120.1 B. $19,169.4 C. $20,567.4 D. $21,333.1arrow_forward

- QUESTION 22 Ann wants to buy a building. The annual NOI for the building will be $175,000. She wants to get a 20 year interest only fixed rate mortgage at an annual rate of 8.35% with annual compounding and annual payments to buy the building. The lender has a minimum Debt Service Coverage Ratio (DSCR) of 1.20. What is the largest annual loan payment the lender will allow Ann to make based on the DSCR? OA. $1,746,506.99 B. $210,000.00 OC. $145,833.33 OD. $102,600.26arrow_forwardQUESTION 1 You plan to buy a machine that has a total cost of RM90,400. You will make a down payment of 10% of the price of the machine. The remainder of the machine’s cost will be financed over a period of 5 years. You will repay the loan by making equal monthly payments. Your quoted annual interest rate is 10% compounded monthly. (a) What will the monthly payment be? (b) If you make a monthly payment at the beginning of every month, how would your answer change in (a)? Briefly explain. Note: 1Please clear question answer no Whois one (a),& (b) 2. No need excel formulaarrow_forward6. You plan to buy a house that sells for $250,000. You plan to put 10% down and finance the rest. You are exploring the following financing options: i. 30-yr mortgage with a stated annual interest of 6.5% ii. 15-yr mortgage with a stated annual interest of 6%. You plan to pay off the loan by making equal monthly payments. What would be your monthly payment if you take the 30-yr mortgage? How much (total) interest would you pay over the life of the loan? $1422.15, $286,974 b. What would be your monthly payment if you take the 15-yr mortgage? How much (total) interest would you pay over the life of the loan? $1898.68, $116,762.01 a.arrow_forward

- QUESTION 1 You plan to buy a machine that has a total cost of RM90,400. You will make a down payment of 10% of the price of the machine. The remainder of the machine’s cost will be financed over a period of 5 years. You will repay the loan by making equal monthly payments. Your quoted annual interest rate is 10% compounded monthly. a. What will the monthly payment be? b.If you make a monthly payment at the beginning of every month, how would your answer change in (a)? Briefly explain.arrow_forward4arrow_forwardMortgage, part 1 (The Loan)5 years ago you purchased a home for $215,000. You made a 10% down payment and paid for the rest with a 30 year mortgage with a rate of 4.65%. How much was the down payment? How much of the purchase price did you finance with the loan? What is your monthly payment? Use solver. Clearly write the formula you will use as well as all values used in the formula. How much of the loan is left to pay after the first 5 years? Use solver. Clearly write the formula you will use as well as all values used in the formula. How much did you pay to the lender (total) over the first 5 years? How much of what you paid to the lender in the first 5 years was interest? If you paid this loan for all 30 years, how much interest would you pay?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education